(NLDO) - Cooling exchange rates along with strong cash flow... make the market expect stock prices to increase before and after Tet holiday.

At the end of the session on January 23, the VN-Index closed at 1,259 points, up 17 points, equivalent to 1.38%.

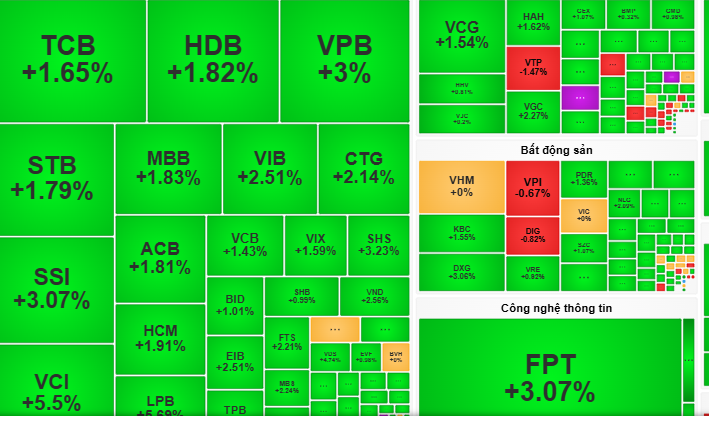

The stock market session on January 23rd increased quite strongly. The VN-Index recovered in the morning session, rising sharply to the 1,255 point area with green covering a wide area. The positive point is that both bluechips and midcaps (stocks with average capitalization value) increased points. The pressure to sell off financial leverage has decreased as investors' cash does not have enough time to arrive before Tet.

In the afternoon session, the market continued to heat up with the number of green stocks increasing. The group of 30 large stocks (VN30) played a leading role in the general index with 26 green stocks, 4 stocks unchanged and no stocks red.

At the end of the session, the VN Index closed at 1,259 points, up 17 points, equivalent to 1.38%.

According to VCBS Securities Company, the increase in the VN-Index on January 23 partly reflects investors' expectations of a positive market scenario in the last session of the Year of the Dragon (25th of the Lunar New Year) and many other sessions after the Tet holiday.

"Investors can realize profits with stocks that do not have a clear upward trend, disbursing to catch the market recovery wave for stocks with growth prospects in 2025" - VCBS Securities Company stated its opinion.

Meanwhile, Dragon Viet Securities Company (VDSC) commented that the stock price increase on January 23rd session too quickly will promote profit-taking supply, creating a state of dispute for the market in the next trading session.

"Therefore, investors should consider taking profits from stocks that have increased rapidly to the resistance zone, and can exploit short-term opportunities in some stocks with positive developments" - VDSC recommends.

Source: https://nld.com.vn/chung-khoan-ngay-mai-24-1-ky-vong-co-phieu-van-xanh-muot-196250123173011332.htm

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

Comment (0)