Mr. Nguyen Duc Thang, Chairman of GAMA Global Vietnam, talked with Dan Tri reporter about the current situation of damage caused by natural disasters, changes in people's and businesses' awareness of property insurance and solutions for the insurance market to promote its role in supporting sustainable development in the context of climate change.

Insurance helps the economy recover after natural disasters

After the recent storms and floods, how do you perceive the level of damage to people's and businesses' property?

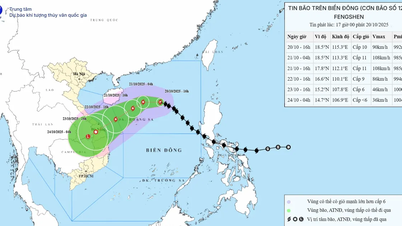

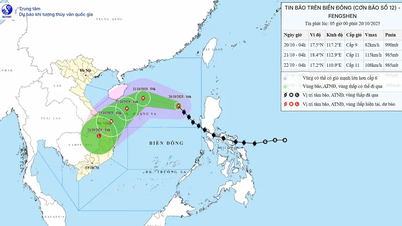

- The impact of storms No. 10 and 11 caused flooding in many provinces and cities, causing great damage to people.

The Insurance Management and Supervision Department ( Ministry of Finance ) said that as of October 10, the total amount of non-life and health insurance claims was estimated at VND1,674 billion, corresponding to 3,748 cases. Insurance companies also recorded 2,653 cases related to motor vehicles, with estimated losses of about VND76 billion.

With these figures, we can see that the level of property damage to people and businesses after the recent storms and floods is very serious.

Through recent natural disasters, how do you see people's and businesses' awareness of property insurance changing?

- We clearly see that people and businesses' awareness of property insurance has changed significantly. If in the past many people considered insurance an unnecessary expense, now, after witnessing the losses of tens of thousands of billions of dong, they see insurance as an important "financial shield".

People are starting to pay more attention to home and vehicle insurance; businesses are focusing on factory, machinery, warehouse and business interruption insurance.

Not only that, the loss of life and casualties has also made people realize more clearly that protecting financial security for themselves and their families is important when participating in life insurance.

However, the insurance participation rate is still low, most of the damage caused by natural disasters is still not protected. This shows that we need to continue to raise awareness, make products transparent and simplify the compensation process, so that insurance can truly become a tool to help people and businesses feel secure when choosing suitable insurance products.

From your perspective, which groups of people are in most urgent need of insurance in the context of increasingly extreme climate change?

- In the context of increasingly extreme climate change, I believe that the need for property loss insurance and life insurance is more urgent than ever, especially for certain groups of people.

First of all, people in areas frequently affected by natural disasters - where people, houses, vehicles, and crops are vulnerable to direct or indirect damage during and after storms and floods.

Second are small and medium enterprises in the fields of agriculture , aquaculture, logistics, which have little financial reserves and are prone to production disruptions when storms and floods occur. Third are essential infrastructure and public service enterprises such as electricity, water, telecommunications - without insurance, the lack of financial resources to overcome damage will have a chain effect on the whole community.

It can be said that insurance is not only a tool to protect assets and protect family financial security, but also a "financial cushion" to help these vulnerable groups quickly recover from natural disasters, reducing the burden on the budget and society.

