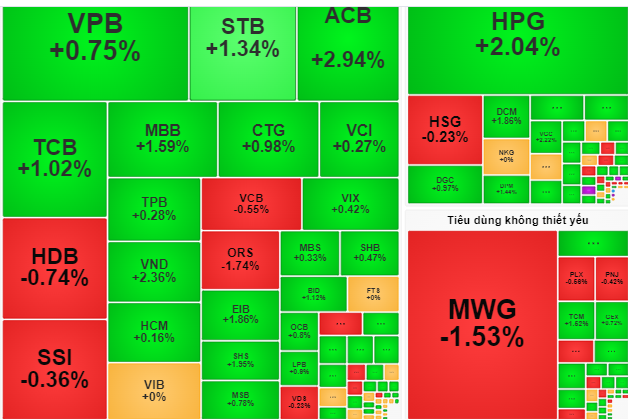

At the end of the session on October 9, the VN-Index closed at nearly 1,282, up 9.8 points, equivalent to 0.78%.

Vietnamese stocks spread green from the beginning of the morning session thanks to the active buying force. The positive point is that many large stocks in the banking, real estate, steel groups and some individual stocks increased in price, helping the market consolidate its upward momentum.

The increase in points was extended in the afternoon session with increased active buying liquidity. Accordingly, the codes in the group of large stocks that increased in price such as VHM (+2.16%), HPG (+2.04%),ACB (+2.94%)... spread this trend to many other stocks, strongly affecting the market score.

At the end of the session, the VN-Index closed near 1,282, up 9.8 points, equivalent to 0.78%.

Vietcombank Securities Company (VCBS) commented that the active buying liquidity of the session 9-10 increased, focusing on large-cap stocks, along with the widespread movement of cash flow, creating the premise for the next uptrends. From there, many investors expect cash flow to continue pouring into stocks, supporting the market to go up in the session 10-10.

ACBS Securities Company said liquidity increased compared to the previous session, showing that buying pressure is gradually overwhelming selling pressure.

"In the coming time, the 1,300-point threshold of the VN-Index will be an important milestone to confirm the market trend" - ACBS forecasts.

Therefore, VCBS recommends that investors maintain the proportion of stocks in banking and securities sectors that are showing signs of recovery, taking advantage of fluctuations in each session to disburse sideways stocks in real estate, public investment, transportation, oil and gas, etc.

Source: https://nld.com.vn/chung-khoan-ngay-mai-10-10-co-phieu-lon-tiep-tuc-ho-tro-da-tang-diem-196241009180529305.htm

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[Photo] Solemn opening of the 8th Congress of the Central Public Security Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/f3b00fb779f44979809441a4dac5c7df)

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)