According to the Transaction Office of the Social Policy Bank (SPB) of Ham Tan district, as of March 31, 2024, the total outstanding loan program reached 434,119 million VND/9,250 borrowing households, an increase of 11,823 million VND, a growth rate of 2.8% compared to the beginning of the year; loan turnover reached 32,233 million VND/816 loans.

The Board of Directors of the District Social Policy Bank has focused on implementing many solutions to effectively implement social policy credit programs. The total capital as of March 31, 2024 reached 437,969 million VND, an increase of 15,457 million VND, an increase of 3.66% compared to the beginning of the year. Of which: The capital entrusted from the district budget is 10,153 million VND, accounting for 2.32% of the total capital structure, an increase of 2,544 million VND, an increase of 33.43% compared to the beginning of the year. However, besides the achieved results, there are still some difficulties and problems such as overdue debt increased by 220 million VND compared to the beginning of the year, and the balance of savings deposits mobilized from organizations and individuals decreased compared to the beginning of the year.

In 2023, in the first 3 months of 2024, Ham Tan district had over 3,800 borrowers with nearly 146 billion VND, the highest loan turnover compared to recent years.

Therefore, to carry out the tasks of the second quarter and the remaining months of 2024, members of the Board of Directors of the District Social Policy Bank focused on solutions to overcome difficulties in the work of collecting bad debts. Further promoting the role of policy credit management of the village chief and improving the quality of activities of the District and Commune-level Associations and the Management Board of Savings and Loan Groups... Chairing the recent meeting of the Board of Directors of the Ham Tan District Social Policy Bank, Mr. Nguyen Thanh Nam, Vice Chairman of the District People's Committee, Head of the Board of Directors of the District Social Policy Bank requested relevant departments, socio -political organizations, People's Committees of communes and towns to step up propaganda and mobilize organizations and individuals in the area with idle money to deposit in the District Social Policy Bank to supplement capital for lending to poor households and other policy beneficiaries in the area. The district Social Policy Bank strengthens coordination with the People's Committee and socio-political organizations entrusted at the commune level to organize propaganda and dissemination of policies and guidelines on social policy credit to the people, proactively receiving recovered capital to promptly meet the borrowing needs of poor households and other policy beneficiaries.

The People's Committees of communes and towns proactively grasp information and coordinate in handling risky cases; direct and urge early debt collection for borrowers who leave their place of residence, go to work far away and do not produce or do business in the locality. Closely coordinate with the Vietnam Bank for Social Policies to improve credit quality, evaluate loan applicants publicly and transparently...

Source

![[Photo] General Secretary To Lam attends the 8th Congress of the Central Public Security Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/79fadf490f674dc483794f2d955f6045)

![[Infographic] Notable numbers after 3 months of "reorganizing the country"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/ce8bb72c722348e09e942d04f0dd9729)

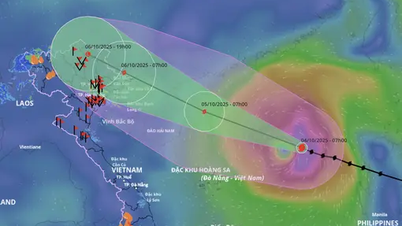

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)