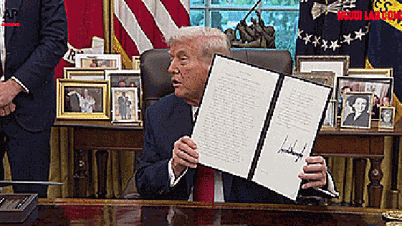

DNVN - In the trading session on January 20, gold prices increased slightly as the USD weakened, in the context of the market analyzing the impact of economic policies of US President Donald Trump's second term after his inauguration.

Earlier, gold prices fell as tensions in the Middle East cooled. World gold prices have recorded three consecutive weeks of increase, while gold prices in the Asian region are also heading for a third consecutive week of increase.

Spot gold prices recorded an increase of 0.3%, reaching 2,709.09 USD/ounce at 01:49 Vietnam time, amid low trading volume due to the US market being closed for Martin Luther King Jr. holiday. Meanwhile, US gold futures prices decreased by 0.7%, to 2,730.20 USD/ounce.

"I believe that President Donald Trump's term will lead to more market volatility, and some of his policies could lead to higher inflation over a longer period. This will continue to support safe-haven assets like gold," said Giovanni Staunovo, an analyst at UBS.

While gold is often seen as a hedge against inflation, Mr Trump's inflation-fuelling tariff policies have prompted the US Federal Reserve to keep interest rates higher for longer, reducing the appeal of gold, an asset that does not generate interest.

President Trump has proposed imposing a 10% import tax on global goods, 60% on products from China and 25% on items coming from Canada and Mexico.

Goldman Sachs stressed: "Gold's status as a major asset class means it is likely to be exempt from broad-based taxation. Therefore, we only assess a 10% chance of gold being subject to a 10% tax in the next 12 months."

A 0.9% drop in the dollar index made gold more attractive to foreign buyers.

In the Vietnamese market, at 6:00 a.m. on January 21, the price of SJC gold listed by Saigon Jewelry Company in Hanoi reached 84.90 - 86.90 million VND/tael (buy - sell).

Cao Thong (t/h)

Source: https://doanhnghiepvn.vn/kinh-te/gia-vang-nhich-nhe-sau-le-nham-chuc-tong-thong-my-cua-ong-donald-trump/20250121092732669

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)