"Up to this point, it can be said that the corporate bond market has had a soft landing," said Ms. Nguyen Ngoc Anh - General Director of SSI Fund Management Company - at the seminar "Promoting the development of an effective, safe and sustainable corporate bond market" organized by the Government Electronic Information Portal on December 4.

According to Ms. Ngoc Anh, the Ministry of Finance has resolutely issued Decree 08 to provide a legal basis for the parties to negotiate and extend the bonds. At the same time, the rapid operation of the secondary private bond market also greatly supports the rebuilding of investor confidence in the market.

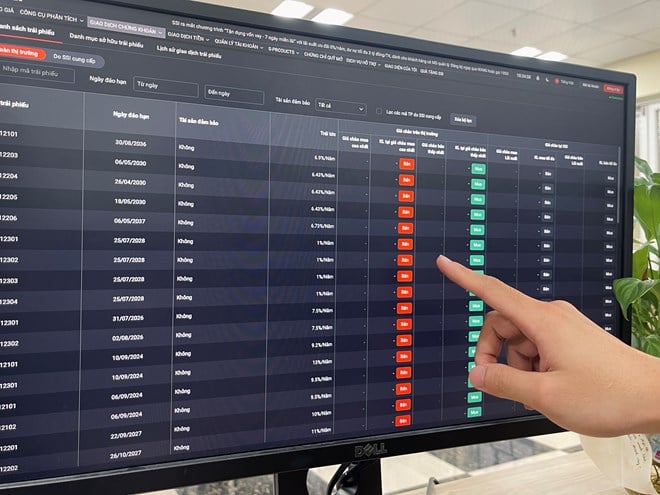

Sharing more specifically, Dr. Can Van Luc - Economic expert - said that the operation of a centralized individual bond trading system is an important point to increase liquidity and publicize information transparency. Statistics from HNX show that there have been about 760 bond codes of about 200 issuers put on this system. Thereby, market liquidity has increased about 20 - 30 times compared to the previous period.

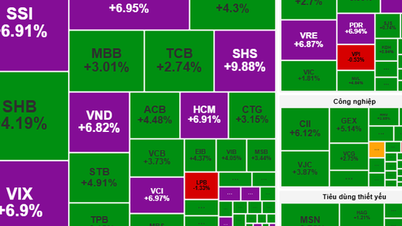

"We have developed some conditions to move towards a healthier market such as adding a credit rating organization to operate. Especially recently, bond violations have been dealt with resolutely. The above policies have contributed to the recovery of the bond market. Data to date shows that about 240 trillion VND has been issued, of which 220 trillion VND is privately issued bonds, 20 trillion VND is issued to the public, down only 10% compared to the same period last year.

Although there are still barriers, it is clear that the market is recovering positively and confidence is recovering. These are signs that will help the corporate bond market develop better," said Dr. Can Van Luc.

In addition, Mr. Phan Duc Hieu - National Assembly Delegate, Standing Member of the National Assembly's Economic Committee - also said that the Prime Minister recently issued Official Dispatch 1177 with 3 main highlights.

Firstly, the Telegram has a very systematic approach, not only solving the problem of the bond market but also the market connected with the bond market.

The second is the real estate issue, the sector that absorbs individual bond capital.

Third is the issue of interconnected credit capital. Regarding time, the Official Dispatch has short-term and long-term solutions, for example, the issues of issued bonds, or newly issued bonds... Regarding institutions, the Ministry of Finance is assigned to review current institutions including Decree 08 to amend legal provisions if necessary...

"The bond market or any market must go through a period of development and stumble to adjust regulations, policies and standardize its development process. After this stumble, we have learned from experience and avoided as much as possible stumbles on a larger scale.

"The end of 2023 is also the time when we all see that a very difficult year has passed. This is truly an opportunity, a premise for outstanding growth in the bond market in 2024" - Ms. Nguyen Ngoc Anh expected.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Government Standing Committee to remove obstacles for projects.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759768638313_dsc-9023-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chaired a meeting of the Steering Committee on the arrangement of public service units under ministries, branches and localities.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/06/1759767137532_dsc-8743-jpg.webp)

Comment (0)