Some countries in the world have built separate laws for financial leasing activities, creating conditions for businesses, especially small and medium-sized groups, to access this medium and long-term capital supply channel.

Proposal to remove obstacles in the financial leasing industry and develop medium and long-term capital supply channels

Some countries in the world have built separate laws for financial leasing activities, creating conditions for businesses, especially small and medium-sized groups, to access this medium and long-term capital supply channel.

According to information from the Vietnam Finance Leasing Association (VILEA), the total outstanding financial leasing debt of member companies reached VND 40,496.6 billion, an increase of 8.6% compared to the end of 2023, equal to more than 50% of the overall increase of the whole system. The reason is that some member companies have to focus on debt settlement, restructuring customer portfolio and product lines.

Financial leasing is a popular medium and long-term capital supply channel in many developed countries, along with bank credit, bonds and stocks. However, compared to the total outstanding credit balance of more than 15.6 million billion VND by the end of 2024, the market share of financial leasing in Vietnam is still very small.

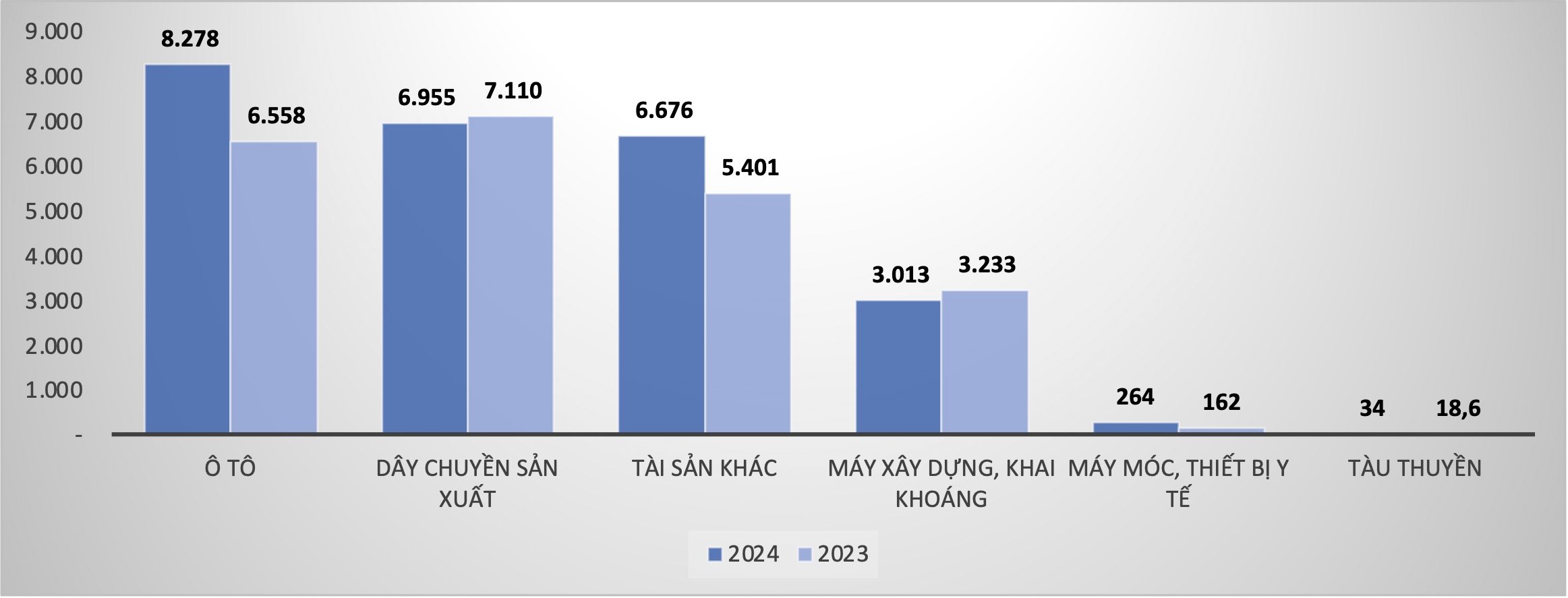

Mr. Pham Xuan Hoe - General Secretary of the association said that 100% of credit granted through financial leasing are assessed for environmental risks. Green credit in the financial leasing industry has been implemented early and fully, many financial leasing transactions have contributed to greening the textile and garment industry; ... In particular, the financial leasing subjects are increasingly diverse. In particular, outstanding debt for car leasing of all kinds is 8,300 billion VND, an increase of 26.2% compared to the end of 2023; outstanding debt for construction and mining machinery leasing is 3,000 billion VND, down 6.79%; medical equipment is 264.3 billion VND, up 62.9%; production machinery lines are at a stable level, outstanding debt is 6,955 billion VND, down slightly by 2.18% compared to the end of 2023.

|

| Outstanding financial leasing credit balance at the end of 2023 and the end of 2024 |

According to the Association's report, financial leasing outstanding balance has increased steadily over the quarters, with the number of leasing contracts for the whole year being 9,669 contracts, an increase of 15.8% compared to 2023. Total assets as well as capital mobilization and credit activities of the industry have quite good growth. Total assets of member companies reached over 45 trillion VND, an increase of 10.36% compared to 2023. Total mobilized capital is 23.4 trillion VND, an increase of 18.1% compared to 2023, with a capital mobilization increase equal to 1.5 times the general increase of the entire system of credit institutions.

