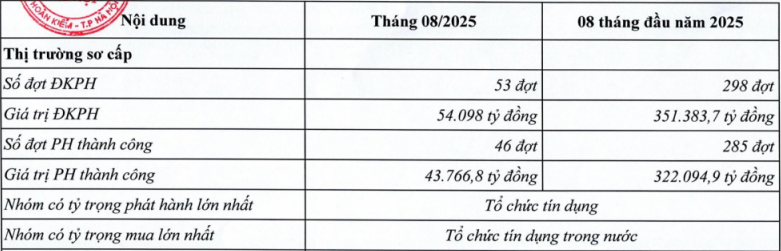

According to information from the Hanoi Stock Exchange (HNX), in the private corporate bond market, last August recorded 46 successful issuances with an issuance value of VND43,766.8 billion, down 33% compared to the issuance value in July.

In the first 8 months of the year, there were 285 private bond issuances, thereby mobilizing 322,094 billion VND.

Credit institutions are still the group with the largest issuance proportion and also the group with the largest purchase proportion.

|

| Individual corporate bond market August 2025. Source: HNX |

In the secondary market, 48 bond codes were newly registered for trading in August with a newly registered trading value of VND 51,036 billion. Including the first 8 months of 2025, the total market trading value reached VND 856,538 billion with an average trading value of VND 5,254.8 billion/session. Credit institutions and securities companies are the groups with the largest trading proportion.

Previously, data updated by the Vietnam Bond Market Association (VBMA) added that August 2025 recorded 6 public corporate bond issuances worth VND 6,332 billion, from the banking group VietABank, Bac A Bank, HDBank and 1 construction group enterprise, Ho Chi Minh City Infrastructure Investment Joint Stock Company (CII).

VBMA said that in August, businesses bought back VND27,032 billion worth of bonds before maturity, an increase of 70% over the same period in 2024.

In the remaining 4 months of 2025, it is estimated that there will be about 69,740 billion VND of bonds maturing, of which the majority are real estate bonds with 29,883 billion VND, equivalent to 49%. Regarding the situation of unusual information disclosure, there were 4 bond codes with late interest and principal payments worth 313 billion VND in August.

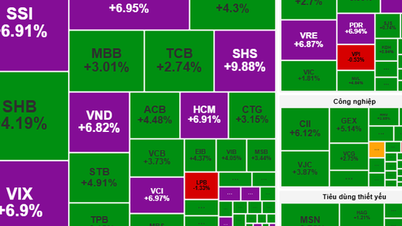

According to the upcoming issuance plan, VNDIRECT Securities JSC (VND) will issue individual bonds in the third quarter of 2025 with a maximum total value of VND 250 billion. These are non-convertible bonds, without warrants, without collateral and an expected face value of VND 100 million/bond. The bonds have a term of 1 year with an interest rate of 7.5%/year.

In addition, Saigon - Hanoi Commercial Joint Stock Bank (SHB ) has also approved a plan to issue individual bonds in the third quarter of 2025 with a maximum total value of VND 5,000 billion.

This is a non-convertible bond, without warrants, without collateral and with an expected face value of 1 billion VND/bond. The bond has a term of 7 years with a combined interest rate of fixed and floating.

Source: https://baodautu.vn/phat-hanh-trai-phieu-doanh-nghiep-ha-nhiet-d383764.html

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee to remove obstacles for projects.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759768638313_dsc-9023-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting of the Steering Committee on the arrangement of public service units under ministries, branches and localities.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759767137532_dsc-8743-jpg.webp)

Comment (0)