The acceleration phase can happen very quickly, in just 3 months. According to VPBankS experts' forecast, VN-Index may fluctuate within a narrow range in the first half of the year, and may even fall into a trough in May 2025 before bouncing back.

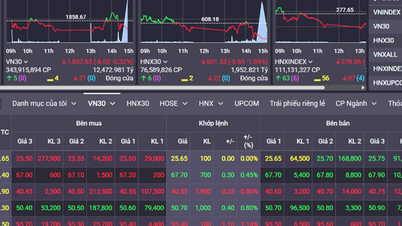

VPBankS expert: VN-Index may surpass 1,400 points in the second half of 2025, a boost for the upgrade story

The acceleration phase can happen very quickly, in just 3 months. According to VPBankS experts' forecast, VN-Index may fluctuate within a narrow range in the first half of the year, and may even fall into a trough in May 2025 before bouncing back.

The boost from the market upgrade story

Sharing at VPBankS Talk #4 with the theme Steadfastly overcoming storms, Mr. Vu Huu Dien, Chairman of the Board of Directors and General Director of VPBank Securities Joint Stock Company (VPBankS) assessed that 2024 is not an easy year for the stock investment channel. Looking back at the market, not only did foreign investors net sell with the largest value in 24 years of market operation, but the VN-Index traded in a narrow range, causing great difficulties for investors. The stock market is also competing with many other investment channels such as real estate, gold, and cryptocurrencies. Geopolitical issues also have a big impact, especially the return of President-elect D. Trump to the White House.

According to the head of VPBankS, GDP growth in 2024 is expected to increase by about 7%, the PMI index remains above 50 points, reflecting the economy is recovering. Profits of listed enterprises in 2024 are forecast to increase by about 20% over the same period and according to forecasts of VPBankS experts, it is possible to achieve profit growth of 25% next year. Although profit growth next year depends a lot on variables such as the level of interest rate reduction as well as tariff policies in the US, Mr. Dien said that the PEG ratio, which evaluates the investment value of a company based on the P/E ratio and the company's earnings growth rate, is lower than 1, showing that the valuation of Vietnamese stocks is at a relatively attractive level.

|

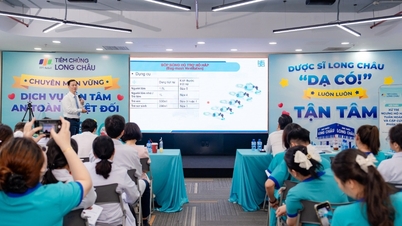

| Mr. Vu Huu Dien, Chairman of the Board of Directors and General Director of VPBank Securities JSC |

In addition, an important factor next year is that the management agency is stepping up solutions to meet the requirements of FTSE's market upgrade. Mr. Dien also emphasized that the upgraded stock market will affirm Vietnam's position in attracting foreign capital flows, especially capital flows from ETFs or active investment funds in the future.

This could be a boost and become an investment highlight of Vietnamese stocks in the second half of 2025. According to Mr. Tran Hoang Son - Director of Market Strategy, VPBankS Research, recently VN-Index has been moving sideways in the range of 1,200-1,300 points, despite many negative factors such as exchange rates and net foreign capital withdrawal.

“This period could be a historical accumulation period, similar to what happened in 2005-2006 before the signing of the WTO agreement and 2014-2016 with the wave of equitization and divestment of state capital. We expect the next wave to be a market upgrade wave in the second half of 2025. Vietnamese stocks are preparing for a big wave with attractive valuations.” VPBankS’s chief economist believes that market liquidity will continue to move sideways on an average or low base but will increase in the period before being upgraded, possibly in August-September with an average level of VND23,000 billion.

|

| VN-Index's performance after the accumulation period - Source: VPBankS |

Regarding the index, with foreign net selling pressure, high exchange rates and Trump's new tax policy that can cause fluctuations in the exchange rate, the VN-Index fluctuates in the range of 1,200-1,300 points. The trough may fall in April-June, creating conditions for investors to buy medium-term, disburse and take profits at the end of the year. In the second half of the year, the VN-Index may reach a peak of 1,400 points, fluctuating on average around the threshold of 1,300 points. The acceleration phase can happen very quickly, in just 3 months.

The driving forces supporting the market growth pointed out by Mr. Tran Hoang Son include the policy easing cycle, the continued profit recovery trend despite the differentiation between industry groups, and the stock market valuation remaining attractive in the medium and long term.

Many macro variables to watch

|

| Experts discussed at VPBankS Talk #4 with the topic Steadfastly overcoming storms |

According to Mr. Son, exchange rate fluctuations are one of the factors that have clearly affected the stock market in 2024 and will continue to affect it next year. Net foreign capital selling in many months this year has put considerable pressure on the general index's performance. In addition, the US tariff policy is one of the factors affecting the stock market in the first half of 2025.

“Looking back at the first term of President Trump, the tax policy was declared strongly in the initial period but was aimed at drawing countries into negotiations to come up with the most beneficial policy for the US.” Mr. Son also said that the Trump 2.0 administration will also have a move of “raising high and hitting lightly”. The tariff policies, in addition to trade factors, restrain China’s development of some products. At the same time, in response to the US tariff policy, China may use exchange rate measures. Typically, in the period of 2018-2019, the yuan depreciated by 12%. The USD/VND exchange rate also decreased by 2-3%.

Sharing the same view with VPBankS Research Market Strategy Director , Mr. Pham The Anh - Head of the Faculty of Economics, National Economics University (NEU), Chief Economist of the Vietnam Center for Economic and Strategic Studies (VESS) also said that in the long term, the US's goal is to negotiate with hungry countries on immigration issues and trade balance. The economic expert said that the dollar will appreciate because of the expectation that the tariff policy can help reduce the trade deficit, thereby reducing the supply of USD and increasing the value of USD.

Regarding the fluctuations of the USD/VND exchange rate, Mr. Pham The Anh advised investors to observe the interest rate difference between the US and Vietnam. US inflation figures will show whether interest rates have room to decrease or the rate of decrease. At the same time, the level of US tariff policy will also affect exchange rate movements.

Forecasting GDP growth in the coming time, economic expert Dr. Pham The Anh said that the short-term driving force will come mainly from public investment with the launch of a series of projects that will become the main driving force for growth in 2025. At the same time, the export growth rate may slow down compared to the high base level of 2024 and instability from tariff policy. Although it may not reach double-digit growth, exports are still an important factor supporting GDP growth. The trend of FDI capital inflows into Vietnam will continue not only because of the China + 1 story but also because of its geographical location, Vietnam's labor costs are cheap compared to the world and attractive to foreign investors.

Dr. Pham The Anh forecasts that the GDP growth rate in 2025 will reach 6.5%, which is feasible. In the long term, through streamlining the apparatus, public investment, restarting large projects such as high-speed railways, nuclear power, attracting "eagles"..., the Vietnamese economy can have profound and long-term impacts. Because in the past, Vietnam only talked about economic reform through account and monetary policies, but now it is expanding to institutions, the business environment, and implementing deep reforms.

Source: https://baodautu.vn/chuyen-gia-vpbanks-vn-index-co-the-vuot-1400-points-o-nua-cuoi-nam-2025-cu-hich-cau-chuyen-nang-hang-d232638.html

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

Comment (0)