| Commodity market today October 15, 2024: 'Bright red' energy prices lead the trend of the entire commodity market Commodity market today October 16, 2024: World raw material commodity prices continue to fluctuate |

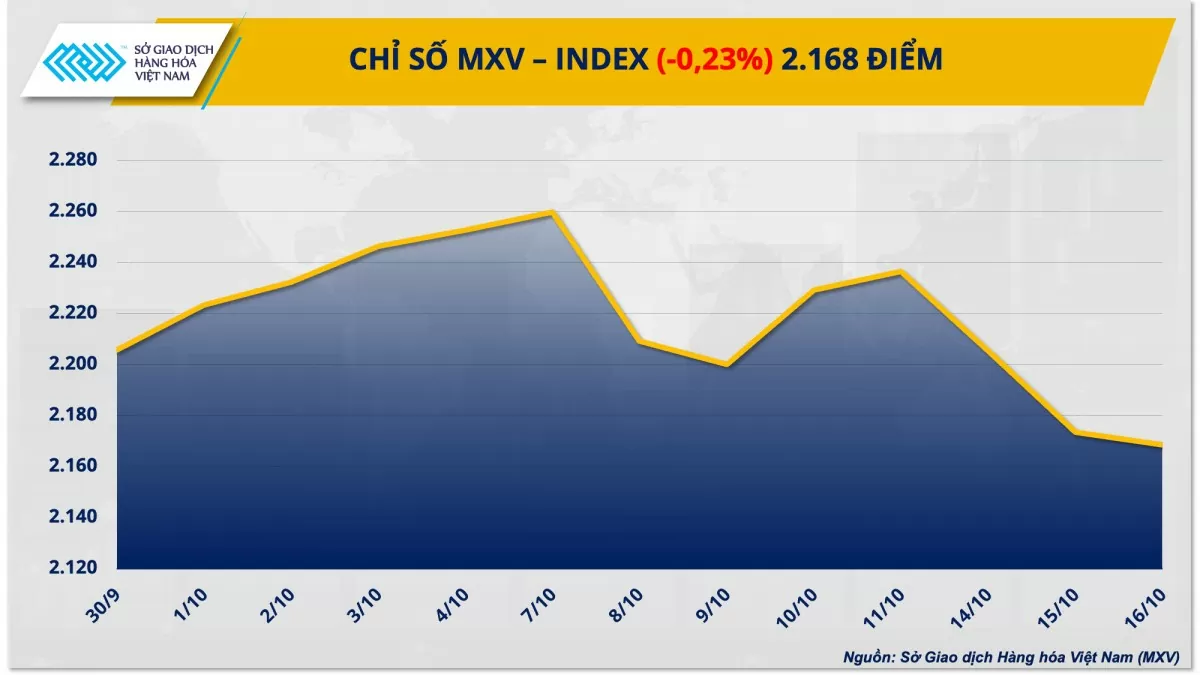

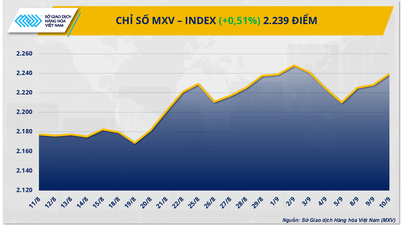

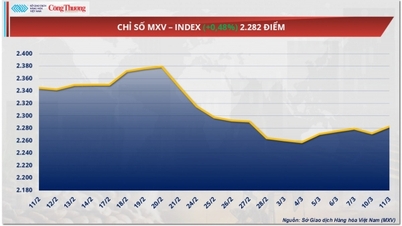

According to the Vietnam Commodity Exchange (MXV), at the close of trading yesterday (October 16), the MXV-Index decreased slightly by 0.23% to 2,168 points, marking three consecutive sessions of weakness. The industrial raw materials group led the trend of the entire market when the prices of many commodities were deep in the red, in which the price of raw sugar fell to the lowest level in nearly a month. Contrary to the developments of the remaining commodity groups, the metal market recovered after two previous volatile and strong correction sessions.

