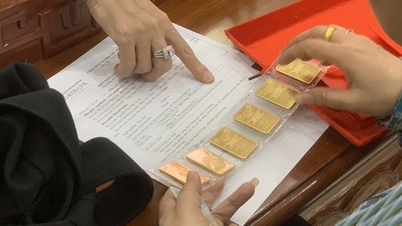

At the end of the trading week from June 30 to July 5, SJC gold bar prices were listed by large enterprises at 118.9-120.9 million VND/tael (buy - sell). Gold bar prices opened the week at 117.2-119.2 million VND/tael (buy - sell) and the highest price recorded was 119.3-121.3 million VND/tael (buy - sell).

Thus, after a week of trading, although the price could not be kept at the peak, both buying and selling prices increased by 1.7 million VND.

The listed price of plain round rings is 114.3-116.8 million VND/tael (buy - sell), down 200,000 VND each way before closing the week.

In the international market, the price of gold closed the week at 3,335 USD/ounce. The world precious metal started the week at 3,271 USD/ounce and at one point dropped below 3,250 USD - the lowest of the week. However, the price then reversed and started to increase steadily, before turning down slightly and closing the week at the current level due to technical selling pressure and the influence of the US non -farm employment report.

However, gold prices still recorded a 2% increase during the week.

World gold price recorded a 2% increase this week (Photo: Tien Tuan).

Adam Button, head of currency strategy at Forexlive.com, said the US dollar’s performance last week was the main factor explaining the ups and downs in gold prices last week. The greenback’s slight rise after the jobs report but then quickly reversed shows that the selling trend of the US dollar has been dominant since the beginning of the year. “As the US dollar continues to weaken, gold will continue to benefit,” he said.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said the US Federal Reserve is in a difficult position, caught between pressure to cut interest rates and rising inflation risks. He also stressed that the recent stability in gold prices is mainly due to the weakness of the US dollar.

Adrian Day, president of Adrian Day Asset Management, is more cautious, saying that a number of negative factors could come together and overshadow gold's role: the possibility of a Fed rate cut as early as this month, new tariff agreements and a slowdown in central bank buying, especially from China. However, he stressed that any correction in gold would be mild and short-lived.

Marc Chandler, an expert from Bannockburn Global Forex, also maintains a cautious view. Forecasting the world gold price next week, he believes that the recovery of gold is fragile. According to him, the price may return to the $3,250/ounce area or lower. "Strong employment data and rising interest rates are putting a lot of pressure on gold," he said.

Sharing this view, Sean Lusk, co-director of trade defense at Walsh Trading, questioned the appropriateness of the Fed's rate cut at the present time.

According to experts, interest rate cuts are often a sign of economic trouble. But right now, stocks are still at their peak and the economy is doing well. According to him, if the Fed cuts too soon, the risk of inflation returning is not to be underestimated.

However, Sean Lusk also believes that in the long term, gold still has the potential to increase in price. “If there is a correction, it will only be temporary. We are still in a big price cycle,” he said.

Jim Wyckoff, an expert at Kitco, believes that gold will continue to fluctuate sideways or fluctuate until there is a strong enough factor to break the current price range.

Source: https://dantri.com.vn/kinh-doanh/du-bao-gia-vang-sau-tuan-tang-gia-20250706020136208.htm

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

![G-DRAGON 2025 WORLD TOUR [Übermensch]](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/3/0dec353013874c2ead28385a8c4ccf55)

Comment (0)