Many large stocks continued to be sold heavily, falling by more than 1%. This caused the VN-Index to close the session on February 17 in red.

Many large-cap stocks fell deeply, VN-Index turned down more than 3 points

Many large stocks continued to be sold heavily, falling by more than 1%. This caused the VN-Index to close the session on February 17 in red.

After the previous week's recovery with a slight increase of 0.07% to 1,276.08 points, the buying force was not strong enough to maintain the upward momentum in the first session of the week. Investors' cautious sentiment was evident when cash flow showed no signs of returning to large-cap stocks, causing the index to continuously fluctuate around the reference level. Although there were some recoveries during the session, selling pressure appeared more clearly in the leading stocks, making it difficult for the VN-Index to break through the important resistance zone. At times, the VN-Index was pulled back below the reference level.

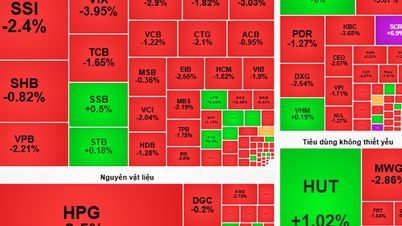

The trend of differentiation continues to dominate the market, with liquidity shifting to mid- and small-cap stocks, where trading remains active. This shows that the psychology of seeking short-term profits is overwhelming the interest in large-cap stocks, which are under pressure from strong selling pressure from foreign investors.

In the afternoon session, trading was still concentrated in the mid- and small-cap stocks while the large-cap stocks were sluggish. In fact, strong selling pressure, especially from foreign investors, pushed a series of large stocks down, thereby pushing the VN-Index back below the reference level. The VN-Index closed the session at the lowest level of the day.

At the end of the session on February 17, VN-Index decreased by 3.36 points (-0.26%) to 1,272.72 points. HNX-Index still increased by 1.97 points (0.85%) to 233.19 points thanks to the momentum from mineral stocks. Similarly, UPCoM-Index also increased by 1.04 points (1.06%) to 99.39 points.

A total of 419 stocks increased in price across the market today, while 320 stocks decreased and 795 stocks remained unchanged/no trading. The market recorded 58 stocks hitting the ceiling while 7 stocks hit the floor.

|

| Top 10 stocks with strong increase/decrease on HoSE. |

In the VN30 group, there were 19 stocks decreasing in price while only 9 stocks increasing in price. Of which, stocks such as MSN, MWG, BVH, TCB or BID all decreased by more than 1%. MSN closed at 66,400 VND/share with a decrease of up to 2.5%. MSN took away 0.61 points from VN-Index. BID decreased by 1.11% and was the stock with the worst impact on VN-Index when it took away 0.74 points. The two stocks MWG and VNM decreased by 2% and 0.5% respectively due to strong net selling pressure from foreign investors.

On the other hand, among the few actively traded stocks, SSB,SHB and GVR were among the good contributors to the VN-Index. SSB increased by 1.8%, SHB increased by 1.9% and GVR increased by 0.66%.

Meanwhile, the stock with the best impact on VN-Index was GEE with 0.24 points. At the end of the session, GEE hit the ceiling price of 52,700 VND/share. VIX also attracted attention with an explosive trading session when nearly 88 million units were matched. VIX closed up 5.9% and contributed 0.21 points to VN-Index, just behind GEE and SSB.

The VIX breakout also created momentum for the securities group to increase, in which, BVS increased by 3.4%, VND increased by 2.8%, SHS increased by 2.2%...

The market focus is on the group of mineral stocks as cash flow is still pouring in strongly. Stocks such as MSR, KCB, MGC, BKC, BMC... were all pulled up to the ceiling price. Besides, AMC also increased by 9.3%, KSV increased by 6.2%...

|

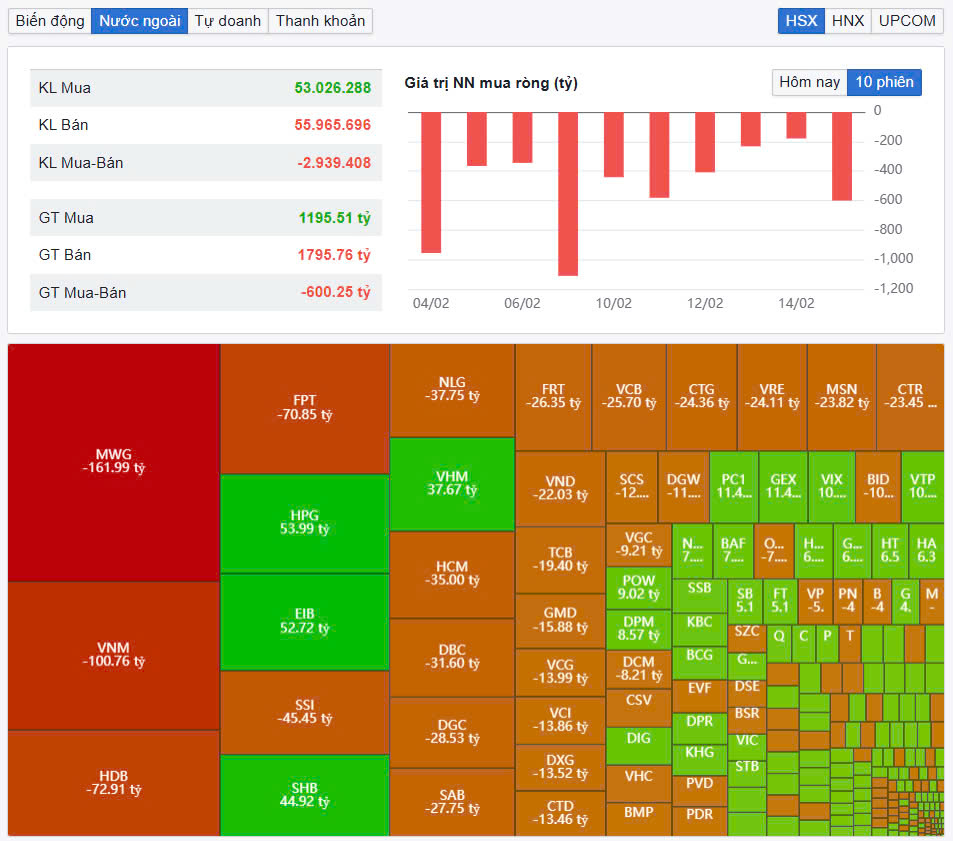

| Foreign investors extended their net selling streak, focusing on MWG and VNM. |

The total trading volume on HoSE reached more than 850 million shares, equivalent to a trading value of VND17,667 billion, up 19% compared to the previous session, of which negotiated transactions contributed VND2,252 billion. The trading value on HNX and UPCoM reached VND1,223 billion and VND1,149 billion, respectively. VIX was the most traded stock in the market with a value of VND931 billion. SSI and HCM followed with values of VND463 billion and VND403 billion, respectively.

Foreign investors pushed up net selling of VND650 billion across the market, in which, foreign investors focused on selling MWG with VND160 billion. VNM and HDB were net sold VND100 billion and VND72 billion respectively. In the opposite direction, HPG was the strongest net bought with VND54 billion. EIB and SHB were net bought VND53 billion and VND45 billion respectively.

Source: https://baodautu.vn/nhieu-co-phieu-von-hoa-lon-roi-sau-vn-index-quay-dau-giam-hon-3-diem-d247305.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Binh Trieu 1 Bridge has been completed, raised by 1.1m, and will open to traffic at the end of November.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/2/a6549e2a3b5848a1ba76a1ded6141fae)

Comment (0)