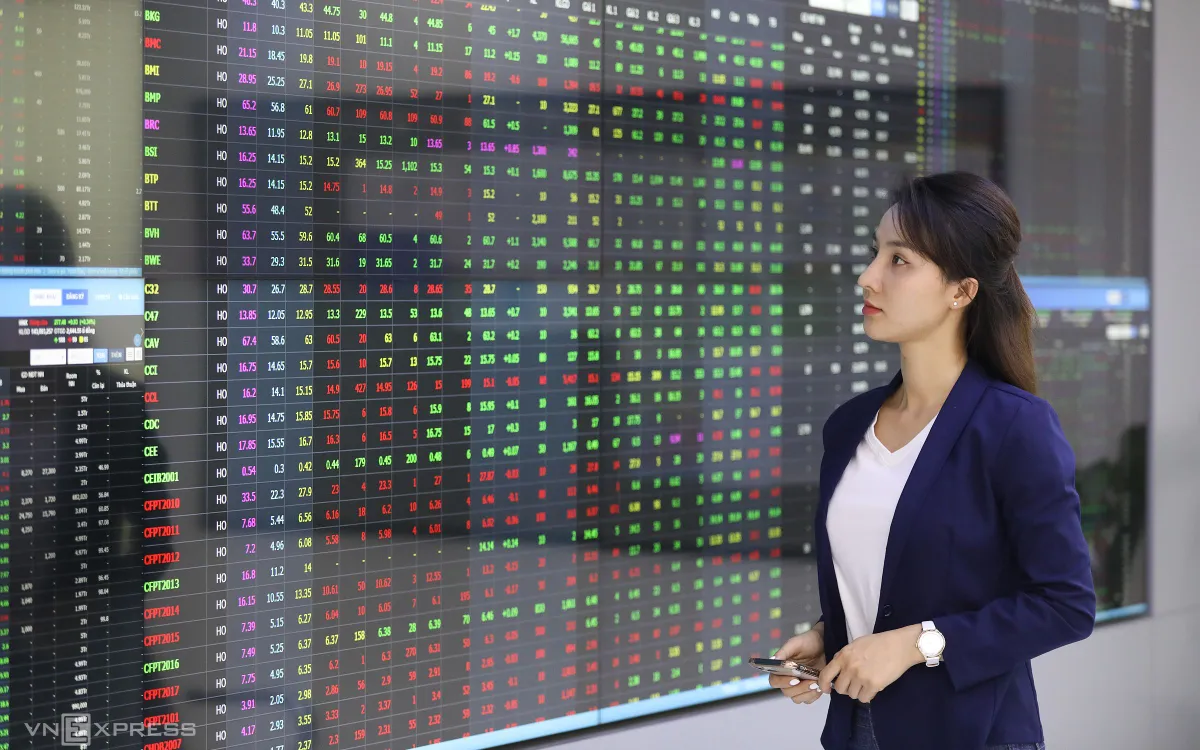

Vietnam's stock market has just marked a brilliant milestone when FTSE Russell, a prestigious global rating organization, announced its decision to upgrade it from a frontier market to a secondary emerging market.

On the morning of October 8, FTSE Russell officially upgraded Vietnam's stock market from frontier to secondary emerging, effective from September 21, 2026. This is a historic milestone, opening the door to attracting foreign capital, promoting sustainable economic growth.

The market "leap"

Vietnam's stock market has just reached a milestone when FTSE Russell, a prestigious global rating organization, announced its decision to upgrade it from a frontier market to a secondary emerging market. The event took place at exactly 3 a.m. on October 8, 2025, Hanoi time, marking a long journey that Vietnam has been persistently pursuing since September 2018, when it was first put on the watch list. At that time, the stock market was still stuck on two key important criteria: the DvP payment cycle and the method of handling failed transactions, both of which were rated as "limited".

But with the determination to reform, by November 2024, the regulatory agencies had implemented a non-prefunding trading model, allowing domestic securities companies to secure capital to support foreign institutional investors to buy securities. At the same time, a process for handling failed transactions was officially established, to quickly remove the final barriers.

The FTSE Russell Index Governing Board (IGB) has acknowledged these achievements, confirming that Vietnam meets all criteria under the FTSE Equity Market Classification Framework.

