New consumption remains very low

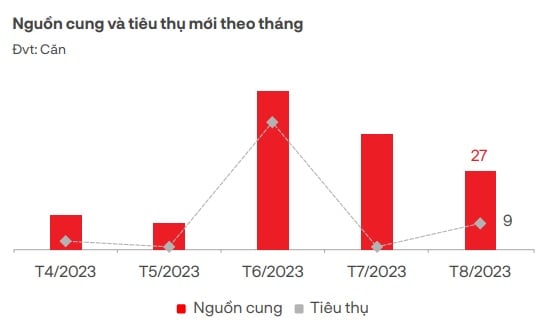

According to the August 2023 real estate market report of DKRA Group, with the resort villa type, new supply continued to decrease from the end of the second quarter of 2022 until now due to investors being more cautious in bringing products to the market. Thereby, only 1 project was recorded in the next phase of sale and 27 new units were opened for sale, down 88% compared to the same period last year.

The consumption of this type in August was only 9 units, down 85% compared to the same period. Market demand is also extremely modest, the consumption is only 15% compared to 2022. Most transactions in the month focused mainly on products priced under 10 billion VND/unit.

Meanwhile, primary selling prices have not fluctuated compared to the previous month. Many investors continue to apply interest rate support programs, quick discount incentives up to 40% - 50%, etc. to stimulate buyers. In addition, investors are also focusing on restructuring their business activities after being affected by economic instability as well as the pressure of extending bond maturity at the end of the year, which is expected to continue to put pressure on the market in the coming time.

Supply and consumption of resort villas (Photo: DKRA Group).

As for the resort townhouse/shophouse type, according to DKRA Group, new supply continues to decline, decreasing by approximately 99% compared to the same period and concentrated locally in the Southern region. Through the survey, only the project opened for sale in the next phase and the new supply was only 11 units. In particular, the North and Central regions still lack new projects for sale.

Market demand for this type is also very low, consumption is still limited with a decrease of up to 99% compared to the same period in 2022 with 3 new consumption units. The gloom of the market along with the tourism recovery speed not meeting expectations makes the market liquidity quite low.

Primary selling prices have not fluctuated much, and projects for sale continue to widely apply many preferential policies, quick payment discounts, interest rate support, principal grace period, leaseback commitments, etc. to stimulate market demand in the current difficult context. It is expected that in the coming months, market supply and demand will recover but not significantly, mainly concentrated in Kien Giang and Binh Thuan.

As for the Condotel segment, supply recorded a decrease of more than 75% compared to the previous month and a decrease of more than 77% compared to the same period. New supply came from 2 projects, both in the next sales phase with 100 units, mainly concentrated in the Southern region (accounting for 87%) and the Northern region (accounting for 13%). The Central region continued to record no new sales supply. Meanwhile, market demand continued to remain low, with only 17 new units sold, down 86% compared to the same period in 2022.

According to DKRA Group, macroeconomic instability as well as the gloomy market situation have made buyers more cautious when making investment decisions. Accordingly, primary selling prices have not fluctuated much compared to last month and continue to remain high due to the current high cost of capital.

Condotel is one of the types of oversupply and low consumption rate.

Incentive programs, quick payment discounts, principal grace periods, interest rate support, etc. are still widely applied to attract customers' attention. The market remains in a prolonged state of stagnation. In the context of the macro-economy facing many challenges, tourism has not recovered as expected, which are the factors that make the transaction situation less optimistic.

Large inventory makes resort real estate stagnant

Also in the previous report of DKRA Group, the cumulative Condotel inventory by June increased to 42,364 units. Of which, the total inventory of coastal townhouses increased to approximately 30,000 products. Particularly for beach villas, the cumulative inventory by the end of the second quarter of 2023 reached 15,000 units in both the North and the South.

Data from the Market Research Department of BHS Group also shows that from 2020 to present, the whole country has 81 resort real estate projects that have been and are in the process of handing over, providing the market with more than 44,000 products, including both high-rise and low-rise.

Currently, 67/81 projects have been put into operation, equivalent to nearly 20,000 products. However, only 31/67 projects are fully operational, the rest are partially operational. Thus, although only 14/81 projects have not been operational, up to 24,000 products are still "unused".

Resort real estate is forecast to recover the slowest among all types.

The oversupply has caused consumption to drop every month, even though investors continuously offer preferential policies such as flexible payment, high direct discounts, interest rate support, etc. This situation occurs in all types of resort real estate across the country, leading to an alarming amount of inventory.

According to experts, the inventory of resort real estate is partly due to the general difficulties of the market as well as the recovery of the tourism industry that has not met expectations. This has affected the psychology of investors in general, causing the cash flow into this type to be "blocked".

Many opinions also stated that the recovery of resort real estate compared to other segments in the market is almost certain. For that reason, more motivation is still needed from removing legal obstacles, creating a healthy and stable investment environment for resort real estate products. In order to bring cash flow back to this market.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the 16th meeting of the National Steering Committee on combating illegal fishing.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759848378556_dsc-9253-jpg.webp)

![[Photo] Super harvest moon shines brightly on Mid-Autumn Festival night around the world](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759816565798_1759814567021-jpg.webp)

Comment (0)