At the end of the session on August 12, the VN-Index decreased by 1.2 points (-0.1%), closing at 1,282 points.

Continuing the upward trend from the previous session, Vietnamese stocks continued to be green when entering the trading session on August 22. However, the upward trend quickly stopped and retreated at the 1,288 point area of the VN-Index.

At the end of the session, VN-Index decreased by 1.2 points (-0.1%), closing at 1,282 points.

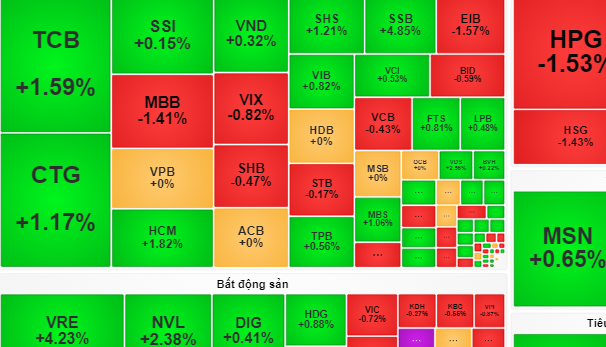

In this session, demand concentrated on a number of banking and real estate stocks... helping to limit the market's decline. Accordingly, the stocks that positively impacted the stock indexes included: SSB (+4.85%), TCB (+1.59%), CTG (+1.17%),... Therefore, many investors expect this trend to continue in the next session.

Dragon Capital Securities Company (VDSC) believes that if cash flow continues to support, the market will head towards 1,305 points in the near future.

"Investors can consider corrections to buy stocks with positive developments. However, stock players need to limit chasing purchases when stock prices have increased, and consider good price zones to sell for profit" - VDSC recommends

However, Asia Commercial Bank Securities Company (ACBS) has a different perspective. Specifically, in the session of August 22, investors traded in a narrow range and ended the previous 4 consecutive sessions of increasing points. The selling pressure focused on stocks with good price growth momentum in recent sessions, including many large stocks in the banking industry such as VCB, MBB...

"In the coming time, the market is likely to correct from the resistance zone of 1,280 - 1,300 points, bringing the VN-Index back to the 1,250 point zone, creating an opportunity for investors to accumulate stocks" - ACBS forecasts.

Source: https://nld.com.vn/chung-khoan-ngay-mai-23-8-co-phieu-ngan-hang-bat-dong-san-tiep-tuc-hut-dong-tien-196240822183851792.htm

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

![[Infographics] Biography of Central Party Committee Member, An Giang Provincial Party Secretary Nguyen Tien Hai](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/3/92491af6e2714aeb80cb1cdf831eb18a)

Comment (0)