LIVE UPDATE TABLE OF GOLD PRICE TODAY 9/29 AND EXCHANGE RATE TODAY 9/29

| 1. PNJ - Updated: September 29, 2023 00:00 - Website supply time - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 56,500 | 57,500 |

| HCMC - SJC | 68,100 | 68,800 |

| Hanoi - PNJ | 56,500 | 57,500 |

| Hanoi - SJC | 68,100 | 68,800 |

| Da Nang - PNJ | 56,500 | 57,500 |

| Da Nang - SJC | 68,100 | 68,800 |

| Western Region - PNJ | 56,500 | 57,500 |

| Western Region - SJC | 68,250 | 68,850 |

| Jewelry gold price - PNJ rings (24K) | 56,500 | 57,500 |

| Jewelry gold price - 24K jewelry | 56,400 | 57,200 |

| Jewelry gold price - 18K jewelry | 41,650 | 43,050 |

| Jewelry Gold Price - 14K Jewelry | 32,210 | 33,610 |

| Jewelry gold price - 10K jewelry | 22,550 | 23,950 |

Domestic gold prices go in the opposite direction to the world market, increasing on their own, causing the price difference to increase.

SJC gold price increased by 50 thousand VND/tael in both buying and selling compared to the opening session in the morning. At the closing session on September 28, at Saigon Jewelry Company, SJC gold price was listed at 68.1 - 68.8 million VND/tael.

The price of gold rings and 9999 gold has dropped sharply, buying at 56.6 million VND and selling at 57.55 million VND, down 50,000 VND on the buying side and down 150,000 VND on the selling side after one day. Thus, if an investor bought gold rings a week ago and sold them now, they would lose up to 1.6 million VND/tael. At Saigon Jewelry Company, the price of 9999 gold has also been adjusted to 56.45-57.4 million VND/tael, down about 700,000 VND/tael on both buying and selling sides compared to the peak last week.

According to the World & Vietnam Newspaper , at 9:00 p.m. on September 28 (Vietnam time), the world gold price on Kitco was trading at 1,873.50 USD/ounce , continuing to decrease by 1.5 USD compared to the previous session. The December gold futures price was last traded at 1,896.30 USD/ounce, up 0.26% during the day.

Gold prices have slipped below $1,900 an ounce. The gold market appears to be ignoring the latest economic data and a stronger-than-expected labor market. Meanwhile, the precious metals market is seeing some modest bargain-hunting activity after gold prices fell to their lowest level since March.

The latest US labor market data does not bode well for gold as it continues to support the US Federal Reserve's aggressive monetary policies, which have pushed bond yields to a new 16-year high above 4.5%.

Converted according to the USD exchange rate at Vietcombank, the international gold price is currently equivalent to 55.4 million VND/tael, about 13 million VND higher than the world price.

|

| Gold price today September 29, 2023: Gold price is losing ground, USD is on the rise, SJC gold price increases, should we sell to cut losses or hunt for bargains? (Source: Shutterstock) |

The possibility that US interest rates will remain high for longer than previously expected has boosted the US dollar, making gold more expensive for buyers with other currencies. The current rise in the dollar is not entirely due to the improving US economy, but also because US interest rates are very high. The US benchmark interest rate is at a 22-year high of 5.25%-5.5%. Meanwhile, interest rates in many other countries are lower, causing capital to flow out of emerging markets, also pushing the dollar up.

The possibility of a US government shutdown this weekend is weighing on market sentiment and could slow the dollar’s rise. In addition, the Chinese economy has received some positive news, including the first increase in industrial production in August in more than a year. These factors could curb the dollar’s rise, thereby supporting gold.

Summary of SJC gold prices at major domestic trading brands at the closing time of September 28:

Saigon Jewelry Company listed the price of SJC gold at 68.15 - 68.87 million VND/tael.

Doji Group currently lists SJC gold price at: 68.05 - 68.85 million VND/tael.

Phu Quy Group listed gold price at 68.10 - 68.80 million VND/tael.

PNJ system listed at: 68.10 - 68.80 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 68.17 - 68.85 million VND/tael; Rong Thang Long gold brand is traded at 56.48 - 57.38 million VND/tael; jewelry gold price is traded at 56.10 - 57.20 million VND/tael.

Will the decline in gold prices continue?

World gold prices have fallen sharply, extending their decline and remaining under pressure.

The precious metal has extended its decline over the past three sessions as expectations of higher US interest rates for a long time have sent investors flocking to the safe haven of the US dollar. That has also pushed US government bond yields to a 16-year high. The yield on the 10-year US Treasury bond briefly reached 4.648% and the yield on the 2-year bond also rose. This is the main reason why gold has lost its appeal to investors.

Gold's decline could continue, reaching a 2023 low of around $1,810 an ounce, according to some analysts. Analysts note that the sell-off in gold comes after the Fed signaled it would maintain a restrictive monetary policy for the foreseeable future, even after the tightening cycle ends. The Fed's stance has pushed the dollar to its highest level since November.

The Fed and other central banks' view that monetary policy will remain tighter for longer has held back gold's growth, said Everett Millman, precious metals expert at Gainesville Coins, an online gold dealer . He predicts that gold will trade in the range of $1,910 to $1,950 an ounce for the rest of the year.

Inflation remains a major concern, said Greg Bassuk, CEO of AXS Investments . Investors are concerned not only about rising interest rates but also about how that impacts companies with higher borrowing costs.

As for Ryan McKay, commodity strategist at TD Securities , he said that as long as the narrative of higher interest rates for longer continues, it will continue to weigh on the precious metal. Gold’s fall below $1,900 an ounce has triggered technical selling pressure. If inflation data continues to be strong, that will be a negative for gold.

Source

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

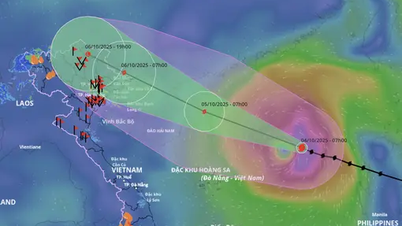

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)