Stock market cautiously awaits news of upgrade - Photo: QUANG DINH

Cash flow is more cautious before the announcement of stock upgrade results

* Mr. Le Tien Dat - Agribank Securities analyst:

- Market expectations for the upgrade are high. Therefore, as the announcement date approaches, it is understandable that investors will be more cautious in the uncertain context.

But in reality, upgrading is a long way to meet international standards and increase attractiveness to both domestic and foreign capital flows.

In the context that Vietnam is still making efforts to improve market quality, being upgraded by FTSE (possibly MSCI in the future) is a matter of time.

In the short term, in general, VN-Index has been in a large sideways range for the past two months, with a tendency to gradually narrow the current range to the 1,620-1,670 point range.

Although the index has not seen any deep correction in the past 2 months, many stocks/stock groups have decreased by 20-30% and lost their previous price base.

I think the market may have discounted some of the negative scenarios and this is a good sign for investors as the risk factor has been discounted.

Accordingly, it is forecasted that next week, VN-Index will likely retreat and retest the support zone of 1,620 points in the first two sessions of the week before the official upgrade information is announced.

Strong fluctuations in amplitude may appear in the middle of the week when there is official news announcement, to test whether the market trend will break out in an upward direction (at the resistance of 1,670 points) or downward direction (at deep support around the 1,500-1,550 point area).

The market needs a strong enough push.

* Mr. Phan Tan Nhat - Head of SHS Market Strategy Department:

- After a period of strong price increases, VN-Index surpassed the historical peak of 2022 and entered an accumulation phase entering the fourth quarter.

However, the short-term trend is showing a less positive signal as the index failed to maintain the nearest support zone around 1,660 points - corresponding to the average price zone of 20 sessions. This development has increased short-term selling pressure in many stocks.

Currently, the VN-Index is fluctuating within a narrow range. The index may face correction pressure to retest the support zone of 1,600 - 1,620 points in the short term. The market needs a strong enough push, along with a significant improvement in liquidity, to be able to break out of the accumulation zone that has lasted for more than a month.

The Vietnamese stock market is in a period of re-evaluating fundamental factors, including the third quarter macroeconomic developments, business results of listed enterprises and especially expectations of market upgrade from international organizations such as FTSE.

These will be key factors that will guide investment trends in the coming time. In the upcoming October 2025 strategic report, the analysis organizations are expected to update the macroeconomic overview, evaluate each industry group and build a portfolio of potential stocks that can be considered for the FTSE Emerging Markets basket when Vietnam is upgraded.

Closely follow the market to manage risks

* Mr. Quach Anh Khanh - expert of Vietcombank Securities (VCBS):

- Although still maintaining movement in the 1,620 - 1,680 range, VN-Index has been forming a downward zigzag trend for over a month now.

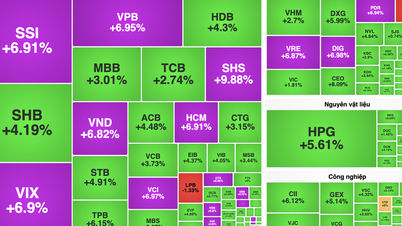

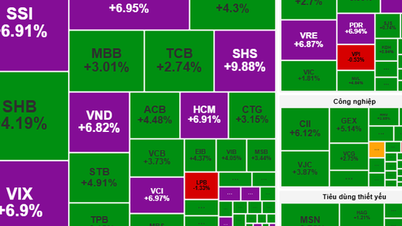

Last week, the adjustment pressure mainly came from the real estate and public investment groups, which had increased rapidly in recent times, and cash flow gradually focused more on large-cap stocks such as the Vingroup group (VIC, VHM, VRE) and the banking group.

Therefore, we recommend that investors closely follow market developments next week and pay attention to portfolio risk management while waiting for the upgrade results of the Vietnamese stock market as well as the second quarter business results of listed companies.

In addition, investors can also consider exploratory disbursement in stocks that are still holding the support zone or bouncing from the accumulation base in recent sessions, with notable industry groups being banking and securities.

Source: https://tuoitre.vn/chung-khoan-sap-don-su-kien-rat-lon-dien-bien-tuan-nay-du-bao-ra-sao-2025100608553426.htm

Comment (0)