.jpg)

Home loan up to 70% of estimated value

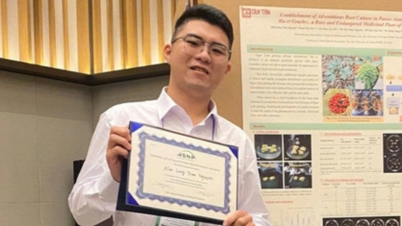

In December 2023, Mr. Vien Van Tiep in Thanh Binh village, Dam Rong 1 commune, borrowed 500 million VND for 25 years from the preferential loan source of the Social Housing Loan Program of the Vietnam Bank for Social Policies.

Mr. Tiep (born in 1985) and his wife, a former teacher, have been living in a temporary house built on land divided by their parents since 2011. When they learned about the policy on preferential loans to build and repair social housing from the Social Policy Bank, he and his wife decided to register for a loan.

At the end of 2023, with 500 million VND in loan capital and savings, his family started building a new house of 130 square meters, to be completed in June 2024.

Currently, every month, the couple deducts a portion of their civil servant income to pay the principal and interest, expected to be paid off within 25 years. Thanks to that, the family has a stable place to live and ensures a balanced living budget.

The social housing loan policy that Mr. Tiep's family enjoys is according to the Government 's decrees detailing a number of articles of the Housing Law on the development and management of social housing and piloting a number of specific mechanisms and policies for social housing development, effective from October 10, 2025.

As of September 30, the outstanding balance of the social housing loan program of the entire branch reached more than 505 billion VND, an increase of nearly 2.2 billion VND compared to the beginning of the month and an increase of nearly 25 billion VND compared to the beginning of the year, completing 91.5% of the 2025 plan. The total number of borrowers under this program to date is 1,369 customers.

.jpg)

Preferential interest rates when buying or leasing social housing

Accordingly, the preferential loan interest rate is set at 5.4%/year, applicable to those who buy, lease-purchase social housing, housing for the people's armed forces, or build, renovate, or repair houses through the Social Policy Bank.

In particular, credit contracts signed before October 10, 2025 will also have their interest rates adjusted down to 5.4%/year for the actual principal balance and overdue principal (if any).

The loan amount can be up to 80% of the contract value for purchasing, leasing or purchasing social housing or housing for armed forces, creating conditions for people, workers, civil servants, public employees and low-income people to access capital more easily than ever.

Preferential credit program for social housing loans with the aim of supporting subjects according to regulations.

In Lam Dong , the Department of Construction has announced the receipt of applications for purchasing social housing under the Social Housing Project for workers and laborers in Phu Hoi Industrial Park, Pre village, Duc Trong commune. The project has a scale of 3 apartment blocks with a total of 303 apartments; including 241 apartments for sale and 62 apartments for rent.

In this sale, the investor receives applications to buy social housing apartments in block 3C of the project. Up to now, the Lam Dong Social Policy Bank has lent 33 apartments for sale with a total amount of more than 15.4 billion VND.

Reducing interest rates for preferential loans for social housing and adjusting old loans demonstrates humanity, fairness and encourages people to boldly borrow to buy social housing.

This new credit policy, combined with specific mechanisms on land and capital as prescribed, has created a comprehensive support ecosystem, both removing difficulties in supply and increasing access to capital for home buyers.

Source: https://baolamdong.vn/hien-thuc-hoa-uoc-mo-ve-nha-o-cho-nguoi-thu-nhap-thap-396036.html

Comment (0)