|

| MXV-Index |

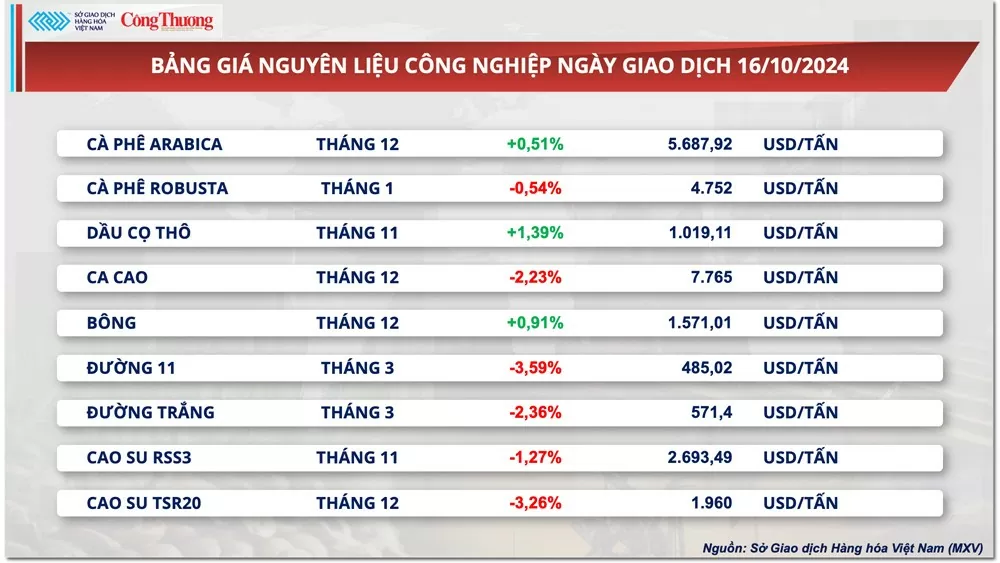

Sugar prices fall to near one-month low

Closing yesterday's trading session, raw sugar prices led the decline of the industrial raw materials group when they fell more than 3%, losing all the gains gained in the previous 4 consecutive sessions of increase and returning to the lowest level in nearly a month.

|

| Industrial Raw Material Price List |

Rains have returned to most of Brazil’s sugarcane growing regions, including the main Central-South region. This has boosted expectations for the 2025-2026 sugar supply outlook. The rains will both provide moisture to the soil and lower temperatures, creating favorable conditions for sugarcane fields to recover after a long period of record drought.

In addition, the Dollar Index increased by 0.32% in yesterday's session along with the weakening of the Brazilian Real, pushing the USD/BRL exchange rate to its highest level in more than a month. This helped stimulate the psychology of increasing sugar sales among Brazilian farmers in the hope of earning more foreign currency.

Earlier, September export data showed that Brazil is still boosting sugar supplies internationally, despite logistical problems and concerns about lower-than-expected production due to drought and fires. The South American country's government announced that it exported 3.95 million tons in September, up 23.82% from 3.19 million tons in the same period last year.

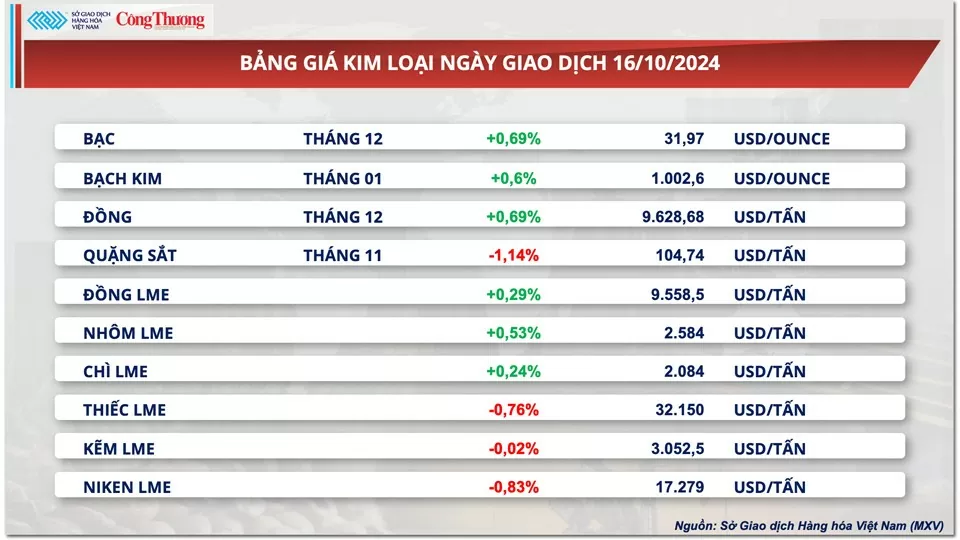

Metal market recovers, iron ore prices still face difficulties

According to MXV, green gradually returned to the metal price chart in yesterday's trading session with 6/10 items increasing in price, after two consecutive previous sessions of decline. In the precious metal group, silver and platinum prices both increased by about 0.6%, closing at 31.97 USD/ounce and 1,002.6 USD/ounce, respectively.

|

| Metal price list |

The precious metals group did not have any major fluctuations in yesterday's session due to the temporary lack of new economic data in the market. In addition, mixed signals from fundamental information also caused the prices of silver and platinum to move sideways recently.

In addition to the Fed’s interest rate developments, investors’ attention is also gradually shifting to the upcoming important election in the US. Increased uncertainty before the identity of the next President is announced could boost demand for precious metals as a risk-off tool, thereby limiting the possibility of a sharp decline in silver and platinum prices.