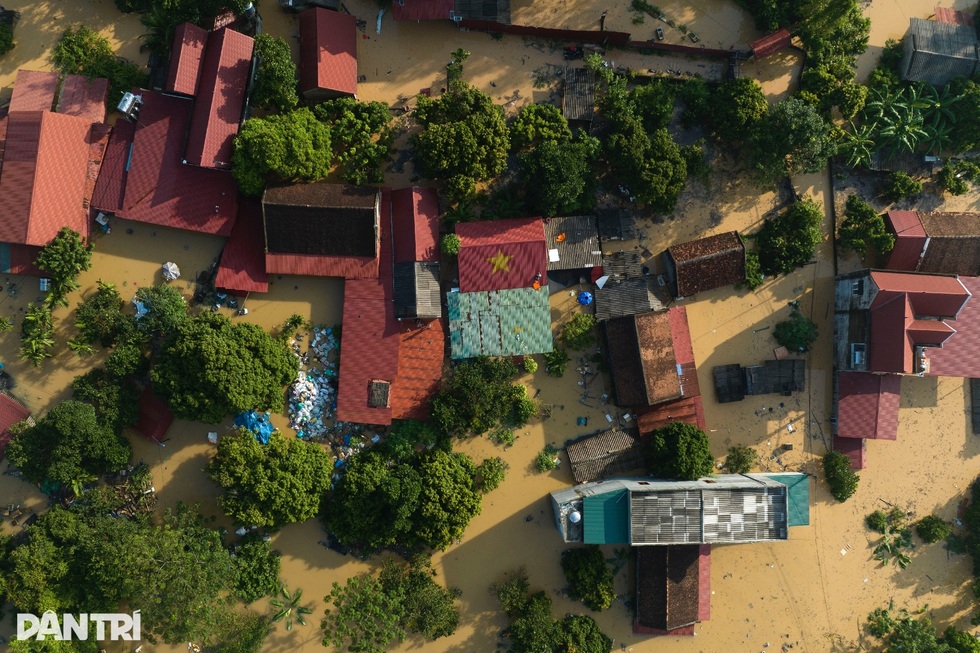

Severe flood impacts in Bac Ninh (Photo: Manh Quan).

How do you predict the insurance market trend will change in the coming time due to the impact of climate change?

- Given the increasingly severe impact of climate change, I believe that the insurance market in Vietnam will have clear changes in the coming time.

Firstly, the demand for property, agricultural and natural disaster risk insurance will increase sharply, especially in areas frequently affected by storms, floods and droughts.

Second, insurance companies will have to research appropriate product restructuring options, add climate risk protection clauses, and promote the application of technology for faster appraisal and compensation.

Third, transparency and market trust will be prioritized, as people and businesses increasingly demand clear, easy-to-understand processes and timely payments.

To make insurance more than just a "compliance procedure"

At many banks, when people borrow, they are also allowed to buy insurance. The fact that banks “sell” insurance is a formality, not really based on the need to protect customers’ assets, and how does the fact that people buy insurance in a “coping” manner create a risk gap, especially when natural disasters and floods are increasingly unusual?

- The practice of "bundling" insurance to achieve sales targets, and people buying it to complete the procedure or out of respect, creates systemic risk gaps for the insurance industry, deeply affecting both borrowers and the country's economy.

Customers are not able to compare and choose, products are not suitable, and benefits received do not reflect the level of protection needed against risks; this reduces the motivation of businesses and households to invest in practical risk reduction measures such as flood-proof houses or upgrading the safety level of production and business facilities.

People's lives in Bac Ninh are seriously affected by floods (Photo: Manh Quan).

I think three coordinated interventions are needed.

First is to promote and maintain product transparency and separation: Banks should not force; customers must be clearly advised on property insurance, income insurance, and loan insurance options; policies must openly compare products and costs.

Second, the State should have policies to encourage and support insurance companies to offer products suitable for climate risks: Develop property and agricultural insurance, clear and quick compensation procedures, and customer benefits with effective preventive measures; the State should also have policies to support fees for vulnerable groups to increase coverage.

At the same time, insurance companies also need to invest in improving implementation capacity and quick compensation mechanisms; expand the network of local assessors and closely coordinate with authorities to verify losses after natural disasters.

I believe that if insurance is only considered as a “compulsory procedure”, purchased only to deal with it, it will not be able to protect anyone. But when separated, transparent and designed according to needs, insurance will certainly become a key tool to reduce damage, protect assets for people and businesses and thereby keep the economic cycle from breaking.

Cars damaged after flooding in Thai Nguyen (Photo: Thanh Dong).

How should insurance companies take advantage of this opportunity to both spread a positive image and promote sustainable market development?

- In the context of natural disasters, climate change and challenges to market confidence, I believe this is also an opportunity for insurance companies to affirm their social role and spread a positive image.

First, make payments transparently, quickly and fairly. Each timely compensation not only helps customers overcome difficulties, but also is the clearest proof of the value of insurance.

Second, strengthen communication and financial education. Enterprises need to work with management agencies to raise public awareness, helping people and businesses understand the rights, obligations and long-term significance of insurance.

Third, innovate products towards sustainability. Insurance products should integrate protection against climate, health and welfare risks, while also being linked to green development and responsible investment goals.

Fourth, apply digital technology to simplify the process, from participation to compensation, thereby improving customer experience and strengthening trust.

If these things are done well, insurance companies will not only develop financially sustainably, but also become a "trusted companion" of society, contributing to reducing the burden on the State budget and improving the economy's resilience to natural disasters.

Source: https://dantri.com.vn/kinh-doanh/bien-doi-khi-hau-khoc-liet-chuyen-gia-vi-bao-hiem-nhu-tam-khien-kinh-te-20251014092801737.htm

![[Photo] Da Nang residents "hunt for photos" of big waves at the mouth of the Han River](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761043632309_ndo_br_11-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the Hungarian National Assembly Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760970413415_dsc-8111-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh received Mr. Yamamoto Ichita, Governor of Gunma Province (Japan)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761032833411_dsc-8867-jpg.webp)

Comment (0)