(Dan Tri) - State-sector employees participating in social insurance (SI) from 2025 will have their pensions calculated similarly to private-sector employees.

According to the current Social Insurance Law (2014) as well as the amended Social Insurance Law (2024), the monthly pension of employees participating in compulsory social insurance is calculated by multiplying the pension rate by the average monthly salary used as the basis for social insurance contributions.

How to calculate pension (Photo: Son Nguyen; Graphics: Tung Nguyen).

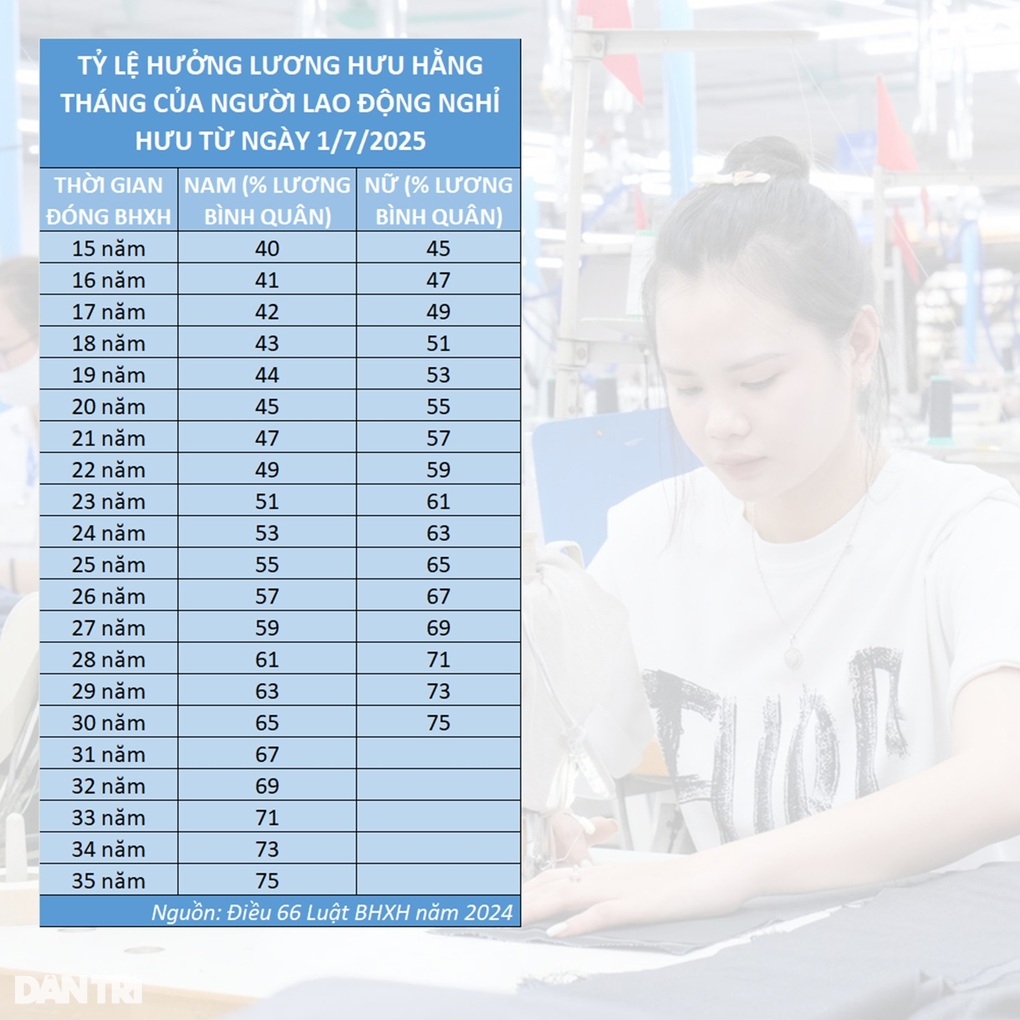

Regarding the calculation of pension rates, according to the 2014 Social Insurance Law, the pension rate for female workers is 45% of the average salary used as the basis for social insurance contributions corresponding to 15 years of social insurance contributions, then for each additional year of contributions, an additional 2% is calculated, with a maximum of 75%.

The pension rate for male workers is 45% of the average salary used as the basis for social insurance contributions corresponding to 20 years of social insurance contributions, then for each additional year of contributions, an additional 2% is calculated, with a maximum of 75%.

The Social Insurance Law 2024, effective from July 1, 2025, also stipulates the same pension rate calculation method as above. The only difference is that the Social Insurance Law 2024 adds a provision for male workers who have paid social insurance for 15 years to less than 20 years when they reach retirement age.

In this case, the monthly pension rate of male workers is equal to 40% of the average salary used as the basis for social insurance contributions corresponding to 15 years of social insurance contributions, then for each additional year of contributions, an additional 1% is calculated.

How to calculate pension rate (Photo: Son Nguyen: Graphics: Tung Nguyen).

