According to the roadmap, in the first and second quarters of 2026, the State Securities Commission will coordinate with the Vietnam Securities Depository and Clearing Corporation (VSDC) to issue a Circular replacing Circular No. 119/2020/TT-BTC dated December 31, 2020 of the Ministry of Finance providing guidance on securities registration, depository, and payment activities.

From the third quarter of 2025 to the fourth quarter of 2026, the Department of Accounting and Auditing Supervision will coordinate with the State Securities Commission and VSDC to issue a Circular replacing Circular No. 89/2019/TT-BTC dated December 26, 2019 of the Minister of Finance guiding accounting applicable to VSDC to guide accounting for accounting operations arising when implementing the CCP mechanism.

During the period from the third quarter of 2025 to the first quarter of 2026, the State Securities Commission will coordinate with VSDC and related units to prepare for the establishment of a subsidiary of VSDC to perform CCP functions.

Also in 2026, VSDC and its members will take preparatory steps to deploy the CCP mechanism for the underlying stock market from the first quarter of 2027.

Source: https://hanoimoi.vn/lo-trinh-trien-khai-co-che-doi-tac-bu-tru-trung-tam-cho-thi-truong-chung-khoan-co-so-709480.html

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

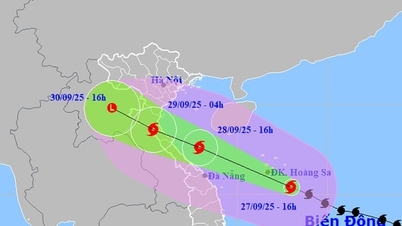

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

Comment (0)