Huge purchasing power from a market of billions of people

The world gold market witnessed a fever during the week from March 3 to March 8 with prices continuously setting new records. According to Bloomberg, demand from China and expectations of the Fed easing monetary policy were the two main factors driving this increase. In particular, China's demand for gold increased dramatically.

|

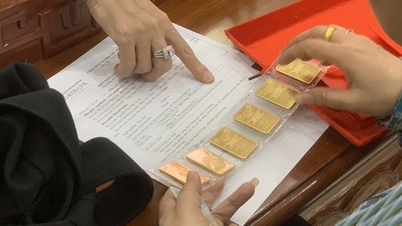

| Demand from China and expectations of the Fed easing monetary policy are two main factors driving the gold price increase this time - Photo: GETTYIMAGES |

After months of struggle, the world gold market suddenly became active again on March 8. Previously, on March 5, the gold price broke the record set in December 2023 and continuously increased to new highs in the following days.

Bloomberg said the foundation of this record recovery comes from China. According to data from the US Commodity Futures Trading Commission, Chinese money managers increased their gold buying activities in the week to March 5, contributing to the increase in gold prices.

Expectations of Fed monetary easing

In addition to demand from China, expectations of the Fed easing monetary policy are also an important factor driving gold prices.

Gold prices jumped on March 1 after the latest economic data showed lower-than-expected US manufacturing activity and a drop in consumer sentiment, leading to speculation that the Fed would cut interest rates sooner than expected, giving investors an incentive to focus on gold.

Next, on March 6 and 7, at a hearing before the US Congress , Fed Chairman Jerome Powell once again affirmed the possibility of the Fed cutting interest rates this year, creating more momentum for the gold price increase.

Despite its recent surge, gold still has room for growth, according to Bloomberg, which said the world's gold market still has a long way to go before reaching its inflation-adjusted peak set more than a decade ago.

Since the early 2000s, the world gold price has increased by a total of more than 600%. However, based on inflation, the price of gold is still lower than the level of $850/ounce reached in January 1980, equivalent to more than $3,000/ounce today.

Source

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)