According to economic experts, the plan of the State Bank of Vietnam to sell SJC gold bars directly to 4 State-owned commercial banks and Saigon Jewelry Company (SJC) to sell SJC gold bars directly to the people will bring about the target price reduction. However, there is still a need for a long-term solution such as amending Decree No. 24/2012/2012/ND-CP dated April 3, 2012 of the Government on the management of gold trading activities (Decree No. 24) to suit the current situation.

Flexible intervention measures

In the context of the volatile world economy, gold is an international story, not just Vietnam. According to Governor of the State Bank of Vietnam Nguyen Thi Hong, implementing the Government's direction, the State Bank of Vietnam has had many solutions.

“ The State Bank of Vietnam has inherited the 2013 method of organizing gold bar auctions to increase supply to the market. However, after 9 auctions, the price difference has not decreased as expected,” said Governor Nguyen Thi Hong.

The gold price difference will be reduced to a suitable level.

According to the assessment of the State Bank of Vietnam, this period has many differences compared to 2013. Therefore, this agency has adjusted and implemented a new intervention measure: from June 3, the State Bank of Vietnam will sell gold directly through 4 State-owned commercial banks and the Gold and Gemstone Company (SJC) so that these units can sell gold to the people. After a week of implementation, the initial achievement is that the difference between the selling price of SJC gold bars and the world gold price has been narrowed, to only about 6 million VND/tael.

Deputy Governor of the State Bank of Vietnam Pham Quang Dung also said that the recent intervention of the State Bank of Vietnam has a legal basis (Decree 50/2014 on management of state foreign exchange reserves; Decree 24/2012/ND-CP on management of gold trading activities; Decree 16/2017 on functions, tasks, powers and organizational structure of the State Bank of Vietnam; Circular 06/2013 guiding the buying and selling of gold bars in the domestic market of the State Bank of Vietnam; Circular amending and supplementing a number of articles of Circular 01/2014/TT-NHNN dated December 10, 2014 of the Governor of the State Bank of Vietnam guiding the organization and implementation of state foreign exchange reserve management activities...).

“However, the State Bank of Vietnam assesses that gold is still very attractive; the demand for gold reserves among the people is large. Therefore, it is necessary to study the exploitation of gold resources in production and business. On the other hand, the situation of dollarization and goldization still exists in the economy, and handling it takes time,” said Deputy Governor Pham Quang Dung.

According to Deputy Governor Pham Quang Dung, the State Bank of Vietnam will continue to study Decree 24, with the goal of preventing goldization of the economy, not letting goldization affect monetary policy management, exchange rates, foreign exchange, and balance of payments; not letting gold prices differ greatly from world prices; not letting gold affect economic policy, not affecting social psychology; and gradually researching the use of people's gold resources in production and business.

Proposal to tax gold transactions

According to economic experts, over the past 12 years, Decree 24 has made important contributions such as changing people's habits of not using gold as a means of exchange, or even no longer as a means of storing assets, pushing back gold-ization in the economy, etc. However, up to this point, Decree 24 has completed its historical mission and needs to have a more suitable alternative solution for the new context.

|

Associate Professor, Dr. Nguyen Thi Mui. |

According to the proposal of economic expert, Associate Professor, Dr. Nguyen Thi Mui, the State Bank of Vietnam should soon recommend the Ministry of Finance to develop tax policies for gold.

“The application of tax policies to the domestic gold market will contribute to reducing the demand for gold of some investors and the market, especially for those who buy gold for the purpose of speculation, hoarding, and manipulating gold prices; the above solution can affect the psychology of consumers, causing them to switch to other investment channels, thereby helping to control gold prices. In addition, the application of taxes will ensure fairness in gold trading activities and create a healthy business environment. Currently, the fields of securities, real estate, etc. are also applying personal income tax, so gold trading should also apply appropriate tax policies,” Ms. Mui commented.

Sharing the same view, Professor, Dr. Hoang Van Cuong said that between importing gold to make raw gold for jewelry processing and importing to make gold bars for exchange, these two goals are different, but no matter what, taxes must be collected.

According to Dr. Le Xuan Nghia, the most effective tool is tax. If there is no incentive, then the tax should be high, otherwise it should be reduced. Anti-smuggling sometimes uses administrative measures that are not as effective as tax.

|

Professor, Dr. Hoang Van Cuong. |

“Tax is an important regulatory tool of any state. The state can also use tax as a tool to regulate not only income but also consumer behavior. I think the Ministry of Finance and the tax authority will certainly research so that when a tax is issued, the tax rate is applied to the right people, the right jobs, and the right activities in the economy,” Dr. Truong Van Phuoc also shared his views on the issue of applying appropriate tax policies to gold trading activities.

People need to be careful when buying gold.

In addition to the tax solution mentioned above, recently, economic experts have also issued warnings for people to be cautious when buying gold. According to Dr. Truong Van Phuoc, the State Bank of Vietnam sold gold to 4 State Commercial Banks and SJC Company and the gold price has decreased. People are concentrating on buying gold in large numbers.

“But the market is also experiencing many fluctuations. At this time, people need to be extremely cautious because just one move by the Chinese Central Bank to stop buying gold for their reserves will cause the price of gold to drop by 80 to 100 USD per night, as well as many economic variables in the US and Europe,... Therefore, people need to be cautious, of course, property is the right of citizens, the law does not prohibit buying and selling, but they should be cautious,” Dr. Truong Van Phuoc advised.

|

At a meeting to discuss gold market management policy and amend Decree No. 24 between economic experts and leaders of the State Bank of Vietnam. |

In addition, Dr. Truong Van Phuoc also proposed a policy approach. Accordingly, the State Bank of Vietnam should retain control over gold import and export activities; while processing can be handed over to enterprises or credit institutions with conditions.

“Thus, we will witness the regulation of the gold market according to the law of supply and demand and prices will certainly not have the difference as in the recent past. Gradually, people will move away from physical gold,” Mr. Truong Van Phuoc shared.

According to Mr. Phuoc, supplying gold to the market and reducing the price of gold is an effort of the State Bank of Vietnam and the Government. Besides gold, the Government or the State Bank of Vietnam also has to balance many other essential items for people's lives. "If one day we don't hold gold bars, we will certainly still live. But if one day we don't have gasoline, fertilizer, rice, or necessities, what will happen...", Dr. Phuoc said.

Therefore, some economic experts also believe that the State Bank of Vietnam needs to soon end this form of gold sale intervention. Because to fully meet the demand, it will have to import gold and spend foreign currency resources, affecting the state's foreign exchange reserves.

“In the context of an integrated economy, with imports approaching 400 billion USD/year, how can we only reserve it for gold when there are many other essential goods in the economy? Recently, the State Bank of Vietnam successfully explored the policy, now is the time to have a new legal framework to replace and stabilize this market and consider gold as just a normal commodity to have appropriate solutions. Accordingly, return to the State Bank of Vietnam the basic functions of operating monetary policy and providing money for the economy,” an economic expert commented.

Source: https://nhandan.vn/can-giai-phap-can-co-lau-dai-trong-quan-ly-thi-truong-vang-post813595.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

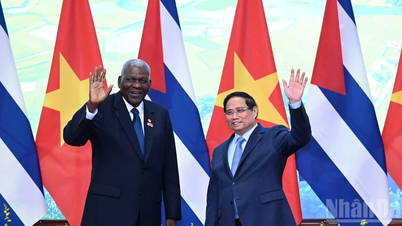

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

Comment (0)