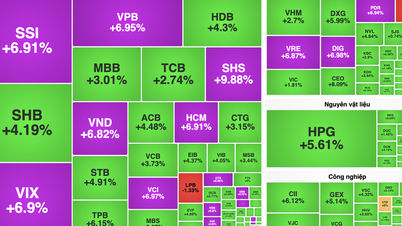

At the end of the trading session on October 7, VN-Index closed at 1,685 points, down about 10 points compared to the previous session; HNX-Index also decreased by 1.82 points to 272 points. Liquidity remained low when the transaction value on the HOSE floor was only over VND 25,600 billion, a sharp decrease compared to the previous session.

The market's decline today was surprising, contrary to the expectations of many investors when the previous session increased by nearly 50 points.

On stock forums, many investors said they were "holding their breath" waiting for the announcement of the results of upgrading Vietnam's stock market from frontier to emerging early tomorrow morning (October 8, Vietnam time).

The whole country has nearly 11 million securities accounts.

Foreign investors continued to sell net, with a net selling value of over VND1,300 billion on the HOSE. Since the beginning of the year, foreign investors have sold net over VND100,000 billion on the Vietnamese stock market. However, according to experts, the trading ratio of foreign investors is currently only about 11% - the scale is not large, so the impact on the VN-Index is not as great as before.

In another development, according to data from the Vietnam Securities Depository (VSD), the number of domestic investor accounts increased by nearly 290,000 in September 2025, increasing for many consecutive months. By the end of September 2025, individual investors had a total of nearly 11 million accounts.

Foreign investors are net sellers but experts say it does not have too big an impact on the VN-Index.

Regarding the market upgrade, early tomorrow morning (Vietnam time), FTSE Russell will announce the results, with the expectation that the Vietnamese stock market will be upgraded from frontier to secondary emerging market.

Talking to a reporter from Nguoi Lao Dong Newspaper, Mr. Tran Quoc Toan, Director of Branch 2 - Headquarters of Mirae Asset Securities Company (MAS), analyzed that the stock market had a period of price increase of over 33% since the beginning of the year, then went through a period of stagnation in September to early October and had a strong increase on October 6 - the time close to the time before FTSE will announce the results of ranking the Vietnamese market.

"The market is showing signs of a new wave of growth as the macro foundation is being supported with high GDP growth, low interest rates, especially the profit growth of listed enterprises. With a P/E valuation of about 15x, high growth prospects of listed enterprises, especially the pillar industry of banking, the market is still relatively attractive" - Mr. Toan said.

If upgraded stock, which stock to choose?

Dr. Ho Sy Hoa, Director of Research and Investment Consulting, DNSE Securities Company, said that when Vietnam's stock market is upgraded, entering the fourth quarter of 2025, the market is expected to be strongly affected by macroeconomic policies, in the context of the Government's efforts to achieve the annual GDP growth target of 8%.

GDP growth in the third quarter was impressive at 8.23%, thanks to large contributions from the industrial - processing - manufacturing and retail services sectors. In the first 9 months, GDP increased by 7.85% compared to the same period last year, very close to the annual target.

To achieve the 8% growth target, the fourth quarter needs to maintain an increase of about 8.4% - a challenging figure in the context of not much room for credit growth (13% increase after 9 months), while the USD/VND exchange rate has appreciated by about 4%.

Currently, the probability of market upgrade is forecasted at over 90% by financial institutions.

Public investment disbursement has only reached 55.7% of the plan, equivalent to the same period in 2024. This makes promoting disbursement one of the Government 's policy focuses in the last quarter of the year.

"If the disbursement speed improves, infrastructure stocks - public investment such as construction materials, construction, industrial park real estate... will likely become the focus of the market in the coming period.

The group of securities stocks is also assessed to have clearly benefited. If the positive trend of the market continues in the fourth quarter, this group will continue to be the leading force, strongly attracting speculative cash flow" - Dr. Ho Sy Hoa said.

Unupgraded script

According to experts, upgrading the stock will certainly be an event that causes big fluctuations for the index and stocks in the short term. If the results are not as expected, it is likely to cause negative sentiment among investors and lead to a sell-off.

Mr. Tran Quoc Toan said that monitoring the upgrade event, maintaining a prudent portfolio, and having the necessary cash ready should be considered. The market may discount reflecting investor sentiment if the upgrade does not take place in the October announcement period.

"The upgrade is only a short-term catalyst for the market. Whether or not it is upgraded will not affect the core business activities of many enterprises. Vietnam's GDP growth target of up to 10% by 2026 is a solid foundation for the growth of the stock market," said Mr. Toan.

Source: https://nld.com.vn/vn-index-gay-bat-ngo-truoc-gio-cong-bo-nang-hang-chung-khoan-kich-ban-nao-cho-nha-dau-tu-196251007172230508.htm

![[Photo] Prime Minister Pham Minh Chinh chairs the 16th meeting of the National Steering Committee on combating illegal fishing.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759848378556_dsc-9253-jpg.webp)

![[Photo] Super harvest moon shines brightly on Mid-Autumn Festival night around the world](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759816565798_1759814567021-jpg.webp)

Comment (0)