Current family deductions and tax schedules put pressure on the lives of wage earners (photo of people shopping at the supermarket) - Photo: QUANG DINH

In the draft Personal Income Tax Law recently sent to the Ministry of Justice for review, the Ministry of Finance proposed reducing the number of tax brackets from 7 to 5, while increasing the family deduction and adding deductions for health and education. As a result, many taxpayers will have their tax payments reduced, or even no longer subject to tax.

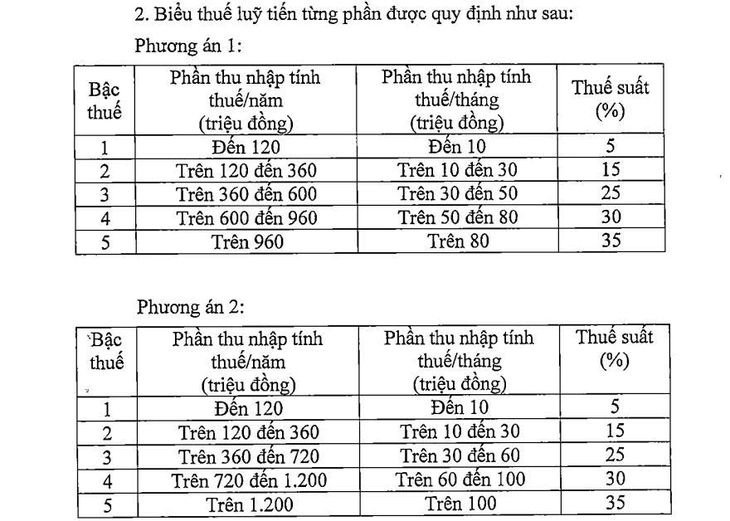

Proposal to reduce progressive tax rate to 5 levels

The Ministry of Finance has proposed two options for a progressive tax schedule. Both options have five tax brackets, with bracket 1 applying to taxable incomes below VND10 million.

But option 1 has the highest tax rate of 35% applied to taxable income from 80 million VND or more. As for option 2, the highest tax rate is 35% applied to taxable income from 100 million VND or more.

The Ministry of Finance proposed two options for a progressive tax schedule - Photo: L.THANH

Speaking with Tuoi Tre Online , Dr. Nguyen Ngoc Tu, a tax expert, said that reducing tax rates and widening the gap between rates will help reduce the tax burden on salaried workers.

According to the Ministry of Finance's calculation for option 1, individuals with a taxable income of 10 million VND/month will receive a reduction of 250,000 VND/month; individuals with a taxable income of 30 million VND/month will receive a reduction of 850,000 VND/month; individuals with a taxable income of 80 million VND/month will receive a reduction of 650,000 VND/month...

For option 2, basically every individual with taxable income from 50 million VND/month or less will receive a tax reduction equivalent to option 1.

For individuals with taxable income over 50 million VND/month, the reduction will be greater.

"Adjusting the tax rate according to the two options mentioned above and increasing the family deduction level, adding deductions for health, education , etc., will reduce the income tax that individuals have to pay. In particular, individuals with average and low income will not have to pay personal income tax" - Ministry of Finance assessed.

The Ministry of Finance cited an example of an individual with one dependent, earning 20 million VND/month from salary and wages, currently paying 125,000 VND/month in taxes. However, when implementing family deductions and tax schedules according to option 2, this individual will no longer have to pay taxes. Therefore, the Ministry of Finance proposed implementing option 2.

Family deduction expected to increase to 15.5 million VND/month

Regarding the family deduction, the Ministry of Finance proposed 15.5 million VND/month, nearly 3 times the average income per capita, and higher than the average income of the 20% of the population with the highest income.

The Ministry of Finance estimates that the budget will reduce revenue by about 29.7 trillion VND/year.

In the draft Law on Personal Income Tax, the Ministry of Finance proposed that the Government regulate the family deduction level to adjust it to suit the socio-economic situation in each period. Because the family deduction level needs to be consistent with the taxpayer's living situation, the living standard and average income of the workers.

The Ministry of Finance proposed the law to be passed by the National Assembly at its session next October and take effect from July 1, 2026.

The family deduction level will be implemented according to the resolution of the National Assembly Standing Committee, expected to be submitted by the Government in October. The new deduction level will be applied until this resolution expires and the Government stipulates a replacement family deduction level.

Source: https://tuoitre.vn/nhieu-nguoi-se-khong-phai-dong-thue-thu-nhap-ca-nhan-20250905114133942.htm

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] Solemn opening of the 12th Military Party Congress for the 2025-2030 term](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/2cd383b3130d41a1a4b5ace0d5eb989d)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)