Coffee prices today on the world market

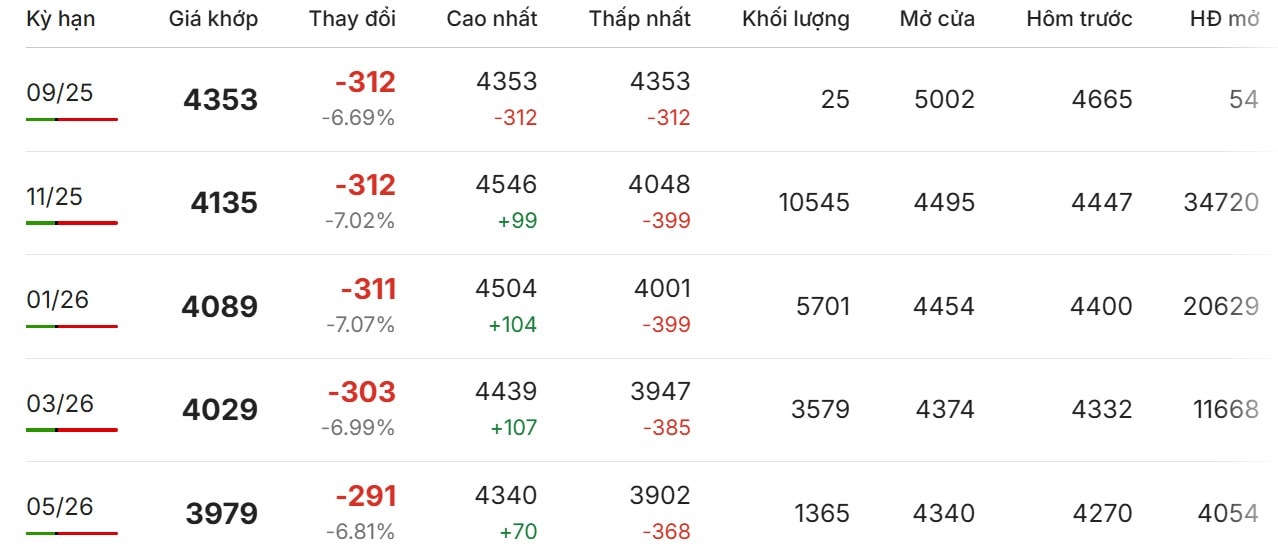

Today, the world coffee market on the London floor experienced a dramatic decline across the board. Robusta coffee prices plummeted across all terms, with notable fluctuations in the long-term terms.

The nearest futures price 09/25 fluctuated at 4,353 USD/ton, down slightly by 312 USD.

The 11/25 futures price saw the biggest drop, losing 312 USD, or 7.02%, to 4,135 USD/ton.

The 01/26 term was not out of the trend, down 311 USD, bringing the price to 4,089 USD/ton.

The two further terms of 03/26 and 05/26 continued the downward trend, losing 303 USD and 291 USD respectively, closing at 4,029 USD/ton and 3,979 USD/ton.

The Arabica coffee market on the New York floor today was painted in red as all terms plunged. Trading prices slid at low levels, highlighted by sharp declines in the near term.

December 25 futures fell 15.55 cents to close at 365.30 cents/lb.

March 26 futures also did not escape the trend, losing 15 cents, trading at 346.25 cents/lb.

May 26 and July 26 futures prices decreased by 14.85 cents and 14.15 cents, respectively, to 332.45 cents/lb and 319.25 cents/lb.

The September 26 term alone recorded a much more modest decrease, only 3.10 cents, stopping at 331.50 cents/lb.

Coffee futures in New York and London fell sharply on improving supply prospects, while traders closely watched the impact of tariffs, according to Bloomberg. In New York, Arabica coffee futures fell more than 4% shortly after the Washington Post reported that a group of US lawmakers planned to introduce a bill to exempt coffee products – from roasted and decaffeinated beans to coffee husks and coffee-containing products – from import tariffs.

The move, if approved by President Donald Trump after passing the House and Senate, could open up trade flows between the US and Brazil – the world’s largest supplier of Arabica. “If the bill passes, it will ease pressure on US domestic stocks, boost imports and ease input cost concerns for the processing industry,” said Hedgepoint expert Laleska Moda.