The FTSE Russell Index Governing Board (IGB) has acknowledged these achievements, confirming that Vietnam meets all the criteria under the FTSE Equity Market Classification Framework. However, the agency also pointed out the limitations of the role of global brokers in trading, emphasizing the need for "index simulation" according to the Statement of Principles. FTSE Russell expects the current efforts of the regulator to bring the Vietnamese stock market closer to international standards, reduce counterparty risk and increase investor confidence.

The upgrade roadmap is divided into stages, with a mid-term review in March 2026, and officially effective from September 21, 2026. According to the State Securities Commission (SSC), this is an "important milestone marking strong development", thanks to the strong direction of the Government , close coordination from the State Bank, ministries, and the accompaniment of the Stock Exchange, VSDC and the press. SSC is committed to continuing to coordinate with FTSE Russell, deploying comprehensive solutions for a transparent, efficient market, deeply integrated into global finance.

Golden opportunity and great responsibility

Upgrading is not only a badge of honor but also a key to opening up foreign capital markets, making the stock market a key driver for economic growth. With a population of nearly 100 million and a GDP growing steadily at around 6% per year, Vietnam is in an ideal position to welcome the wave of investment. For listed companies, this is an unprecedented opportunity to raise capital, especially when the banking system is facing high interest rates and credit risks.

A new wave of IPOs could explode in the consumer, banking, energy, industrial real estate and infrastructure sectors, thanks to the smooth operation of the KRX system, which makes the listing process transparent. International reality proves this attraction: when Pakistan was upgraded from frontier to emerging by MSCI in 2017, the IPO value doubled in just two years. Vietnam can absolutely expect a larger scale, effectively implementing Resolution 68-NQ/TW dated May 4, 2025 of the Politburo, promoting the private economy to contribute about 40% of GDP and aiming for a growth rate of 10-12%/year.

Upgrading is a turning point and a key driving force to help Vietnam integrate globally and improve liquidity.

Dr. Dinh The Hien, an economic expert, emphasized: from the business perspective, upgrading helps reduce dependence on bank loans with an average capital cost of 8-10%/year, opens a channel for issuing stocks or bonds easily, and attracts cheap foreign capital at only 4-6%/year from international funds. This diversifies capital sources, finances strategic projects such as digital transformation or export expansion, and is also a premise for building international financial centers in Ho Chi Minh City and Da Nang according to the National Financial Development Strategy to 2030. Ho Chi Minh City, with its leading position, can become the "Singapore of Southeast Asia" if the market meets emerging standards, attracting FTSE Russell or MSCI to invest in modern infrastructure. Da Nang specializes in becoming a green financial center, supporting sustainable projects, creating high-quality jobs and balancing regional development.

However, opportunities always come with heavy responsibilities. Foreign investors demand high transparency, good governance and compliance with IFRS or ESG. Lawyer Vu Anh Duong, Vice President of the Vietnam International Arbitration Center (VIAC), advised the State to issue a set of preliminary credit criteria, tax incentives for investment funds, encourage ESG and green loans; businesses must improve internal governance and develop clear strategies.

In particular, an independent risk assessment center will increase trust and reduce risks. Businesses need to act immediately: improve the quality of information disclosure, apply IFRS, increase independent members on the board of directors, and be transparent about sustainable strategies. When foreign capital flows in, the differentiation will be fierce: large, transparent companies are favored, while weak companies are easily eliminated from the investment basket. Improving risk management, applying technology and expanding international markets are the keys to turning challenges into advantages.

Upgrading is a turning point, a key driving force to help Vietnam integrate globally and improve liquidity. A transparent, competitive and sustainable market will create long-term attraction for foreign capital, become an effective medium- and long-term capital mobilization channel, contribute to promoting economic growth and raising international status.

Source: https://vtv.vn/thi-truong-chung-khoan-duoc-nang-hang-giai-phap-hut-von-ngoai-100251008071300097.htm

![[Photo] President Luong Cuong attends the 80th Anniversary of the Traditional Day of Vietnamese Lawyers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1760026998213_ndo_br_1-jpg.webp)

![[Photo] General Secretary To Lam visits Kieng Sang Kindergarten and the classroom named after Uncle Ho](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1760023999336_vna-potal-tong-bi-thu-to-lam-tham-truong-mau-giao-kieng-sang-va-lop-hoc-mang-ten-bac-ho-8328675-277-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee on overcoming the consequences of natural disasters after storm No. 11](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/09/1759997894015_dsc-0591-jpg.webp)

Comment (0)