ANTD.VN - In the context of world gold prices being under pressure to adjust due to higher-than-expected US inflation data, domestic gold prices tend to fluctuate but still maintain a very high price level.

In yesterday's trading session, domestic gold prices fell slightly at the beginning of the session but recovered in the afternoon and closed the session with an increase of about 200,000 VND per tael.

Entering the weekend morning session, the precious metal market adjusted again and slightly decreased by 200 - 300 thousand VND per tael.

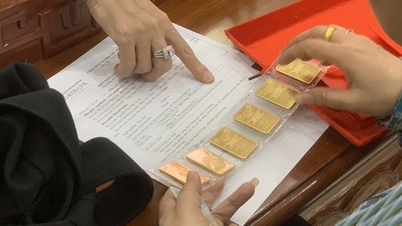

Specifically, opening the trading session this morning, Saigon Jewelry Company (SJC) listed the buying and selling prices at 79.00 - 81.50 million VND/tael. Compared to the closing price yesterday, the national gold brand reduced the price by 700 thousand VND per tael for buying but only reduced the selling price by 200 thousand VND/tael, thereby widening the buying and selling difference to 2.5 million VND per tael.

At DOJI Group, gold bars this morning decreased by 300,000 VND per tael in both directions, down to 79.40 - 81.40 million VND/tael.

Bao Tin Minh Chau reduced the buying price by 500,000 VND/tael and the selling price by 300,000 VND/tael, listed at 79.55 - 81.35 million VND/tael; Phu Quy also had a similar reduction, down to 79.50 - 81.40 million VND/tael...

Similarly, PNJ this morning also decreased by 200 thousand VND per tael in both directions, listed at 79.50 - 81.40 million VND/tael.

|

Domestic gold prices are still very high. |

For gold rings, the decrease in the weekend morning session fluctuated around 100 - 100 thousand VND per tael.

Accordingly, SJC 9999 gold rings are listed at 67.65 - 68.85 million VND/tael; Bao Tin Minh Chau plain round rings are 68.18 - 69.48 million VND/tael; DOJI Hung Thinh Vuong 9999 rings are 68.10 - 69.40 million VND/tael...

In the world, precious metals witnessed the third consecutive decline with a decrease of nearly 5.5 USD/ounce at the end of the week, closing the week at 2,156 USD/ounce.

Last week, gold prices were under pressure as two important inflation data, the US consumer price index (CPI) and producer price index (PPI), both increased higher than experts expected.

Gold typically benefits in a high inflation environment, as it is considered a hedge against inflation. However, the opposite is true in the current environment, as high inflation means high interest rates and the US dollar – which is inversely correlated with gold prices – has remained high for a long time.

Investors are now waiting for inflation to actually fall to the Fed's desired 2% target, which would officially start the monetary easing cycle of the world's largest economy . And with last week's data, the possibility of the Fed cutting interest rates this summer is almost gone.

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee to remove obstacles for projects.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759768638313_dsc-9023-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting of the Steering Committee on the arrangement of public service units under ministries, branches and localities.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759767137532_dsc-8743-jpg.webp)

Comment (0)