Domestic people have to buy gold at 22.6% more expensive than the world

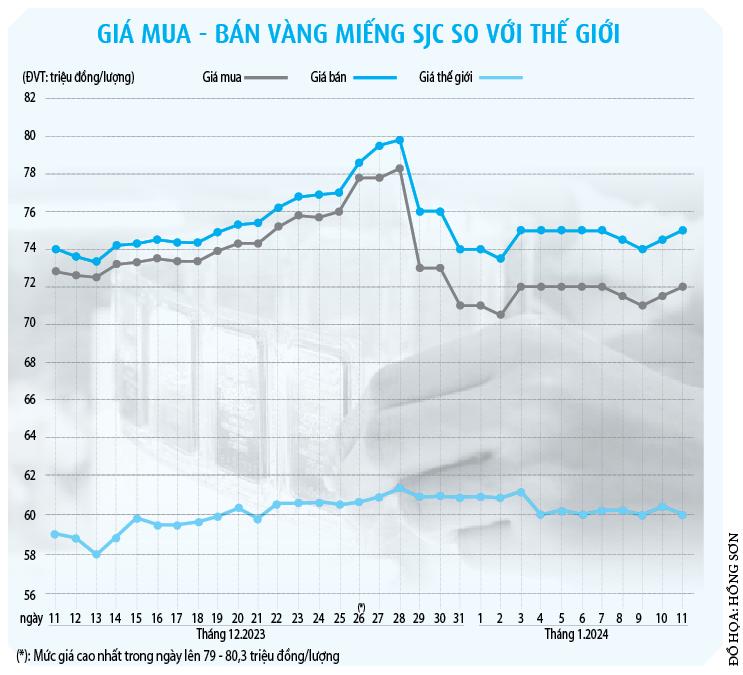

The price of SJC gold bars on January 11 fluctuated in the opposite direction to the world price, suddenly increasing by 800,000 VND/tael. Saigon Jewelry Company (SJC) bought at 72.8 million VND/tael, sold at 75.3 million VND/tael. Doji Group bought at 72.75 million VND, sold at 75.25 million VND. Eximbank bought at 72.5 million VND/tael, sold at 75 million VND/tael... 4-digit 9 gold rings also increased in price by 150,000 VND per tael, SJC Company bought at 62 million VND/tael, sold at 63.2 million VND/tael...

The difference between the buying and selling prices of SJC gold bars of business units is still high, up to 2.5 million VND/tael, gold rings are at more than 1 million VND/tael. It can be seen that both SJC gold rings and gold bars are still anchored at a very high level. In contrast to the downward trend at the end of December 2023 after the Prime Minister requested the State Bank (SBV) to urgently have effective solutions to manage and operate domestic gold bar prices according to market principles, not to let the difference between domestic gold bar prices and international gold prices be high, negatively affecting macroeconomic management, reporting implementation results in January 2024. The direction was given when SJC gold bars climbed to a peak of more than 80 million VND/tael, 20 million VND/tael higher than world gold.

SJC gold price is 14 million VND/tael higher than world price

Immediately after that, the price of SJC gold bars plummeted continuously. In just a few days, it had dropped by tens of millions of VND/tael. However, the fall lasted for a few days and then stopped, the precious metal in the country gradually recovered and as mentioned above, SJC gold bars are still very expensive, 14 million VND/tael higher than the international price. With this price, people in the country are having to spend money to buy SJC gold bars at a higher price of up to 460 USD, equivalent to 22.6% higher. It is even more absurd that with the same quality of 4-number 9 gold, the same brand, but SJC gold bars are 11 - 12 million VND/tael higher than gold rings.

According to Mr. Dinh Nho Bang, Vice President of the Vietnam Gold Trading Association, in the international market, the gold price is about 1 - 2 USD/ounce, in some countries the highest is 4 USD. But in Vietnam, the price of SJC gold bars is currently 14 million VND higher than the world price, while other types of jewelry such as gold rings are about 2 - 3 million VND/tael.