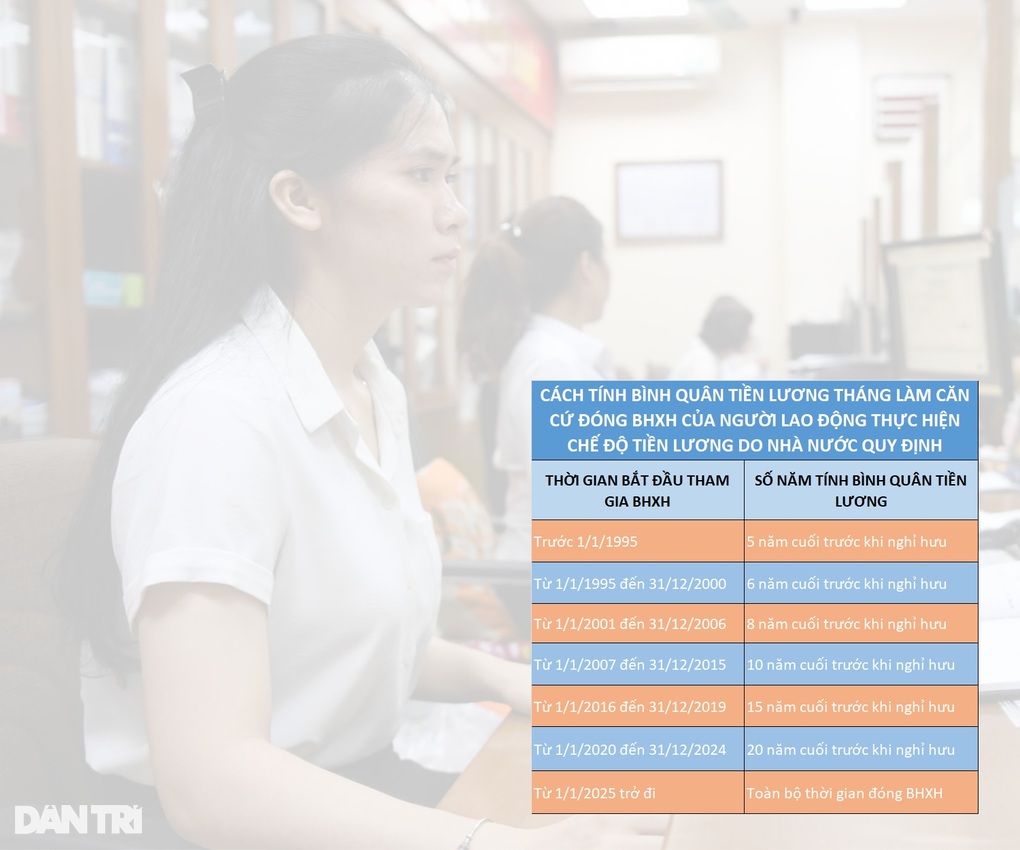

In the pension calculation formula, the biggest difference between state sector workers and other groups is the way the average monthly salary is calculated as the basis for social insurance contributions.

In the 2014 Social Insurance Law, the method of calculating the average salary is stipulated in Article 62. In the 2024 Social Insurance Law, this method of calculation is stipulated in Article 72. The method of calculating the average salary in both of these laws is stipulated the same.

Accordingly, the average salary used as the basis for social insurance contributions of non-state employees and voluntary social insurance participants is calculated as the average monthly salary for social insurance contributions during their entire time participating in social insurance.

As for state sector employees, the average salary used as the basis for social insurance contributions is calculated as the average of the last years of social insurance contributions before retirement, depending on when they participate in social insurance.

Roadmap to adjust the calculation of average monthly salary for social insurance contributions in the public sector (Photo: To Linh; Graphics: Tung Nguyen).

Because the way to calculate the average salary used as the basis for social insurance contributions is different, the way to calculate pensions for state-sector employees is currently different from that of non-state-sector employees and voluntary social insurance participants.

However, according to the above adjustment roadmap, the calculation of the average salary as the basis for social insurance contributions of state-sector employees participating in social insurance from January 1, 2025 will be calculated as the average monthly salary for social insurance contributions of the entire time they participate in social insurance.

That is, state-sector employees participating in social insurance from January 1, 2025 will have the same method of calculating the average salary as the basis for social insurance contributions as other groups of employees.

With the same method of calculating pension rates and the same method of calculating average monthly salary as the basis for social insurance contributions, the monthly pension of employees participating in compulsory social insurance from January 1, 2025 will be calculated the same, regardless of the state and non-state sectors.

Source: https://dantri.com.vn/an-sinh/cach-tinh-luong-huu-nhan-vien-nha-nuoc-tham-gia-bhxh-tu-nam-2025-20241107130503655.htm

![[Photo] Unique Phu Gia horse hat weaving craft](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760084018320_ndo_br_01-jpg.webp)

![[Photo] Opening of the World Cultural Festival in Hanoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760113426728_ndo_br_lehoi-khaimac-jpg.webp)

![[Photo] Ho Chi Minh City is brilliant with flags and flowers on the eve of the 1st Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/10/1760102923219_ndo_br_thiet-ke-chua-co-ten-43-png.webp)

Comment (0)