VN-Index fell 1.6 points as domestic and foreign investors focused on dumping large-cap stocks, thereby extending the decline to three consecutive sessions.

Before entering today's trading session, October 16, some experts predicted that the VN-Index would continue to maintain its accumulation status or have some slight adjustments before the consensus on price increases in large industry groups was more clearly demonstrated.

The actual developments in the session partly proved these predictions when VN-Index opened in red due to selling pressure from stock holders. Due to the caution of investors, some slight fluctuations occurred from the beginning of the session. The index surpassed the reference point in the middle of the morning session, but continued to plummet after the lunch break and at one point lost nearly 5 points, down to 1,276 points.

The decrease gradually narrowed before closing thanks to the appearance of cash flow disbursement at low prices. The index representing the Ho Chi Minh City Stock Exchange closed the session at 1,279.48 points, down 1.6 points from the reference and extending the decline for the third consecutive session.

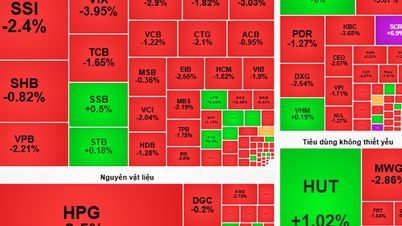

VN-Index was covered in red in the trading session on October 16 when 209 stocks decreased, while the number of stocks increased was only 153. The VN30 basket had a strong differentiation when the selling side dominated, leading to 18 stocks closing below the reference, while the number of stocks increased by only half that number.

Most banking stocks closed the session in negative territory. According to Mirae Asset, SSB was the stock that weighed down the VN-Index the most, falling 4.02% to VND16,700. Next, LPB fell 1.4% to VND31,750, BID fell 0.3% to VND49,850 and MBB fell 0.58% to VND25,500.

Red dominated steel stocks as almost all closed below reference. Similarly, the fertilizer group also recorded a series of price reductions, in which two pillar stocks DCM and BFC lost 2.1% and 1.5%, down to VND36,800 and VND39,900, respectively.

On the other hand, MWG topped the list of stocks that positively impacted the market when it increased 1.71% compared to the reference price to 65,500 VND. VHM increased 0.78% to 45,000 VND to rank second in the list of stocks that contributed the most, helping the VN-Index avoid a deeper decline.

Some positive market signals were recorded in the food group when two pillar stocks, VNM and SAB, were also included in the above list. Specifically, VNM increased by 1.05% to VND67,500 and SAB increased by 1.23% to VND57,800.

Market liquidity today reached 536 million shares, down 176 million units compared to yesterday's session. Trading value accordingly reached 13,313 billion VND, down 3,316 billion VND compared to 16,629 billion VND recorded in the previous session. Large-cap stocks contributed more than 6,944 billion VND to liquidity, equivalent to nearly 198 million shares successfully transferred.

Not only pioneering in terms of contribution points, MWG also leads in order matching value with over VND894 billion (equivalent to 13.7 million shares). This figure far exceeds the following stocks, MSN by over VND653 billion (equivalent to 8 million shares) and STB by over VND615 billion (equivalent to 18.4 million shares).

Foreign investors continued to be net sellers in today's session. Specifically, this group sold more than 49.5 million shares, equivalent to a transaction value of about VND1,507 billion , while only disbursing nearly VND1,176 billion to buy 35.8 million shares. The net selling value was approximately VND331 billion.

Foreign investors dumpedFPT shares with a net selling value of nearly 70 billion VND, followed by HDB with more than 62.1 billion VND, VHM with nearly 48.7 billion VND. On the other hand, foreign investors bought STB shares with a net value of 77 billion VND. MWG ranked next with a net absorption of 48.8 billion VND, followed by DGC with 23.7 billion VND.

Source: https://baodautu.vn/vn-index-giam-phien-thu-ba-lien-tiep-mat-moc-1280-diem-d227599.html

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

Comment (0)