"Vietnam is a gold importing country, consuming about 20 tons each year. However, in the past 12 years, no more SJC gold bars have been produced for the market, while the demand is always there. The difference in supply and demand for gold has led to high prices on the market. The Association has also reported to the Government that there is no price manipulation in the market; businesses that buy high will sell high, otherwise they will lose money. Most gold trading companies are private, so they have to preserve capital. This has also led to a situation where the buying and selling prices have increased by 1-3 million VND/tael, sometimes up to 5 million VND/tael to limit risks. Also because the supply and demand on the market are not balanced, there are peak days when a company sells 2,200 taels of gold to the market but only buys 600 taels, so how can the supply be balanced?", Mr. Bang informed.

Associate Professor Dr. Nguyen Huu Huan (Ho Chi Minh City University of Economics) said that domestic gold prices have not been linked to international prices, and have been a single market for many years, leading to extremely unexpected and unpredictable fluctuations.

"Currently, the State Bank is the only gold importer in the market, and through SJC, it also has the exclusive right to produce gold bars. The supply is not abundant enough to meet domestic demand, leading to the gold price being pushed much higher than the world price. This also explains why only SJC gold bars create such unstable fevers, while gold rings have abundant supply due to more suppliers, so the price is more competitive and closer to the world price. Unlike stocks - investors can buy and sell directly, the gold market has trading units and gold shops in the middle of buying and selling. Therefore, gold trading units keep the gap between buying and selling prices high to avoid risks when the market fluctuates as well as to make a profit. Not to mention, imported gold bars also have to add taxes, fees, etc.," Mr. Huan added.

Domestic gold price 1 - 2 million VND/tael higher is appropriate.

So how much higher is the domestic gold price than the world price? Associate Professor Dr. Nguyen Huu Huan believes that the domestic gold price should be equal to the converted world gold price (plus taxes and fees) or only about 1-2 million VND/tael higher. If the difference is too high, it will create problems and market failures. Because in principle, where there is a price difference, it will lead to speculation...

"The scarcer the supply, the more people crave gold, using all resources to search for gold, instead of investing in production and business. People rushing to hoard and buy and sell gold will freeze the economy, with no production and business activities," Associate Professor Dr. Nguyen Huu Huan warned.

Sharing the same view, Mr. Nguyen Ngoc Trong, Director of New Partner Gold Company, also said that the domestic price gap being 1-2 million VND/tael higher than the world price (after deducting taxes and fees) is acceptable. However, Mr. Trong is concerned that if the gold price is pulled down, it will stimulate buying demand among the people, and gold imports will affect the exchange rate.

According to him, in order to avoid exporting foreign currency to import gold, the operator can buy domestic gold raw materials to produce gold bars to supply the market. The current market size is much smaller than before, so with just a small amount, domestic prices can drop sharply, narrowing the gap with world prices. When there is intervention in the supply from the state leading to a price drop, many previous buyers take profits, and the supply also increases. Market intervention sales need to take place regularly to bring the price down close to the world price, otherwise there will also be a high "skew" situation.

Agreeing, Associate Professor, Dr. Vo Dai Luoc, former Director of the Institute of World Economics and Politics, also emphasized: Domestic gold prices need to be adjusted based on world gold prices. Currently, Vietnam has traded with the world, the market is so open that there are up to 16 free trade agreements. Goods circulate freely, while gold is just a commodity, so there is no reason why it cannot be equal to the world gold price. Frankly stating that Vietnam currently does not actually have a gold market, Mr. Vo Dai Luoc affirmed that if there were free trading, there would not be such a big difference between domestic and world gold prices.

"The biggest reason for such unstable gold prices is monopoly. Monopoly naturally leads to monopoly prices. Adjusting gold prices is all for the benefit of one company, not following market developments. The market must have many buyers and many sellers. In the world, there is no country that implements a policy of having one unit importing and producing gold bars like Vietnam," he stated.

It's time to abolish the gold bar monopoly.

