Pre-trading margin and foreign room are the two biggest obstacles to upgrading the Vietnamese market and this issue is being urgently resolved by the Securities Commission.

On August 29 in Hong Kong, Securities Commission Chairwoman Vu Thi Chan Phuong chaired a meeting with institutional investors and partners to discuss solutions aimed at upgrading the Vietnamese market from a frontier market to an emerging market.

According to Ms. Phuong, upgrading the market is one of the major goals that the Vietnamese Government is aiming for. This goal has been included in the Project "Restructuring the stock market and insurance market until 2020 and orientation to 2025", and has also been included in the draft "Strategy for stock market development until 2030".

"Vietnam aims to upgrade its market from a frontier market to an emerging market before 2025," the Chairman of the Securities Commission commented.

According to the general assessment of rating agencies and international financial institutions, Vietnam has made many improvements and achieved many important criteria. However, there are currently two groups of issues that need to be improved: prefunding requirements and foreign ownership limits.

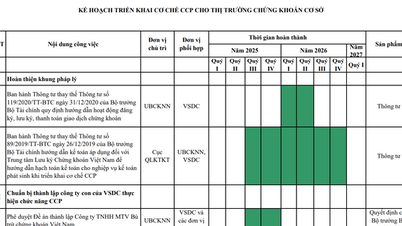

According to investors, to be upgraded, Vietnam needs to implement the central counterparty (CCP) model as stipulated in Decree 155, in which the depository bank must be a clearing member and fully disclose the maximum foreign ownership ratio of conditional business lines. Restricting foreign "room" should only be applied to industries that are really necessary.

According to the Chairman of the Securities Commission, when permitted by the State Bank, the solution to deploy the CCP system - the depository bank is a clearing member - is the optimal solution to handle the problem of pre-transaction margin requirements.

"If the prefunding problem is not resolved, the story of upgrading the Vietnamese stock market will be very difficult to achieve its goal," Ms. Phuong stated her opinion.

A meeting with institutional investors and partners was held by the Securities and Exchange Commission (SEC) and ASIFMA in Hong Kong on August 29. Photo: Securities and Exchange Commission (SEC)

While waiting for the CCP, the Chairman of the Securities Commission said the regulator is studying short-term technical solutions to mitigate foreign investors' concerns. In the long term, the CCP system must be implemented.

Mr. Lyndon Chao, representative of the Asian Securities and Financial Markets Association (ASIFMA), assessed that Vietnam has been and is one of the fastest growing economies in Asia, the fastest growing region in the world.

Vietnam benefits from diversifying global supply chains and a rapidly growing middle class. According to McKinsey, nearly 70% of Vietnamese consumers are optimistic about the future.

ASIFMA representatives also said that global investors will continue to increase their investment in Asia and Vietnam, considering this a prominent investment destination in the future when the management agency's efforts to reform the market will help global fund managers access Vietnam more easily.

Minh Son

Source link

![[Photo] President Luong Cuong receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/6bd456e072504df3a468acbf9b7989c8)

![[Photo] Joy on the new Phong Chau bridge](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/b00322b29c8043fbb8b6844fdd6c78ea)

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

![[Photo] President Luong Cuong receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/29/6bd456e072504df3a468acbf9b7989c8)

Comment (0)