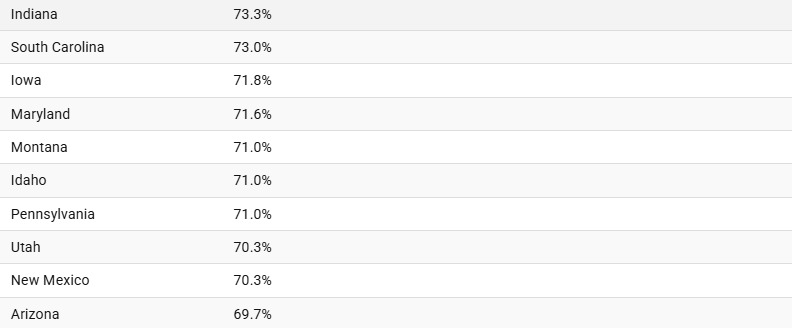

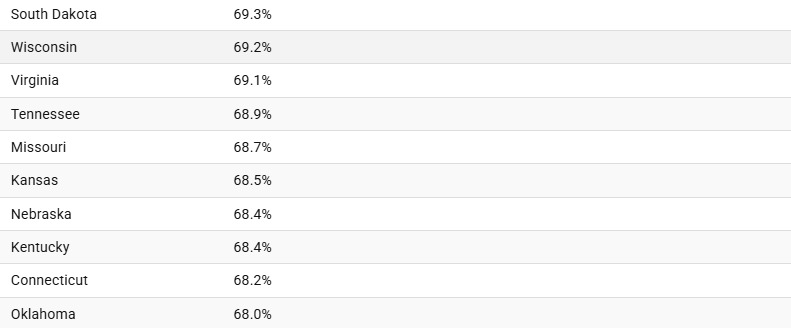

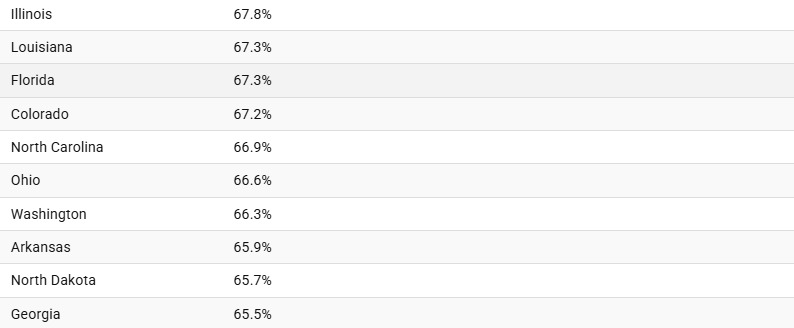

However, this rate varies significantly between states, as well as between urban, suburban and rural areas, reflecting differences in affordability, housing supply and economic conditions at each local level.

In 2023, West Virginia will have the highest homeownership rate in the United States, with 77% of households being homeowners. This is largely due to the state’s relatively low home prices, along with one of the lowest home price-to-income ratios in the country. Additionally, West Virginia’s predominantly rural terrain and low population density make housing supply less constrained than in densely populated urban areas.

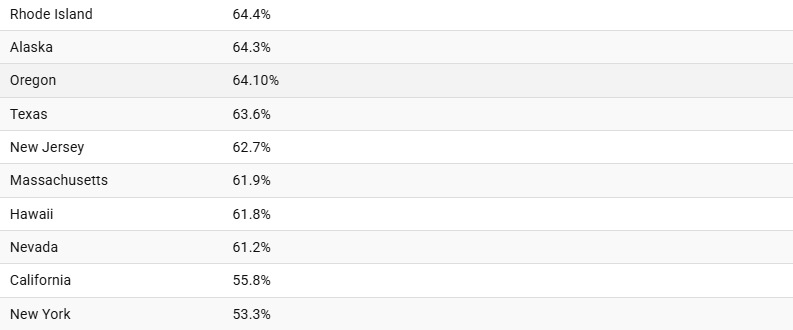

Conversely, states with the lowest homeownership rates, such as Hawaii, California and New York, have very high home prices, making it more difficult to buy a home. These places also have the highest home price-to-income ratios, meaning people have to pay more to own a home.

Downtown Manhattan, New York City. Photo: Unsplash

In addition to high housing prices, states like New York and California have high population densities in major urban centers. This leads to higher demand for rental housing due to the concentration of employment opportunities and the flexible lifestyles of residents. Additionally, these areas often have stricter zoning regulations, which reduces the supply of housing and drives up real estate prices.

While affordability is an important factor, homeownership rates are also influenced by other factors such as housing supply, economic opportunity, and the state of the local labor market. States with plenty of jobs but expensive housing tend to have high rental rates, while states with more affordable housing have higher homeownership rates.

Homeownership Rates by State in 2023:

Ngoc Anh (according to Visual Capitalist, USAFacts)

![[Photo] Prime Minister Pham Minh Chinh chairs the Government's online conference with localities](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/264793cfb4404c63a701d235ff43e1bd)

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

Comment (0)