As of September 30, 2025,SHB 's total assets will reach VND 852,695 billion, an increase of 14% compared to the end of 2024, gradually moving towards VND 1 million billion in 2026.

Outstanding credit balance reached nearly VND616,600 billion, up 15% compared to the beginning of the year. SHB's products, credit programs, and preferential loan packages are "tailored" to suit each customer group from individuals to business households, small and medium enterprises (SMEs), large enterprises... directing capital flows to priority areas and key industries that are focused on development in the period when the country enters a new era.

SHB continues to maintain its position in the Top most efficient banks thanks to its strong investment in transformation, digitalization, and integration of modern technologies. On the other hand, the bank strictly controls asset quality with the target of maintaining bad debt below 2%. Capital adequacy ratios are all better than the regulations of the State Bank and international standards, in which CAR is over 12%, significantly higher than the minimum level of 8% according to Circular 41/2016/TT-NHNN.

Enhancing financial foundation, accelerating transformation

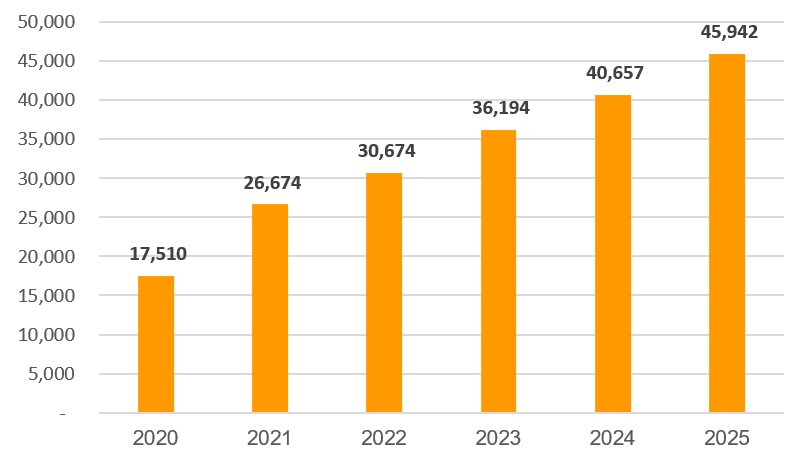

Recently, SHB has completed increasing its charter capital to VND 45,942 billion, according to the plan approved by the general meeting of shareholders at the beginning of the year, by issuing shares to pay the second 2024 dividend at a rate of 13%. Previously, the bank also completed paying the first 2024 dividend at a rate of 5% in cash. The total dividend rate for 2024 is 18% and is expected to continue in 2025.

Recently, SHB announced October 16, 2025 as the closing date for the list of shareholders to collect written opinions on the plan to increase the new charter capital in 2025. The increase in charter capital helps SHB continue to affirm the bank's position in the market, improve its financial foundation and competitiveness, create conditions for expanding its scale and developing business activities in the comprehensive transformation strategy. From there, the Bank continues to accompany people and businesses to supply the growing capital needs of the economy , contributing to achieving the Government's overall growth target.

Strong capital resources allow the bank to boost investment in technology to improve customer service experience and promote credit and business activities more effectively. This is a step to affirm SHB's commitment to accompany the development of the economy and increase sustainable value for shareholders.

The Bank is implementing a strong and comprehensive transformation strategy towards the “Bank of the Future” model. This strategy deeply integrates modern technologies such as Artificial Intelligence (AI), Big Data, Machine Learning into the entire process of operations, risk management, product and service development.

With outstanding financial solutions, SHB has been and is continuing to cooperate comprehensively with strategic partners, which are large state-owned and private economic groups in the country and internationally, developing ecosystem strategies, supply chains of satellite businesses, small and medium-sized enterprises and individual customers, firmly maintaining the reputation of a top bank.

In the international financial market, SHB affirms its brand position as one of the few banks selected by World Bank, JICA, ADB, KFW and other international financial organizations as a re-lending bank, a bank serving key national projects; participating in ADB's global trade finance program...

Recently, SHB was honored in the Top 10 Most Profitable Enterprises in Vietnam and Top 50 Most Effective Enterprises in Vietnam. At the same time, the bank also won many awards such as: "Bank for People", "Best Bank for Public Sector Customers in Vietnam" (FinanceAsia), "Bank with Best Sustainable Financing Activities in Vietnam" (Global Finance), "Best Sustainable Financing Bank for SMEs in Vietnam"... SHB was also ranked by Brand Finance in the Top 33 most valuable brands in Vietnam and in the Top 500 banks with the highest brand value globally in 2025.

In its strong and comprehensive transformation strategy, SHB is currently focusing on four pillars: Reforming mechanisms, policies, regulations, and processes; People are the subject; Taking customers and markets as the center; Modernizing information technology and digital transformation.

SHB aims to become the Top 1 Bank in terms of efficiency; the most favorite digital bank; the best retail bank and the Top Bank in providing capital, financial products and services to strategic private and state-owned corporate customers, with a supply chain, value chain, ecosystem, and green development. Vision to 2035, SHB will become a modern retail bank, a green bank, a top digital bank in the region.

Thuy Nga

Source: https://vietnamnet.vn/9-thang-shb-lai-truoc-thue-12-300-ty-dong-2455015.html

![[Photo] Da Nang residents "hunt for photos" of big waves at the mouth of the Han River](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761043632309_ndo_br_11-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh received Mr. Yamamoto Ichita, Governor of Gunma Province (Japan)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761032833411_dsc-8867-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the Hungarian National Assembly Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760970413415_dsc-8111-jpg.webp)

Comment (0)