Mr. Dinh Nho Bang commented: For more than 10 years, the State Bank has not imported gold and people have not used gold for payment purposes as before. Therefore, fluctuations in gold prices do not affect monetary policy and exchange rate policy. Therefore, there is a view that if gold is imported to increase supply, intervene in the market, stabilize prices but spend foreign currency, the amount of gold in the population increases, and capital cannot be turned into production and business activities...

"The above issues need to be considered by the authorities when re-evaluating Decree 24/2012 on gold market management and finding appropriate solutions in the coming time. However, the State Bank is the gold bar producer, SJC company is only allowed to process with the consent of the State Bank. My opinion is that we should abolish the monopoly on gold bars, consider gold as a commodity. At the same time, we must let the domestic gold market connect with the world to help shorten the gap. The price of gold bars or jewelry is 2-3 million VND/tael higher than the world price, which is reasonable," Mr. Bang stated his opinion.

Just a few more units participating, the market competition will increase and the supply will also increase. Then the gold price will be brought back to its real value. Stabilizing the gold market is necessary for many players. That is the sustainable, long-term market.

Associate Professor, Dr. Nguyen Huu Huan

According to data from the CEIC website, Vietnam's gold reserves are about 649.45 million USD as of October 2023, an increase of 42.08 million USD compared to September. On average, from January 1995 to October 2023, Vietnam's gold reserves reached 348.215 million USD. The all-time high is 649.450 million USD in October 2023 and the record low is 34.79 million USD in January 1995. Thus, with nearly 650 million USD, the amount of gold reserves is about 9 - 11 tons.

To bring the domestic gold price closer to the world gold price, Associate Professor, Doctor of Science Vo Dai Luoc proposed to build an "open" gold buying/selling mechanism with many sellers and many sources of supply. Allow many units to participate in importing and producing gold bars and possibly build a gold trading floor so that people can freely buy/sell gold in a transparent and competitive manner. The gold trading floor is similar to the real estate or stock trading floor, must operate according to clear, transparent management mechanisms and policies and according to international practices, built on the experience of developed countries such as Singapore, Korea... are managing the gold market.

"Only real market relations can regulate the supply and prices of goods. Gold is important but in essence it is just a commodity, not an essential commodity. A mechanism is needed to build a real gold market, eliminate monopoly, create competition and transparency to stabilize this commodity," said Mr. Vo Dai Luoc.

Acknowledging the timeliness and efforts to "cool down" the Vietnamese gold market in the recent period of the Government and the State Bank, Associate Professor Dr. Nguyen Huu Huan said that the determination must be concretized by clear policies. The specific move here, first of all, must be to increase the supply. In theory, the State Bank will have to import gold to stamp more SJC gold. However, importing gold will lead to the risk of foreign currency reduction and loss. Meanwhile, domestic gold is still abundant, it is completely possible to "collect" gold rings, jewelry gold and more raw materials to stamp into SJC gold. However, the State Bank does not have the function of purchasing gold floating among the people. Therefore, the Government can provide a mechanism for the State Bank to buy raw gold from other gold production and trading units, taking advantage of the huge domestic supply of gold rings to stamp into gold bars. At that time, the price of gold bars will decrease, partly solving the shortage of SJC gold supply, and not worrying about goldification or the impact on the macro economy.

In the long term, Dr. Nguyen Huu Huan recommends quickly breaking SJC's monopoly on gold imports and gold bar production by allowing other units to participate in the gold bar market. The current economic context of Vietnam is enough to "open the game" with gold. Gold is not an essential product, so it is necessary to restore the market economy to gold. Monopoly does not bring any benefits to the economy or the Government.

"The important thing is management. The playground is open to many "guys" but not all "guys" are allowed to play. Only large units and large organizations are allowed to participate in the gold bar market. Small gold shops will only have the function of distribution, not production," Mr. Huan emphasized.

The market is waiting for Decree 24 to be amended to bring the gold price down closer to the world gold price as directed by the Government and as well as the view of the State Bank's leaders "not accepting too high a gold price".

Source link

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

Comment (0)