Recently, the Chief Inspector of the State Bank of Vietnam (SBV) Region 3 issued inspection conclusion No. 236/KL-TTrKV for the Joint Stock Commercial Bank for Investment and Development of Vietnam - Lai Chau Branch ( BIDV Lai Chau Branch). The publication of the conclusion is carried out in accordance with the provisions of Article 37 of the Law on Inspection 2025.

BIDV Lai Chau Branch was established in 2003 under the Decision of BIDV Board of Directors, officially operating from January 1, 2004. Currently, the Branch is headquartered at Group 27, Tan Phong Ward, Lai Chau Province, with 69 staff, organized into 5 functional blocks and 10 departments. During the inspection period, the personnel increased by 6 people and decreased by 5 people.

The inspection conclusion noted that the Board of Directors of BIDV Lai Chau Branch conducted its operations in accordance with internal regulations and instructions from BIDV Vietnam. Capital mobilization growth reached 89% of the 2025 plan; credit activities closely followed the orientation, focusing on providing capital for key areas such as hydropower, infrastructure and key projects of the province. The branch also implemented many diverse credit programs, contributing to promoting growth and supporting local businesses. In 2024 and the first quarter of 2025, BIDV Lai Chau Branch was classified as having completed its tasks well.

However, the inspection results also showed that BIDV Lai Chau Branch still revealed some shortcomings and errors in management and credit activities.

Regarding management and administration, the branch has not fully implemented the regulations on organizing meetings between leaders and staff; the implementation of the Grassroots Democracy Regulations has not issued written decisions on periodic dialogues, and the selection of conference secretaries has not been ensured according to regulations. The work of rotating and changing job positions has not been carried out seriously and lacks synchronization.

Regarding credit activities, credit growth during the inspection period was slow, with negative growth in the first seven months of 2025, down 3.8% compared to the beginning of the year. Outstanding loans are highly concentrated in the hydropower and commercial sectors (accounting for 65%), while loans for agriculture and rural areas only account for 0.5% of total outstanding loans. Credit quality shows signs of decline, with bad debts increasing sharply in the first months of the year, mainly in the hydropower, production and business sectors and corporate customer groups.

Compliance with the lending regulations still exists regarding financial legal documents; loan documents; appraisal of loan decisions related to assessment of financial situation, repayment sources, loan terms, loan plans, credit information and related customer groups, existence of disbursement for purposes other than project implementation costs, lack of documents proving the purpose of capital use or invalidity.

Branch inspection and supervision have not seriously and fully implemented the conditions for granting credit as approved by the Head Office, inspection is sketchy, cash flow inspection and supervision is not tight; there are problems with collateral, loans for hydropower projects, guarantees and some other problems.

For bad debt customers, compliance with lending regulations is not guaranteed; some customers have not yet developed or have developed debt settlement plans but they are slow to comply with regulations, and the settlement work is not very effective.

The causes identified include both objective and subjective factors. Objectively, the local economy is still facing difficulties, the credit market is shrinking, and business targets are under high pressure. Subjectively, some officials have not strictly followed the lending process, have not studied the guidance documents carefully, and internal inspections are not regular.

According to the inspector, the branch's board of directors is responsible for the above discovered shortcomings and violations.

The State Bank Inspectorate of Region 3 has requested BIDV and BIDV Lai Chau Branch to urgently overcome existing problems, implement 4 recommendations at the system level, 25 recommendations at the branch level and 4 risk warning recommendations, and report the results of the correction in accordance with the law.

Source: https://doanhnghiepvn.vn/kinh-te/bidv-chi-nhanh-lai-chau-no-xau-tang-manh-chat-luong-tin-dung-suy-giam/20251021104530811

![[Photo] Da Nang residents "hunt for photos" of big waves at the mouth of the Han River](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761043632309_ndo_br_11-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh received Mr. Yamamoto Ichita, Governor of Gunma Province (Japan)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761032833411_dsc-8867-jpg.webp)

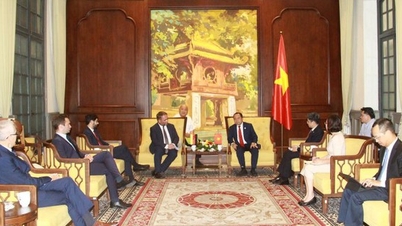

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the Hungarian National Assembly Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760970413415_dsc-8111-jpg.webp)

Comment (0)