At the end of the session on September 29, the VN-Index closed at 1,666 points, up 5 points (+0.35%).

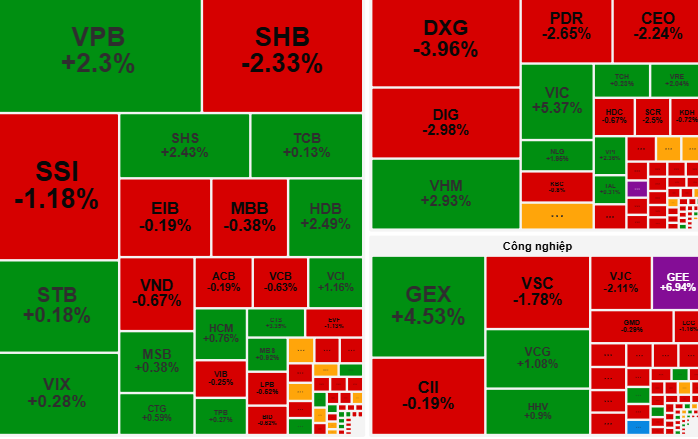

The Vietnamese stock market closed the trading session on September 29 with a slight increase, but there were also fluctuations. The VN-Index opened below the reference price due to intense selling pressure from the banking and securities groups, but quickly reversed thanks to strong demand from the pillar stocks of the Vingroup ecosystem.

By mid-morning, the index fluctuated narrowly around the 1,660-1,670 point range, reflecting a clear differentiation between sectors. The public investment group stood out with VCG increasing by 2.71% and HHV increasing by 0.60%, while red still dominated with 199 stocks decreasing compared to only 94 stocks increasing.

In the afternoon session, the same scenario repeated with a narrow fluctuation range around 1,665 points. The differentiation in the bluechip group continued to be a "negative point", whenFPT , MSN and MWG were under strong selling pressure from large investors. In contrast to the morning, real estate and public investment stocks were "dumped", causing the increase to narrow. The rare bright spot came from the livestock industry group, with HAG increasing by 3.14%, DBC increasing by 2.78% and BAF increasing by 1.0%.

At the end of the session, VN-Index closed at 1,666 points, up 5 points (+0.35%).

VCBS Securities Company forecasts that the market will continue to move in the 1,660-1,670 point range, with cash flow strongly differentiated among industry groups. "Investors should hold stocks that are on an uptrend and reduce leverage on stocks under selling pressure. Notable industry groups for the next session include banking and livestock" - VCBS Securities Company recommends.

Rong Viet Securities Company (VDSC) believes that the market has made an effort to overcome the resistance level of 1,663 points, but the supporting cash flow is still cautious in this area. To balance and return to the uptrend, the cash flow needs to absorb stronger supply, helping the market stabilize. On the contrary, if the supporting cash flow is weak, the market is likely to decrease.

Source: https://nld.com.vn/chung-khoan-ngay-mai-30-9-dong-tien-co-the-dich-chuyen-kho-luong-196250929190916237.htm

![[Photo] Closing of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759893763535_ndo_br_a3-bnd-2504-jpg.webp)

Comment (0)