Improve quality of life

At the end of last September, Ms. Cao Nhat Thuong's family, residential group 1, Dak Mil town, Dak Mil district, received a loan of 50 million VND from the NS-VSMTNT program implemented by the Vietnam Bank for Social Policies (VBSP).

With the loan, she invested in building projects such as: water tanks, toilets, bathrooms...

According to Ms. Thuong, her family has 6 members. In addition to the couple, there are also elderly parents and two small children. Previously, due to difficult conditions, her family had to use a water tank and a dilapidated toilet.

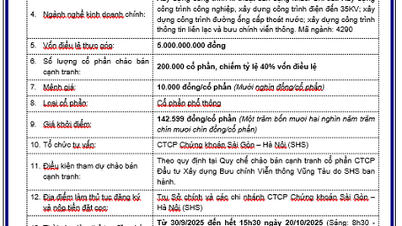

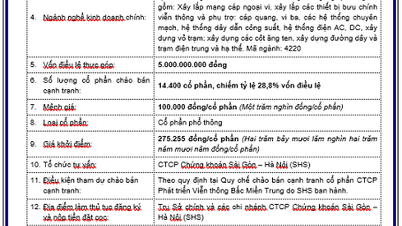

Every rainy season, the construction is damaged and slippery, causing inconvenience to family members when going about their daily activities. Moreover, every time they go on a long trip for work, Thuong and her husband are worried that their parents and children will fall.

Recently, through the village's savings and loan group, Ms. Thuong learned about the NS-VSMTNT program loan package. With the district's Social Policy Bank's loan support, Ms. Thuong's family invested in building a water tank and clean toilet.

“The preferential interest rate and quick loan procedures are suitable for the family’s economic conditions. Since the new clean water and sanitation project was built, all family activities have become much more convenient. My husband and I feel more secure when our parents and children have a clean living space,” Ms. Thuong shared.

The family of Ms. Pham Thi Suong, residential group 2, Dak Mil town, Dak Mil district, has access to the loan package of the NS-VSMTNT program. With the bank loan and the money she has saved, she has invested in a clean water system and a spacious bathroom.

“My family’s water and sanitation system had been degraded to 80%. My family was very excited to be considered for a loan at the new rate. The loan procedure was simple, the disbursement was quick, and the interest rate was reasonable, so it did not put much pressure on the family to repay the bank loan,” said Ms. Suong.

According to Nguyen Thanh Lam, Deputy Director of the Transaction Office of the Social Policy Bank of Dak Mil District, the new point in the current NS-VSMTNT loan program is that the loan amount has doubled.

The loan target is expanded to the towns. This creates more opportunities for people to borrow capital to upgrade and repair more constructions.

According to Mr. Lam, to help people access this source of capital, the district Social Policy Bank has coordinated well with local authorities at the grassroots level and mass organizations to widely disseminate it to people. The capital source is deployed quickly from the planning stage to the lending, investment and capital use stages.

Up to now, Dak Mil district has more than 7,000 households receiving loans for NS-VSMTNT, with a total outstanding loan balance of more than 135 billion VND. Particularly, the loan turnover from September to November 2024 (since the new regulation) reached over 4 billion VND, with more than 80 households receiving loans.

Thanks to the loans, many households have built wells, water filtration tanks and installed water supply networks. This has contributed to reducing environmental pollution and improving the landscape in rural areas.

Create conditions for more people to borrow capital

According to the Provincial Branch of the Vietnam Bank for Social Policies, from September 2, 2024, the loan amount of the NS-VSMTNT program will be increased to a maximum of VND 25 million/project.

Immediately after the decision, the branch directed its affiliated units to deploy it to districts, cities, local associations and unions. The system of savings and loan groups at the grassroots level has widely propagated to beneficiaries.

The affiliated transaction offices of the Social Policy Bank coordinate with local authorities to review people's needs, develop credit plans, and request superiors to supplement loan capital.

Currently, with the NS-VSMTNT program, the maximum loan for a project is 25 million VND (each household can borrow up to 50 million VND/2 projects). Loan interest rate is 9%/year, maximum loan term is 5 years.

This is a favorable condition for people to improve the quality of clean water and living conditions, contributing to helping localities successfully implement the criteria for new rural construction.

Deputy Director of the Dak Nong Provincial Bank for Social Policies Branch, Vu Anh Duc, shared that thanks to the support of the NS-VSMTNT loan package, many households in Dak Nong have the opportunity to borrow capital to repair and upgrade clean water facilities and toilets. This is a necessary condition to meet the criteria for quality of living environment.

“We have coordinated with political and social organizations at all levels to actively promote the policy and content of the loan program to the general public. The unit has guided people on procedures related to documents, loan conditions, beneficiaries, loan amounts, terms, interest rates... so that people can access capital as soon as possible,” Mr. Duc affirmed.

According to Mr. Duc, in the coming time, the Social Policy Bank needs to strengthen coordination with local authorities to expand the scope of the program. The Social Policy Bank will specifically review the subjects of each locality. On this basis, the unit will allocate capital reasonably, contributing to creating opportunities for people to borrow capital.

By the end of October 2024, Dak Nong had 37,576 households accessing NS-VSMT capital deployed by the provincial Social Policy Bank. The total outstanding loan balance of the entire branch for this program was nearly 721 billion VND. Many localities had high outstanding loans such as: Dak Mil 135 billion VND; Dak R'lap 117 billion VND; Dak Song 103 billion VND; Krong No over 99 billion VND.

Source: https://baodaknong.vn/hon-37-500-ho-dan-dak-nong-tiep-can-chinh-sach-tin-dung-nuoc-sach-235110.html

![[Photo] General Secretary To Lam chairs the meeting of the Central Steering Committee on preventing and combating corruption, waste and negativity](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/fb2a8712315d4213a16322588c57b975)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

Comment (0)