Less than 10 years after buying a small two-bedroom apartment in Bengaluru on a shoestring budget, tech professionals Ratnesh and Neha Malviya are looking to upgrade their property.

|

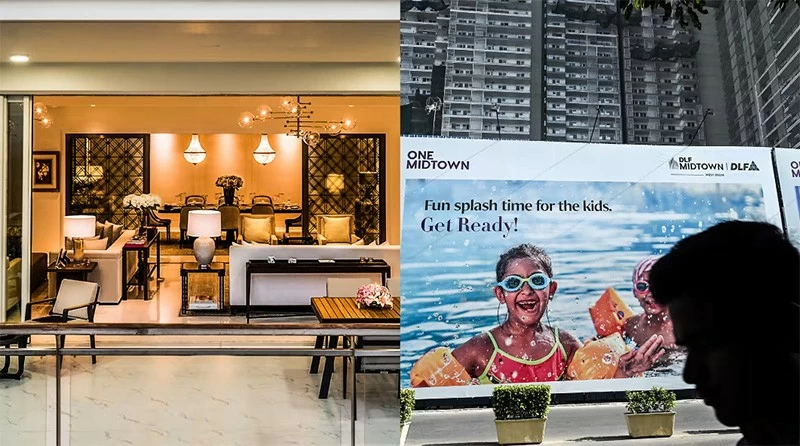

| Luxury home sales are rising thanks to India's strong economic growth, rising wages and buoyant stock market. (Image source: Getty Images and DLF) |

The Malviya couple, in their early 40s, were looking for a four-bedroom house. Ratnesh, who is passionate about sculpture, planned two bedrooms, a study and a guest room.

The couple's monthly income has increased fivefold to about half a million rupees ($5,955) since buying the apartment. The property they are about to buy cost 40.3 million rupees.

“The mortgage will be a bit of a stretch, but it’s better to buy something that meets all our requirements, even if it’s at the top of our budget,” Ratnesh says. “At least it’s better than having to go back to the market in a few years.”

Ambitious millennials like the Malviya family are driving luxury home sales in India, according to Aakash Ohri, co-chief executive officer of DLF, India's largest real estate company.

“This is a new segment that is emerging and they want the best,” Ohri said. “Housing has become a priority, with those without homes now wanting homes and those with homes wanting better homes.”

Luxury home sales are driving India’s economic growth ahead of all other major economies. This has helped boost stock markets, adding to the wealth of business owners and senior executives, and pushing up wages, especially for white-collar workers.

Boston Consulting Group estimates India will create a record $588 billion in wealth by 2023. According to UBS, India will have 868,671 billionaires in 2023, up 14.4% from 2019, and on track to reach 1.06 million by 2028.

Currently, the wealthy in India prefer to buy high-rise apartments with an area of over 185 square meters, mostly located in large suburban urban areas with modern amenities such as tennis courts, swimming pools and jogging tracks.

According to real estate services firm CBRE, 11,755 homes priced at 40 million rupees or more were sold last year in the cities of Mumbai, Delhi and Hyderabad, four times more than in 2019.

“Demand is high but supply of quality homes is limited,” said Karan Khanna, director of Mumbai-based investment consultancy Ambit. “The demand is being driven by a combination of factors including preference for larger homes, a growing hybrid work culture, higher affordability with rising incomes and rapid urbanization.”

In the financial year ended March, DLF collected 147.78 billion rupees from presales of new residential apartments, exceeding its target of 130 billion rupees and doubling sales from two years ago.

Nearly half of last year’s presales came from a single project, the 1,113-unit Privana South development in Delhi’s Gurgaon suburb. Although most apartments were priced between 60 million and 80 million rupees, all were sold within three days of going on the market. DLF repeated the feat in May, selling 795 apartments at nearby Privana West at similar prices within three days.

“If you look at the facts, DLF has really developed the Gurgaon market, which is a luxury housing hotspot,” said Pankaj Kumar, vice president at Kotak Securities in Mumbai, praising the company’s strength in building and marketing luxury homes.

“They have the advantage of being first mover and brand value,” he said. “Also, they have cheap land plots in Gurgaon. That helps them achieve high profit margins.” Indeed, DLF’s net profit last year rose 34% to 27.24 billion rupees, while revenue rose 15.7% to 69.58 billion rupees.

DLF, which has primarily focused on residential properties in the capital region, is moving south into the coastal urban markets of Mumbai and Goa this financial year. The company aims to market a total of 1.2 million square feet of new apartments, up 14% from last year. Most of these apartments will be in the luxury or ultra-luxury segment, including some priced at 500 million rupees and above.

HDFC Securities predicts the move could help DLF surpass its annual pre-sales target of 170 billion rupees to 180 billion rupees.

DLF is not the only company targeting Indians looking for a modern luxury apartment. Key competitors include Oberoi Realty, Godrej Properties and Lodha Group.

According to CBRE, 15,870 new luxury homes were put up for sale in India last year, about five times more than in 2019. That number increased to 13,020 in the first half of 2024. Luxury homes priced above 15 million rupees accounted for a third of new homes in the July-September quarter, according to Anarock, a local real estate consultancy. In 2018, luxury homes accounted for just 9% of new supply.

Interest rates in India have not risen since February 2023, helping to maintain strong home sales growth, in contrast to markets like Singapore and the United States. India’s total outstanding home loans stood at 28.3 trillion rupees as of August 23, up 13% from a year earlier. The growth fueled Bijaj Housing Finance’s successful 65.6 billion rupee initial public offering in September, the country’s largest market debut so far this year.

As Indians look to upgrade their homes, home loans have increased by 2 percentage points to 51% of India’s total personal loans between August 2022 and August 2024. Down payment requirements vary depending on the price of the home; for homes priced above 7.5 million rupees, buyers are required to make a down payment of 25% of the home price, whether from a bank or other mortgage lender.

Apart from financial factors, observers say India’s real estate boom can be partly attributed to the Real Estate (Regulation and Development) Act of 2016, or RERA. The law gave homebuyers a greater sense of security with measures such as a uniform licensing regime and a requirement that developers hold down payments in escrow.

“The sector is currently on a strong growth trajectory, driven by strong policy measures like RERA, which has increased transparency and customer focus, coupled with strong economic momentum and growing desire for home ownership and home upgrades,” said HDFC analyst Parikshit Kandpal, who rates DLF as a “buy” in a recent note to clients.

DLF's luxury home sales were also boosted by the overseas Indian community, known as non-resident Indians (NRIs).

“Not only is money being made and spent here, but there is also a large amount of money coming from overseas through NRI investments,” said Mr. Ohri, who estimates a quarter of the company’s home sales this year will come from NRIs from the United States, Southeast Asia, the Middle East, Africa and Australia. “They want to come back and make a real move.”

Sheelaj Sharma, a medical practitioner in Abu Dhabi, bought his second apartment in Gurgaon last year after seeing the value of the apartment he bought here in 2011 increase five-fold.

“Even though I am an NRI, I felt it was important to have a home in India so that when I retire, I have a place to live,” said Sharma, who has also invested in property in Abu Dhabi and London, where he studied. “Who knows what life will be like?”

Source: https://baoquocte.vn/ly-do-nguoi-an-do-vung-tien-mua-bat-dong-san-lon-va-cao-cap-hon-290382.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

Comment (0)