From July 1, 2025, e-wallets are officially recognized as a means of payment similar to bank accounts. Users can easily transfer money between wallets, or from wallets to bank accounts and vice versa. However, this convenience has also become a "fertile ground" for cybercriminals to create many fraudulent scenarios to appropriate assets. Many victims are e-wallet users and e-wallet operators to do business as intermediary payment services.

A citizen received a call from a person claiming to be an employee of an e-wallet, informing her about the types of e-wallets that can be used for transactions like a bank account. This person correctly read out her ID card number and the type of e-wallet she was using; at the same time, he offered to help her reinstall the application on her phone to upgrade to a new version with many new features and e-wallet gifts.

She trusted and followed the instructions, accessing the link received from this person via text message without knowing she was being scammed.

"They said that if I upgraded the software, I would immediately get 1 million added to my wallet. When I updated the software, everything looked exactly the same, no difference. In the afternoon, when I took out my phone to pay for a taxi, I discovered that nearly 5 million in my wallet was gone," the victim shared.

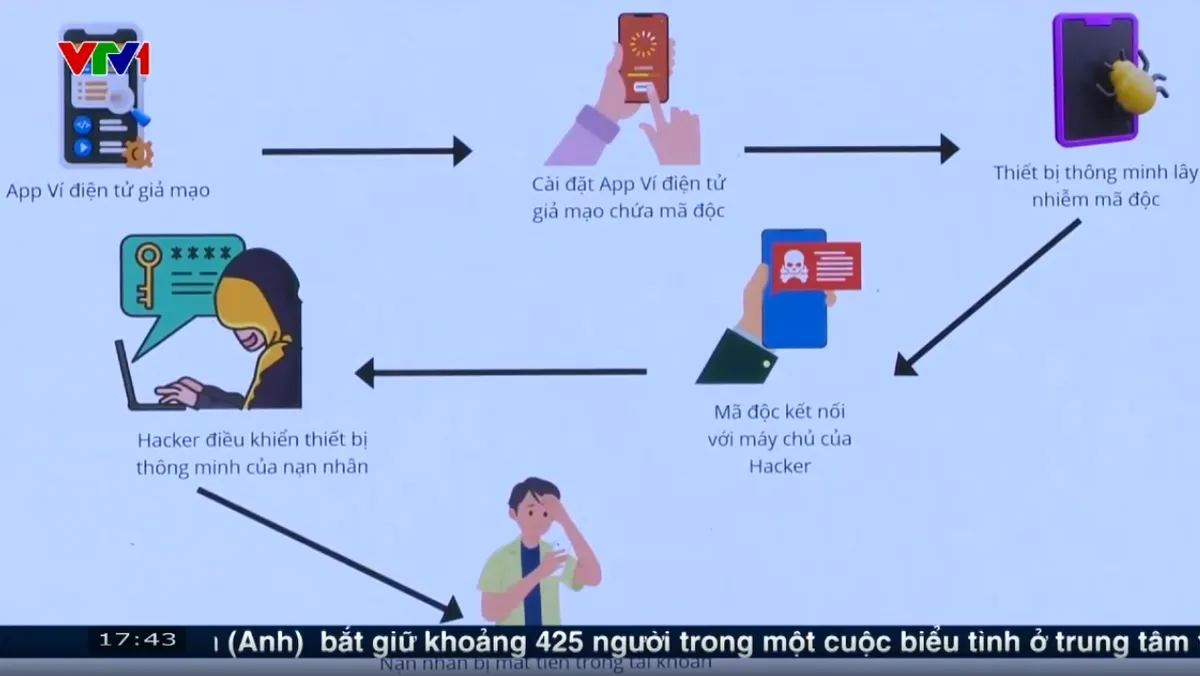

Cybersecurity experts say that hackers sent links containing fake e-wallet applications with malware attached. When users downloaded the fake e-wallet applications, the malware infected the smart devices they were using.

Mr. Vu Viet Tien (cybersecurity expert, Vietnam National Cyber Security Company) said: "These malwares have connected to the hacker's control server. Through it, hackers can send control commands to monitor and take control of the victim's smart device. From there, hackers will steal the OTP code and withdraw all the money from the victim's account."

E-wallet businesses can also be targeted by criminals. Recently, the police received a report from a company representative about money being stolen while cooperating with many banks to do business in the form of integrating technology taxi booking applications into the bank's application.

"Our company still advances money to customers, but recently we discovered that many personal accounts have been advanced money for taxi rides, but after the specified time, the money has not been returned to us," said a company representative.

As a result of the investigation, the three arrested subjects illegally acquired many bank accounts. The purpose was to use these empty accounts to book and withdraw taxi fares from fraudulent trips in the following way: the mastermind booked a taxi through an e-wallet that supports advance fare payments integrated into the banking application. When the trip ended, the e-wallet business unit advanced the taxi fare from the customer and paid it immediately to the driver. Immediately after that, the driver and the mastermind divided the total amount of 60 million VND of embezzled money according to the agreement.

"The taxi drivers in this gang moved their cars to deserted locations with few taxis. Then the drivers sent the location to the mastermind and leader so that Chu Anh Quan could use the taxi booking service on the bank account application to book the right taxis of the taxi drivers in this gang," Major Pham Thai Duong (Department of Cyber Security and High-Tech Crime Prevention, Ninh Binh Provincial Police) informed.

Safe use of e-wallets

Cyber security experts also warn that bad guys can also launch scams via e-wallets in other common forms such as: luring users to participate in "missions" to receive rewards, supporting loan disbursement through transferring and receiving money through many different wallets. As a result, victims not only lose money, but also risk being implicated in money laundering lines..., or through online shopping groups, launching fake promotional programs, typically "transferring to wallets, refunding 50% of the value", forcing victims to transfer money in advance to "confirm the transaction", but the purpose is to defraud and appropriate money. So what measures can be taken to avoid scams via e-wallets?

Linking e-wallets with banks to support prepaid account holders brings many benefits, but also poses many risks of being exploited by bad guys, especially when the illegal buying and selling of bank accounts has not been completely prevented.

People should always be vigilant against calls from strangers and strange links received via text messages; be careful when installing applications on their phones and only download applications from official sources to avoid personal data being exposed or leaked.

Colonel Hoang Ngoc Bach (Head of Department 4, Department of Cyber Security and High-Tech Crime Prevention, Ministry of Public Security ) said: "People are not allowed to buy, sell, rent or borrow e-wallets. This is one of the reasons why people can use these wallets to illegally transfer money. Individuals who rent or lend e-wallets will be held criminally responsible."

With unreliable applications installed from unofficial sources, people need to immediately uninstall them. Because it is possible that during the installation process of these applications, bad guys have tricked phone users into allowing access to sensitive data sources on the phone to carry out profiteering activities.

From scams via fake links to sophisticated fraud in the payment service business, users need to be vigilant. To protect their assets, people should only download applications from official sources, not trust strange calls, not click on suspicious links and absolutely not buy or sell e-wallets. Safety in digital payments is the responsibility of each user.

Source: https://baolaocai.vn/canh-giac-bay-lua-qua-vi-dien-tu-post881554.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

![[Photo] The 1st Congress of Phu Tho Provincial Party Committee, term 2025-2030](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/1507da06216649bba8a1ce6251816820)

![[Photo] President Luong Cuong receives President of the Cuban National Assembly Esteban Lazo Hernandez](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/4d38932911c24f6ea1936252bd5427fa)

Comment (0)