From January 1, 2026, business households will switch from lump-sum tax to self-declaration and tax payment method.

Decision 3389/QD-BTC of 2025 of the Ministry of Finance approving the project of Converting tax management models and methods for business households when eliminating lump-sum tax also clearly states that from January 1, 2026, business households will officially convert from lump-sum tax method to tax declaration and self-payment method.

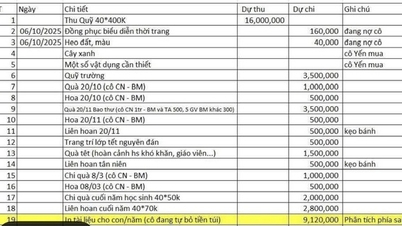

Accordingly, group 1 includes business households with revenue of 200 million VND or less, which are exempt from value added tax (VAT) and personal income tax (PIT), do not need to apply complicated accounting books but still have to declare taxes twice a year.

Group 2 is for business households with revenue from 200 million to less than 3 billion VND/year, applying the method of calculating VAT and personal income tax directly on revenue multiplied by the tax rate of 1.5% for goods distribution, 4.5% for production and food services, 7% for other services and 10% for property rental activities. Households in this group must declare taxes quarterly, keep simple books according to the prescribed form, and are required to open a separate account for business purposes. Households with revenue over 1 billion VND are required to use electronic invoices generated from cash registers.

Group 3 is a business household with a revenue of over 3 billion VND/year. Accordingly, the VAT amount that these households must pay will be equal to input VAT (purchased goods) minus output VAT (sold goods). Personal income tax will be calculated by multiplying taxable income (profit) by the tax rate of 17%, in which profit will be equal to revenue minus reasonable expenses. This group of households is required to use electronic invoices with codes or electronic invoices generated from cash registers; applying the accounting regime according to the regulations of micro-enterprises.

Source: https://nld.com.vn/chi-tiet-tinh-thue-ho-kinh-doanh-khi-xoa-bo-thue-khoan-196251015155950192.htm

![[Photo] Nhan Dan Newspaper launches “Fatherland in the Heart: The Concert Film”](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760622132545_thiet-ke-chua-co-ten-36-png.webp)

![[Photo] General Secretary To Lam attends the 18th Hanoi Party Congress, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760581023342_cover-0367-jpg.webp)

Comment (0)