The bad debt ratio at the end of 2024 was controlled at an average level of 1.68%, higher than in 2023 (0.68%), partly reflecting the difficulties and challenges of businesses and business households. In 2024, the financial leasing industry also increased the total risk reserve fund by nearly 200 billion VND. Pre-tax income of member companies in 2024 therefore also decreased by 24.33%.

Removing obstacles for medium and long-term capital supply channels

Sharing about the reality of financial leasing activities at member companies, Mr. Hoe said that many businesses from Japan, Taiwan... when investing in Vietnam choose to rent office equipment, means of transport... They are willing to rent, reducing capital pressure to focus resources on production.

In China, the small and medium-sized enterprises, especially in the supporting industry, have developed very well. Partly because the country's financial leasing industry has its own law, different from commercial banks in accepting higher levels of risk and focusing more on medium and long-term loans. China currently ranks second in the world in terms of financial leasing, only behind the US. According to Mr. Hoe, this has created a boom in Chinese manufacturing.

“China, Japan and Taiwan (China) all have their own laws on this matter. I really hope that in the long term, the National Assembly, the Government and the State Bank will pay more attention to the financial leasing industry and try to have their own laws on the financial leasing industry so that we can take advantage of the medium and long-term capital supply channel for the economy in the most convenient way without businesses having to mortgage assets,” the Secretary General of VILEA emphasized.

At the same time, according to Mr. Hoe, there should be a more open view and perspective on credit quality for the financial leasing industry, which should not be exactly the same as commercial banks. Because according to international practice, the subjects of financial leasing companies are often small and medium-sized enterprises, which have higher risks than the standards of commercial banks.

In the context of needing large mobilized capital for growth targets, projects in the production chain of high-tech products also require many modern technological machinery lines. While bank loans require collateral, available medium and long-term capital sources are not much, the General Secretary of VILEA said that financial leasing is a good solution that businesses can consider when investing. Mr. Hoe proposed that the Government can authorize the financial leasing industry to invest in injecting capital into a certain field. Financial leasing companies pay a certain fee for the capital, and are responsible for appraisal and self-bearing risks for the loan.

In addition, there are some institutional problems that the Association and members will coordinate to resolve in the coming time. Typically, the regulation on the safety ratio for payment within 30 days is still too high (20%) compared to the specific operations of financial leasing. Regulations on reporting information on related persons when granting credit are not consistent with the credit granted by financial leasing. According to Clause 4, Article 3 of Circular 15/2023/TT-NHNN, dated December 5, 2023 and Decision No. 573/QD-NHNN, March 29, 2024, the Governor of the State Bank stipulates that information on related persons must be reported when a credit grant with a value of 0.5% of the equity capital of a non-bank credit institution arises. At the same time, regulations on new registration and issuance of new license plates for motor vehicles when amending Circular 79/2024/TT-BCA (Clause 2, Article 3) are also problems that affect the demand for financial leasing.

Credit growth in the financial leasing industry in 2025 is expected to reach 18-20%

2025 will continue to be a difficult year for the economy in general. For the financial leasing sector and the business community, Mr. Hoe believes that the difficulties may double. Mr. Pham Xuan Hoe expects the overall outstanding debt of the financial leasing industry to grow by about 18-20%, focusing on lending to means of transport; new technology production lines; and office equipment.

The general direction of the industry is to strongly increase green credit to support businesses and business households to develop greenly and sustainably; focus on handling bad debts arising, increasing income from recovering bad debts that have been provisioned. The Association and its members work together to remove institutional issues that are causing difficulties for financial leasing activities, and at the same time, expand communication to businesses and business households about this form of credit.

Source: https://baodautu.vn/kien-nghi-go-vuong-nganh-cho-thue-tai-chinh-phat-trien-kenh-cung-ung-von-trung-dai-han-d249833.html

![[Photo] Prime Minister Pham Minh Chinh attends the World Congress of the International Federation of Freight Forwarders and Transport Associations - FIATA](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759936077106_dsc-0434-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh inspects and directs the work of overcoming the consequences of floods after the storm in Thai Nguyen](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759930075451_dsc-9441-jpg.webp)

![[Photo] Closing of the 13th Conference of the 13th Party Central Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759893763535_ndo_br_a3-bnd-2504-jpg.webp)

Comment (0)