Session 10/10: Small and medium-cap stocks were sold heavily,FPT and MSN attracted cash flow

FPT and MSN stock liquidity exceeded the trillion VND mark. Cash flow in the session on October 10 only focused on a few large-cap stocks that are pillars, while many mid- and small-cap stocks faced strong selling pressure.

After the session of increasing points beyond the threshold of 1,280 points, VN-Index continued to be excited when entering the trading session on October 10. The market continued to record strong increases in many stock groups and contributed to pulling the indices above the reference level. The positive point in today's session was that VN-Index maintained green throughout the trading time despite "running out of steam" at the end of the session.

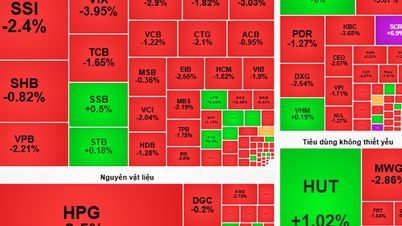

However, a notable point is that cash flow is only concentrated on a few large-cap stocks, while small-cap and mid-cap stocks are being sold off heavily.

FPT and MSN were the focus of the market today. FPT increased by 4.65% to 141,700 VND/share and matched nearly 10 million units. MSN also increased by 3.9% to 80,000 VND/share.

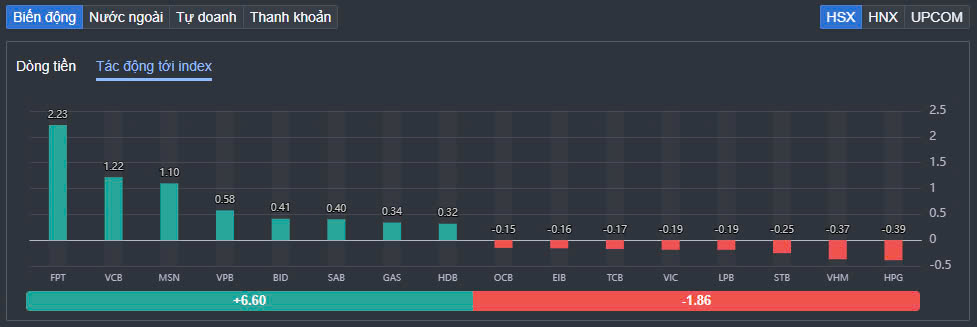

FPT is the stock with the most positive contribution to VN-Index with 2.23 points, MSN also contributed 1.1 points. After today's session, FPT's capitalization reached more than 206,945 billion VND, surpassing a series of other names to become the largest private enterprise in Vietnam listed on the stock exchange.

Regarding MSN shares, according to a recent forecast, the analysis department of SSI Securities Company (SSI Research) believes that Masan Group Corporation could achieve about VND 650 billion in after-tax profit in the third quarter of 2024, an increase of nearly 13 times over the same period last year.

Besides, stocks such as VCB, BID or CTG also maintained good green color and contributed to supporting the general market.

In a recent report on the implementation of the 2024 socio-economic development plan sent to the National Assembly Standing Committee, the Government updated the progress of capital increase for the group of State-owned commercial banks. According to the report, the Government has submitted to competent authorities a plan to invest additional state capital at Vietcombank, and is completing the dossier to increase charter capital for Vietcombank, BIDV , Vietinbank and Co-opBank.

|

| Two large stocks, FPT and MSN, led the market in both score and liquidity. |

Cash flow mostly focused on a few pillar stocks, while many other large-cap stocks decreased in price and put great pressure on the market. HPG corrected when it decreased by 0.91% and took away 0.39 points from the VN-Index. VHM also decreased by 0.82% and took away 0.37 points. STB attracted attention when it dropped sharply by 1.6% despite having a good increase during the session. STB increased by 1.9% to 34,800 VND/share. Thus, STB closed 3.6% lower than the highest price of the session.

In addition, the group of small and medium-cap stocks recorded a lot of stocks being sold heavily in the securities, real estate, steel industries... In the securities group, the trend of pulling at the end of the previous session and "dumping" in the next session continued to take place. After pulling strongly at the end of the session on October 9, in today's session, a series of securities stocks were sold heavily. The name that attracted attention in this group was VCI when it decreased by 2.67% and pushed up pessimism about this group, thereby increasing selling pressure. Other securities stocks such as MBS, VIX, VDS, SHS... were also in red.

At the end of the trading session, VN-Index increased by 4.51 points (0.35%) to 1,286.36 points. The entire floor had 163 stocks increasing, while 206 stocks decreased and 69 stocks remained unchanged. HNX-Index decreased by 0.48 points (-0.21%) to 231.29 points. The entire floor had 62 stocks increasing, 80 stocks decreasing and 76 stocks remaining unchanged. UPCoM-Index increased by 0.12 points (0.13%) to 92.57 points.

|

| Foreign investors ended the net selling streak that had lasted into the fourth session. |

The total trading volume on the HoSE reached 720 million shares, equivalent to a trading value of VND18,471 billion, up 8% compared to yesterday's session, of which the negotiated value accounted for VND1,286 billion. The trading value on the HNX and UPCoM reached VND937 billion and VND1,048 billion, respectively. Notably, the negotiated transaction value on UPCoM today reached VND601 billion, of which VNA negotiated a value of VND345 billion, TLP was VND168 billion.

On the stock exchange, the only two stocks with liquidity exceeding a thousand billion VND are MSN and FPT. These are also the two stocks that strongly attract foreign cash flow.

During the session, foreign investors net bought the most MSN with 367 billion VND. FPT and NTL were net bought 311 billion VND and 158 billion VND respectively. In the opposite direction, STB was net sold the most with 126 billion VND. CTG and VPB were both net sold about 50 billion VND. In total, foreign investors net bought again more than 500 billion VND on HoSE. On all three exchanges, foreign investors disbursed a total of 459 billion VND, ending the net selling streak that had lasted for 4 consecutive sessions.

Source: https://baodautu.vn/phien-1010-co-phieu-von-hoa-vua-va-nho-bi-ban-manh-fpt-va-msn-hut-dong-tien-d227125.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)