March 15 was a session of strong market fluctuations that made many investors scared.

VN-Index was like a roller coaster, at one point dropping sharply to the 1,250 point range before closing at 1,263.78 points, recording an adjustment of 0.48 points, equivalent to 0.04%. HNX-Index decreased by 0.14 points, equivalent to 0.06%; UPCoM-Index decreased by 0.27 points, equivalent to 0.29%.

While profit-taking pressure spread, money continued to pour into buying stocks. Trading volume on HoSE continued to push past 1 billion units, with trading value reaching VND27,508.65 billion.

HNX has 106.98 million shares traded, equivalent to VND 2,220.57 billion, and this number on UPCoM is 50.88 million shares, equivalent to VND 537.19 billion.

Foreign investors sold strongly during the restructuring session of ETF funds (Source: VNDS).

The total amount of money that investors poured into the market to buy stocks in today's session on all three floors reached 30,266 billion VND. Thanks to that, the market breadth was relatively balanced with 485 stocks decreasing compared to 469 stocks increasing.

Notably, the VNSML-Index still increased by 9.84 points, equivalent to 0.66%, showing that investors are still looking for opportunities with small stocks while many large stocks are adjusting. Of the 46 stocks that increased to the ceiling price in the whole market, 37 stocks increased to the ceiling price on the UPCoM floor. Speculative cash flow at this stage is very strong.

There are still 13 VN30 codes increasing in price, in which the "big guy" GVR attracts attention with a strong increase of 5.5%;VIB increases by 3.7%; GAS increases by 1.6%; MBB increases by 1.5% and BID increases by 1%.

Many banking stocks closed higher after falling in price during the session, such as MBB, BID, CTG,ACB , TPB, HDB, STB. Most of the remaining codes also improved their adjustment range.

Notably, financial services (securities) stocks had a spectacular comeback with many codes increasing strongly at the end of the session, including: VDS increased by 4.5%; FTS increased by 4.1%; VCI increased by 2.9%; EVF increased by 2.7%; APG increased by 2.3%; BSI increased by 1.7%; TVS increased by 1.2%. TVB increased by 1.1%... Most of these codes were adjusted during the session.

Green also spread to the real estate sector. In general, investors who disbursed money to buy stocks at the time of the sharpest decline in the afternoon session made profits during the session, however, to realize profits at T+2.5, we still need to wait for the answer in reality.

Notably, this is the portfolio restructuring session of ETF funds such as VNM, FTSE Vietnam and Fubon FTSE Vietnam. In this session, foreign investors sold a very strong net amount of up to 1,354 billion VND in the whole market, with the net selling value on HoSE alone being approximately 1,312 billion VND.

Strong net selling activities took place in some large codes such as HPG with a net selling value of 199 billion VND, VHM with 158 billion VND, VND with 118 billion VND, VIC and VNM with 95 billion and 94 billion VND respectively.

In the opposite direction, foreign investors net bought FTS 138 billion VND, DIG 99 billion VND, EIB 68 billion VND, DGW 44 billion VND and EVF with 43 billion VND.

Thus, despite strong net selling by foreign investors, the market still had a rebound at the end of the session with very strong liquidity on the 3 floors, showing that domestic demand was still "balanced" very well.

Source

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

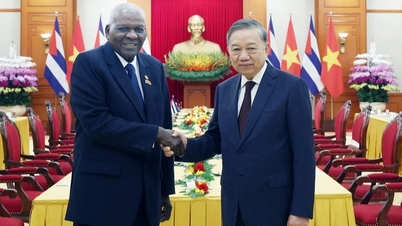

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

Comment (0)