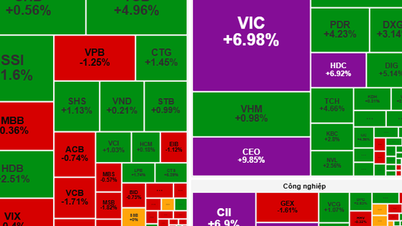

Opening the trading session on October 14, the stock market continued to explode. The VN-Index increased by nearly 20 points, extending the streak of days reaching historical peaks.

As of 9:30 a.m. on October 14, the VN-Index increased by nearly 25 points (+1.4%) to 1,790 points. The VN30 increased by 40 points (+2%) to 2,051 points. Liquidity improved significantly as domestic cash flow returned, although foreign investors still maintained a net selling streak.

Thus, after the VN30 index surpassed the 2,000-point threshold for the first time in history - reaching a record 2,012 points on October 13 - the index continued to break out, demonstrating the strength of pillar stocks in the context of FTSE Russell's announcement to upgrade the Vietnamese stock market from a frontier market to a secondary emerging market, effective next year.

Many stocks increased sharply. VIC shares of Vingroup Corporation (founded by billionaire Pham Nhat Vuong) continued to increase, adding 14,300 VND to 219,700 VND/share, far surpassing the threshold of 200,000 VND/share recently conquered.

Vinhomes shares (VHM) increased by VND5,200 to VND129,400/share.

Securities, banking, and real estate stocks also made a breakthrough. SSI Securities (SSI) increased by VND1,250 to VND42,600/share. CII increased by VND900 to VND29,550/share...

It can be seen that FTSE Russell's decision is considered a historic turning point, marking the maturity of Vietnam's capital market after more than a decade of reform efforts, opening a "new cycle" for Vietnam's stock market.

Vietnam's stock market continuously hits new peaks. Photo: HH

Mr. David Sol - Director of Global Policy FTSE Russell, said that the decision to upgrade Vietnam's stock market has two key meanings.

Vietnam's stock market has met strict standards, from liquidity, payment mechanisms, to transparency and accessibility for foreign investors.

The upgrade also makes Vietnam’s stock market more attractive to international investors, as the number of funds and investors tracking the FTSE Emerging Market index is many times larger than that of the frontier market group. Vietnam is expected to receive about 2 billion USD in active and passive capital flows.

VNDirect Securities estimates that after being officially included in the secondary emerging market group, Vietnam could attract about 1.5 billion USD from open-end funds and ETFs tracking FTSE indexes. If active capital flows are included, this figure could range from 3.4 billion USD to 6 billion USD.

Stocks also benefited from a positive macro backdrop with third-quarter GDP growing 8.23%.

In addition, the real estate market is heating up and the high prices are also causing some of the cash flow to shift to other investment channels. The rising gold price and difficult transactions are also causing investors to limit their choice of other channels.

Last week, cryptocurrency investors experienced a shock as many coins plummeted in price. Bitcoin lost nearly 15% in a short period of time, many tokens evaporated more than 90% and many accounts were “burned”. The strong volatility of the cryptocurrency market also contributed to the flow of money back to mainstream investment channels such as stocks.

JP Morgan Bank has just predicted that VN-Index will reach 2,200 points in the next 12 months, equivalent to an increase of 30% compared to the current level.

JP Morgan’s report said that the upgrade decision will open up a significant wave of passive capital flows into Vietnam. According to JP Morgan’s estimates, global index funds could pour about $1.3 billion into the Vietnamese stock market, equivalent to a 0.34% weighting in the FTSE Emerging Market All Cap Index basket.

After 7 years of waiting for an upgrade, Vietnamese securities turn a new page. HSBC forecasts that the potential for foreign capital flows could reach 3.4-10.4 billion USD from active and passive investment funds after the Vietnamese stock market is upgraded.

Source: https://vietnamnet.vn/dong-tien-khung-khuay-dong-thi-truong-vn-index-ap-sat-1-800-diem-2452488.html

Comment (0)