VN-Index fell 5.5 points in the session on November 12, extending its decline to four consecutive sessions due to widespread selling pressure across many stock groups.

VN-Index fell 5.5 points in the session on November 12, extending its decline to four consecutive sessions due to widespread selling pressure across many stock groups.

After three consecutive declines, the stock market is expected to move to a state of balance when there is an active buying flow. However, with a large potential supply in the above resistance zones, a strong recovery is predicted by many experts to be unlikely.

In reality, the opposite happened when VN-Index opened in green, but the increase was not too large and maintained this state throughout the morning session.

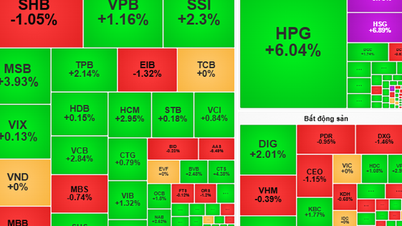

Before the lunch break, selling pressure increased while demand was weak, causing many stock groups such as banks, steel, oil and gas, real estate... to start to plummet. The index representing the Ho Chi Minh City Stock Exchange closed today at 1,244.82 points, down 5.5 points from the reference and continuing a series of declines for 4 consecutive sessions.

Market breadth was skewed to the downside with 236 stocks in the red, while the number of stocks increasing was only 120. The large-cap basket recorded a similar situation with the number of stocks closing below reference 4 times more than the increasing stocks, 20 stocks and 5 stocks respectively.

MWG became the main factor holding back the market's growth when it fell 3.49% to VND60,800. Next, CTG of the banking group fell 1.29% to VND34,500 and took 0.58 points off the VN-Index. BID and TCB also appeared on the list of negative market impacts when they fell 0.43% to VND46,300 and 0.65% to VND23,050, respectively.

Steel stocks traded less enthusiastically in today's session when NKG decreased 1.6% to VND21,250, while HPG and HSG both decreased 0.7% to VND27,500 and VND20,150, respectively.

Oil and gas group was under fierce selling pressure when PSH decreased by the full margin to 3,750 VND, PVD decreased by 4.5% to 24,200 VND and PVC decreased by 1.7% to 11,500 VND.

On the other hand, SAB increased by 2.35% to VND56,600, thereby becoming the market's support in today's session. VTP and HAG followed, both hitting the ceiling to VND113,400 and VND11,200, respectively. HNG also contributed positively to the general index when accumulating 2.08% to VND4,900.

Market liquidity today reached VND14,222 billion, down VND5,395 billion from the previous session. This value came from about 601 million shares changed hands, down 96 million shares from yesterday's session.

VHM and HPG shared the top two positions in terms of matched value, both reaching VND661 billion. Next, MWG reached more than VND655 billion (equivalent to 10.6 million shares) and STB more than VND489 billion (equivalent to 14.6 million shares).

Foreign investors continued their net selling streak for 14 consecutive sessions. Today, this group sold 48.9 million shares, equivalent to a transaction value of about VND1,602 billion, while only disbursing VND995 billion to buy nearly 29 million shares. The net selling value was approximately VND607 billion.

Foreign investors aggressively sold TCB shares with a net value of more than VND103 billion. Next in the list of stocks that foreign investors aggressively sold were PVD with more than VND65 billion, MSN and VHM with nearly VND63 billion each.

On the other hand, foreign investors actively disbursed into STB with a net purchase value of approximately VND 58 billion, followed by SAB with nearly VND 27 billion, HPG with VND 23 billion and BAF with about VND 13 billion.

Source: https://baodautu.vn/vn-index-giam-phien-thu-tu-lien-tiep-mat-moc-1245-diem-d229847.html

![[Photo] Many streets in Hanoi were flooded due to the effects of storm Bualoi](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/18b658aa0fa2495c927ade4bbe0096df)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc Knapper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/c8fd0761aa184da7814aee57d87c49b3)

![[Photo] General Secretary To Lam attends the ceremony to celebrate the 80th anniversary of the post and telecommunications sector and the 66th anniversary of the science and technology sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/8e86b39b8fe44121a2b14a031f4cef46)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the 8th Conference of full-time National Assembly deputies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/29/2c21459bc38d44ffaacd679ab9a0477c)

Comment (0)