Among the base metals, iron ore prices continued to fall due to the gloomy demand outlook while supply remained abundant. At the end of the session, this commodity fell 1.14% to 104.74 USD/ton, recording the sharpest decline in the group.

Specifically, the World Steel Association (WorldSteel) recently lowered its forecast for global steel demand growth to 0.9% this year, equivalent to 1.75 billion tons, lower than the 1.7% increase estimated in April due to weak consumption. This puts great pressure on the price of iron ore, a key raw material in steel production.

Amid a gloomy outlook for consumption, iron ore supplies have remained steady, adding to the selling pressure. Yesterday, the two iron ore giants Vale and Rio Tinto both reported higher production in the third quarter.

Vale's iron ore production reached 91 million tonnes, up 5.5% year-on-year and the highest since the fourth quarter of 2018, mainly due to improved output at its three mining projects, S11D, Itabira and Brucutu. Meanwhile, Rio Tinto also increased its output to 84.1 million tonnes, up 1% year-on-year and 5% quarter-on-quarter.

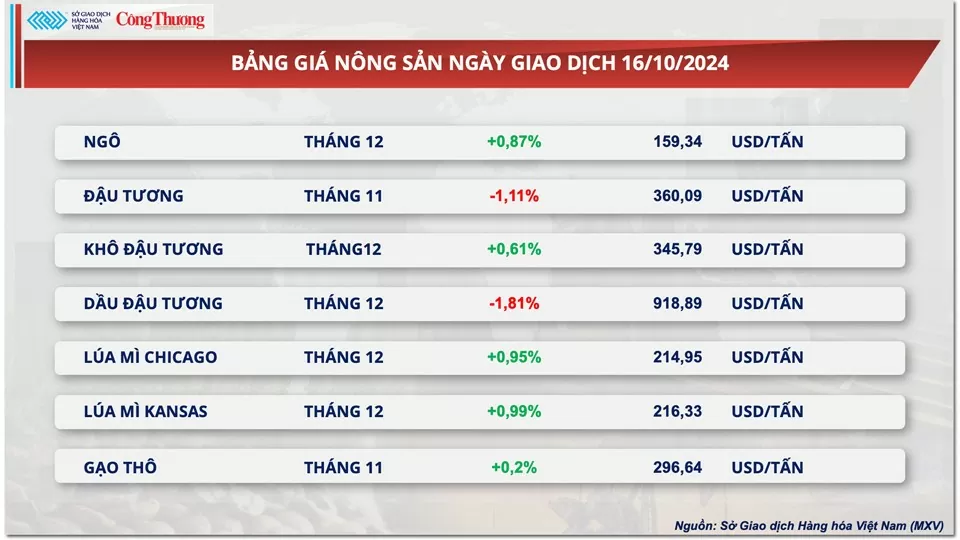

Prices of some other goods

|

| Agricultural product price list |

|

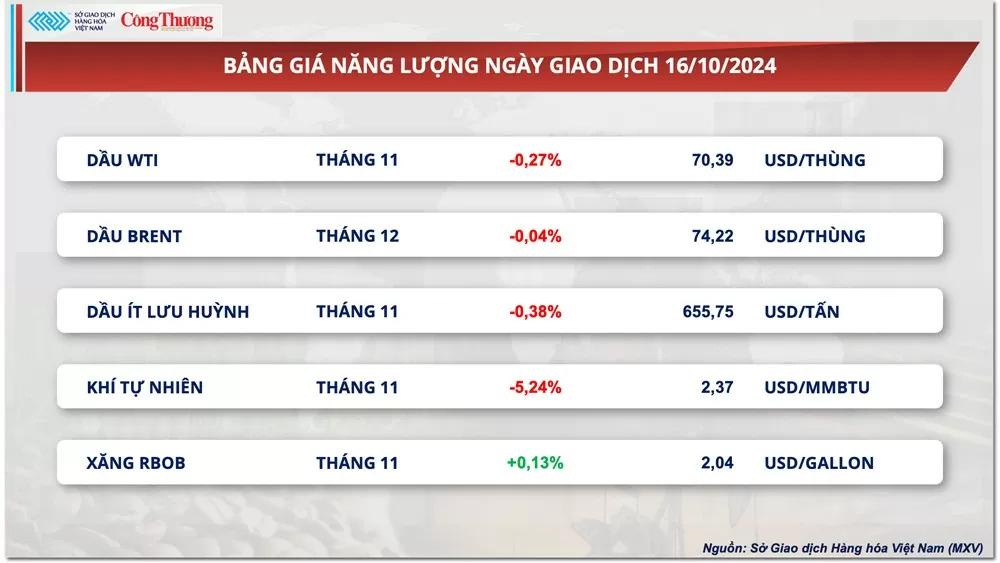

| Energy price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-1710-gia-duong-giam-ve-muc-thap-nhat-gan-mot-thang-352979.html

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)