The Trump administration’s flurry of trade moves is beginning to paint a clearer, if uncomfortable, picture for Asia, the world’s largest manufacturing region. A new order appears to be taking shape, one where unpredictability is replaced by a reality of higher tariffs.

On July 22, President Trump announced a major deal with Japan, imposing a 15% tariff on imports from the world’s third-largest economy . This tariff includes automobiles, which are a major source of the bilateral trade deficit between the two countries. Almost simultaneously, a separate deal with the Philippines was also set at a 19% tariff.

These numbers are not random. They suggest a coherent strategy is taking shape. The Philippines’ 19% tax rate is roughly the same as Indonesia’s, which analysts believe is the benchmark for much of the rest of Southeast Asia.

A "new normal"

Ms. Trinh Nguyen, senior economist at Natixis, encapsulated the situation in a remarkable concept: A “new normal.”

“We are living in a new normal where a 10% tariff is considered the base rate, so 15% or 20% is not too bad if other countries pay the same,” she said. According to her, the logic of American businesses is very realistic, with this tariff level, importing goods from Asia still brings higher profits than investing in domestic production.

In another sign of detente, US Treasury Secretary Scott Bessent confirmed he will meet with Chinese officials in Stockholm for the third round of talks aimed at extending the tariff truce and expanding discussions.

The move, along with the easing of US restrictions on chips and China’s resumption of rare earth exports, suggests relations between the world’s two largest economies are stabilizing after months of tension. Overall, a more predictable level is emerging.

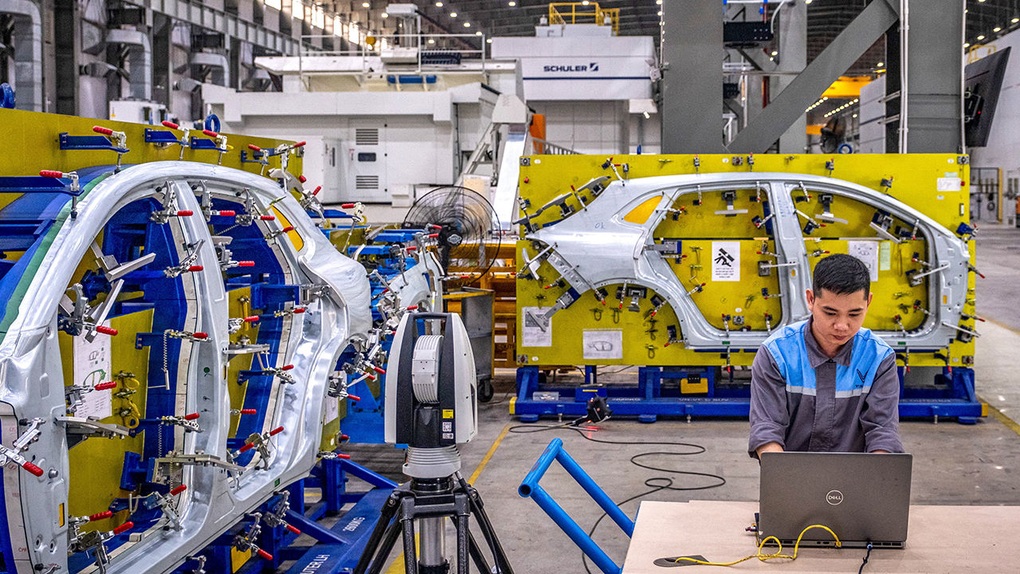

After months of uncertainty, US President Donald Trump's latest tariff deals are helping to outline a clearer new trade picture for Asia - the world's largest manufacturing region (Photo: Getty).

But clarity does not mean safety. There are still many big questions left unanswered. The Trump administration is still considering tariffs on strategic sectors, particularly semiconductors and pharmaceuticals—sectors vital to high-tech Asian economies like Singapore, Taiwan, and India—which have so far lacked clear tariff agreements with the United States.

South Korea also faces the threat of deeper sectoral tariffs, although the Japanese deal could be seen as a model for new President Lee Jae-myung.

The Wave of Displacement and the Price of Uncertainty

As the tariff map begins to unfold, companies with complex supply chains spanning Asia but still dependent on US consumers may finally be able to take action. Industry groups have long warned that policy uncertainty is more damaging to the investment climate than high but steady tariffs.

Now that stability has arrived, and it could trigger a wave of manufacturing relocation similar to the first trade war in 2018. With average tariffs still among the region’s highest, and continued political pressure from Washington targeting Beijing’s tech ambitions, staking out more stable manufacturing locations has become a strategic priority.

The S&P PMI data has shown the price of the earlier uncertainty, with manufacturing across ASEAN recording its sharpest contraction since August 2021, driven by a decline in new orders, layoffs and weaker raw material purchases.

US consumers on the brink of price increases

For American consumers, who have so far felt little direct impact, economists warn that the quiet period is coming to an end. Prices for imported goods are expected to rise in the coming months.

Experts at Goldman Sachs predict that the US “reciprocal” base tax rate will officially increase from 10% to 15%. This will not only put direct pressure on people’s wallets but also push up inflation and slow economic growth. Barclays’ analysis team also agrees, saying that the trend of bringing the tax rate to the threshold of 15-20% significantly increases the risk of GDP decline in Asia.

Source: https://dantri.com.vn/kinh-doanh/chau-a-dieu-chinh-cuoc-choi-truoc-ban-do-thue-quan-moi-cua-my-20250723173730681.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)