The working session is an important opportunity for the two sides to directly discuss reform progress and orientations for upgrading Vietnam's stock market.

At the working session, Minister of Finance Nguyen Van Thang affirmed that Vietnam is aiming for stable, sustainable and high-quality economic growth in the 2025-2030 period.

In the first 6 months of 2025, GDP growth reached 7.52% compared to the same period last year - a positive result in the context of the world economy continuing to face many complex uncertainties and risks. The Government continues to be steadfast in its GDP growth target of 8.3% - 8.5% in 2025.

"Upgrading Vietnam's stock market from frontier to emerging is not a destination, but a natural result when we steadfastly pursue core development goals towards a fair, transparent and effective stock market," said Minister Nguyen Van Thang.

FTSE Russell representatives pledged to support the State Bank of Vietnam (SBV) in establishing indices to help investors better assess and manage financial risks; at the same time, they are ready to support Vietnam in updating its capital market infrastructure to strongly attract international investment flows.

Responding to the above proposals, Minister Nguyen Van Thang said that the Ministry of Finance is finalizing the Draft Decree amending Decree No. 155/2020/ND-CP in the direction of publicizing and making transparent the foreign ownership ratio and eliminating inappropriate regulations, including the regulation on the General Meeting of Shareholders deciding on the maximum foreign ownership limit.

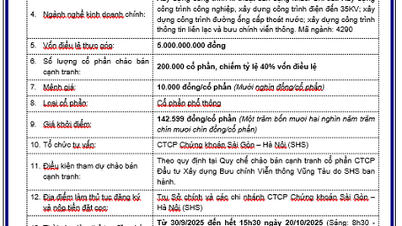

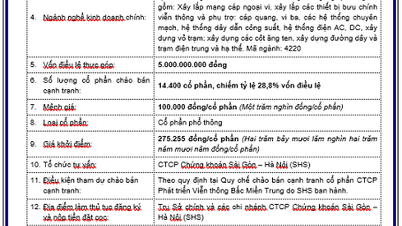

In addition, perfecting the legal framework on securities offering and issuance activities will contribute to improving the quality of goods in the market, expanding the scale of capitalization and enhancing the attractiveness of the market to domestic and foreign investors.

Regarding the implementation of new products, the Ministry of Finance assigned the State Securities Commission to research and propose the implementation of new products in accordance with international practices and market needs.

The Ministry of Finance has closely coordinated with the State Bank of Vietnam to simplify procedures, shorten processing times and remove practical obstacles that are hindering the operations of foreign investors.

Regarding the foreign exchange market, the Ministry of Finance continues to coordinate with the State Bank of Vietnam to research and develop a legal framework allowing foreign investors to access exchange rate risk hedging products, in order to protect investment value in the context of volatile global markets.

Source: https://hanoimoi.vn/hoan-thien-khung-kho-phap-ly-ve-hoat-dong-chao-ban-va-phat-hanh-chung-khoan-709422.html

![[Photo] President Luong Cuong receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/6bd456e072504df3a468acbf9b7989c8)

![[Photo] The 4th meeting of the Inter-Parliamentary Cooperation Committee between the National Assembly of Vietnam and the State Duma of Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/9f9e84a38675449aa9c08b391e153183)

![[Photo] Prime Minister Pham Minh Chinh meets with Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/08ca17cb0c46432dbdb94f9eaf73b47a)

![[Photo] Joy on the new Phong Chau bridge](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/28/b00322b29c8043fbb8b6844fdd6c78ea)

![[Photo] General Secretary To Lam receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/3814a68959e848f586178624b6bd66e5)

![[Photo] President Luong Cuong receives Chairman of the State Duma of the Russian Federation Vyacheslav Volodin](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/29/6bd456e072504df3a468acbf9b7989c8)

Comment (0)