Meanwhile, in London, Robusta coffee – the type used mainly for instant coffee – fell as much as 7%, largely on expectations of a boom in Vietnamese output. Vietnam – the largest exporter of Robusta – is expected to have its biggest harvest in four years, up 6% to about 29.4 million 60kg bags, thanks to favorable rainfall, according to a Bloomberg News survey of seven traders, producers and analysts. “Although not yet finalised, the proposed tariffs offer the potential to improve trade disruptions, helping Brazilian farmers sell off their inventories, easing supply strains and driving down prices,” added Oran van Dort of Rabobank.

Domestic coffee prices today September 21, 2025

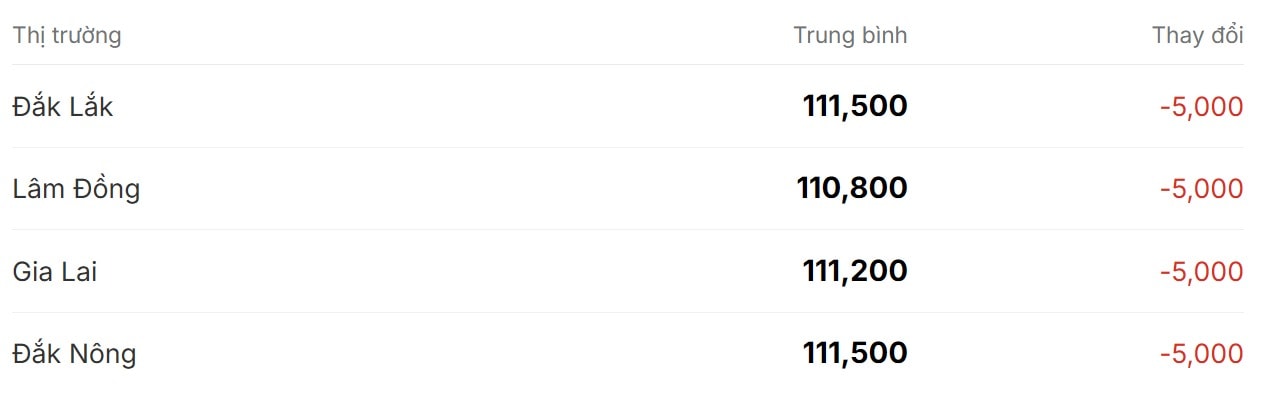

Coffee prices in the Central Highlands today have "plummeted" across all localities, making farmers restless. The uniform decrease of 5,000 VND/kg has pushed coffee prices down to a new level.

In Dak Lak and Dak Nong , coffee prices are currently at 111,500 VND/kg, maintaining the leading position in the region. Meanwhile, Gia Lai follows closely at 111,200 VND/kg. Lam Dong, although still at the bottom of the list, also recorded prices at 110,800 VND/kg, creating a volatile market picture.

Domestic coffee prices today (September 21, 2025) in the Central Highlands simultaneously "plummeted" following the world trend, making farmers restless. The uniform decrease of 5,000 VND/kg has pushed prices to a new low, reflecting pressure from abundant Vietnamese supply and fluctuations in US tariffs - an indirect factor affecting Robusta exports, which account for a large proportion of Central Highlands output.

Despite today’s sharpest decline in weeks, the outlook for coffee prices remains a delicate balance between recovering supplies and weather risks. According to Reuters, Arabica prices are expected to fall by about 30% by the end of 2025, closing at an average of $2.95 per pound, thanks to a projected 40.55 million bag crop in Brazil in 2025/26 (albeit lower than last year) and demand being held back by recent record high prices. Robusta has also plunged, to $4,200 per ton by the end of the year, with Vietnam’s output rising to 29 million bags and Brazil reaching 24.5 million bags.

The World Bank forecasts Arabica prices to rise more than 50% from this year in 2025 before falling 15% in 2026, thanks to a strong recovery in Colombia, the second-largest producer. Citigroup, on the other hand, is more optimistic, raising its US price forecast to $2.80/lb in 2025 and stabilizing at $2.65/lb in 2026, while its analysis highlights a modest increase in global production that will push prices down 8% in 2025 and stabilize the following year. InvestingHaven forecasts a neutral to bearish 2025 forecast, with a potential rise to $3.40/lb but a bumpy road to 2026 due to record global consumption of 170.2 million bags, tight inventories of just 31.8 million bags, and a 6.2% CAGR in the market.

Source: https://baodanang.vn/gia-ca-phe-hom-nay-21-9-ket-thuc-tiec-giam-chong-mat-thi-truong-tro-lai-mat-dat-3303265.html

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Infographic] What are the growth targets of Dong Nai province in the first 9 months of 2025?](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/3/45f9330556eb4c6a88b098a6624d7e5b)

Comment (0)