Accumulate social insurance payment period to calculate pension

Under the new regulations, employees who have participated in both compulsory and voluntary social insurance will have their entire contribution period added together to calculate their pension benefits. This overcomes the disadvantage of those who have flexible working hours or who switch between the public and private sectors.

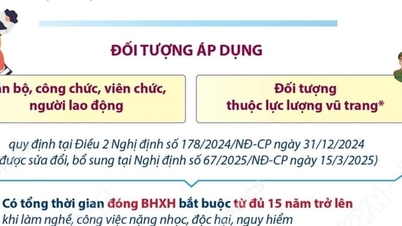

The Decree clearly states that pension conditions are flexibly applied to each group of subjects:

People who have paid compulsory social insurance for 15 years or more will meet the retirement age requirements according to Article 64 of the Law on Social Insurance. Specifically, when they reach the age according to the roadmap for increasing the retirement age (currently 62 years old for men in 2028, 60 years old for women in 2035).

In case of 20 years of compulsory social insurance payment and labor capacity reduction of 61% or more, retirement age conditions are implemented according to Article 65 of the Law on Social Insurance.

Early retirement if participating in voluntary social insurance before 2021

According to the new regulations, people who started participating in voluntary social insurance before January 1, 2021, if they have paid 20 years or more of voluntary social insurance and wish to, will be entitled to receive early retirement benefits when they reach the age of 60 for men and 55 for women instead of having to wait until the retirement age according to the current age increase roadmap.

The monthly pension level and the time of receiving it are calculated according to the provisions of the Law on Social Insurance. Details of the documents and procedures will be specifically guided and regulated by the Ministry of Home Affairs .

For voluntary social insurance participants who have reached retirement age according to the Labor Code but have not yet paid social insurance for 20 years to receive pension and have not yet reached the age to receive social retirement benefits, they will still receive monthly benefits if they satisfy the following conditions: Not receiving one-time social insurance, not reserving social insurance payment period; Having a written request to receive monthly benefits.

The duration and level of benefits are calculated according to a specific formula, based on the number of years of social insurance contributions and the average income of voluntary social insurance contributions. This benefit is paid from the time the employee makes a request until reaching the age of receiving social retirement benefits according to the provisions of the Law on Social Insurance.

Additional contributions may be made to extend the period of benefit entitlement.

If the calculated benefit period is shorter than the remaining time to reach social retirement age, the participant can pay the remaining amount in one lump sum, ensuring continued monthly benefit receipt until reaching the age of majority.

Conversely, if the time calculated by the formula exceeds the remaining time, the participant receives a benefit level higher than the current social pension level.

The monthly subsidy level will be adjusted when the State adjusts pensions, ensuring close adherence to inflation and the cost of living.

Voluntary social insurance participants need to submit a request in writing according to the form issued by Vietnam Social Security for consideration and settlement of benefits.

The new policy is an important step forward in expanding social insurance coverage and improving the welfare of the self-employed, farmers, and those without labor contracts. Creating conditions for early retirement, while also having a mechanism to support those who do not meet the requirements in terms of time or retirement age, demonstrates the flexibility and humanity in reforming current social insurance policies.

VN (according to Vietnamnet)Source: https://baohaiduong.vn/nhung-truong-hop-them-co-hoi-nghi-huu-som-tu-1-7-415210.html

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Infographics] Time, location, content of the 1st Congress of An Giang Provincial Party Committee, term 2025 - 2030](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/9/30/fed466586ad84c3ebea914be993018ca)

Comment (0)