According to experts, workers facing difficulties will be limited in withdrawing one-time benefits if they are given a mortgage loan secured by contributions to the social insurance fund.

Recently, the Ho Chi Minh City Social Insurance (HSI) proposed to study the number of years and the amount of money contributed to the pension fund as accumulated assets so that employees can borrow money from the Social Policy Bank at preferential interest rates when in urgent need. The amount of money borrowed is based on the financial credit rating such as the time and the level of compulsory social insurance contributions of the employee. The insurance agency is responsible for notifying the bank when the pension fund contribution changes so that both parties can conveniently handle the debts.

The above proposal was also sent to the Prime Minister by the Private Economic Development Research Board (Board IV) at the end of May after consulting with workers.

People withdraw one-time benefits at Thu Duc City Social Insurance, end of 2022. Photo: Thanh Tung

Dr. Vu Minh Tien, Director of the Institute of Workers and Trade Unions, said that in terms of workers' needs, this is a suitable solution. A survey conducted by the institute at the end of last year with over 6,200 workers showed that if they lost their jobs, only 11.7% could save enough to last less than a month; 16.7% could last 1-3 months and 12.7% could last more than three months. At this time, the money contributed to the fund is the only savings they have, "no different from a savings book".

According to Mr. Tien, there are people who only need 20-30 million VND to solve their difficulties. However, they cannot ask the Social Security agency to receive a part of the amount they have paid, just enough to cover their expenses, but are forced to withdraw the whole amount. This forces workers to leave the social security system. If they have not finished a year of work, workers will sell their insurance books at child prices.

In fact, there are cases where the Social Insurance is withdrawn at one time, then the job is good, the income is good, and the employee wants to pay back the money, accepting to pay the interest to receive the pension, but the law does not allow it. Therefore, when lending with a mortgage, the amount of money received at one time will give the employee more options.

Mr. Cao Van Sang, former director of the HCM City Social Insurance, said he had known about the model of mortgaging insurance books to borrow capital since 1999 when he went to the Philippines to study experience. All employees participating in the pension fund are eligible for loans depending on the time and level of contribution.

According to Mr. Sang, when implementing this policy, the social insurance industry has two benefits. First, employees are very interested in the results of contributions to the fund, because when paying at a high level, they will be able to borrow a lot over a long period of time. Due to the impact of immediate benefits, employees will react when businesses "split" their salaries into many payments to participate in low-level insurance. This helps limit the situation of underpayment and underpayment.

Second, the fund's surplus is lent to banks by the Social Insurance but at a low interest rate of 6% per year. However, the interest rate when lending to employees through banks increases to 8% per year. This difference is divided equally between the two parties, giving the fund more resources.

"This is a good way to help workers stay with the social insurance fund, make a profit and resolve the request to receive a one-time subsidy," said Mr. Sang.

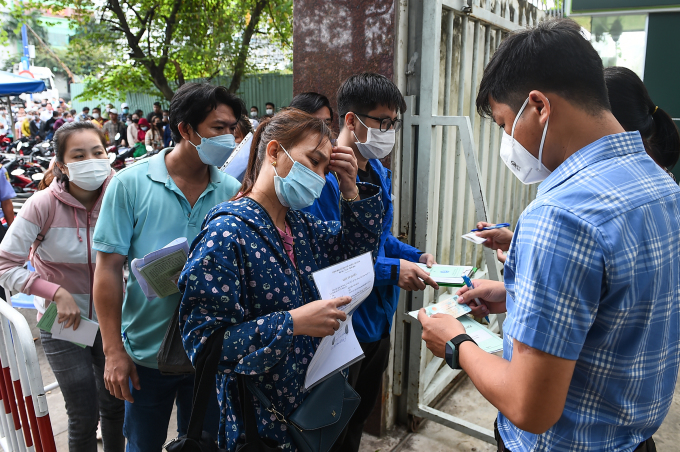

People wait to withdraw social insurance at one time in Hoc Mon district, Ho Chi Minh City, April 2023. Photo: Dinh Van

Financial expert Nguyen Cao Huu Tri said that in order to achieve the goal of mortgaging contributions to the Social Insurance Fund when borrowing capital, helping workers stay in the social security system, the provision for one-time withdrawal of Social Insurance must first be closed. Because between one party having to pay interest on the loan and the other party receiving the entire contribution, the worker will choose to withdraw the insurance.

Currently, the draft Law on Social Insurance (amended) proposes that the maximum one-time withdrawal shall not exceed 50% of the total time of contribution to the pension and death fund. Thus, the amount of the upcoming one-time benefit will be less than the current law. Therefore, if the loan is given with a maximum limit equal to the contribution to the fund, the employee will switch to borrowing. Instead of withdrawing directly from the insurance fund, the employee will switch to withdrawing indirectly from the bank. If they do not repay the debt, the last option is to handle the mortgaged assets to preserve capital.

"When the amount of money contributed to the insurance fund is processed by the bank for a loan, the worker is no longer in the system. Thus, the goal of keeping them in the social security system will not be achieved," said Mr. Tri. Therefore, the loan limit needs to be designed appropriately, helping workers access capital to solve sudden difficulties while still maintaining the entire process of contributing to the fund to receive pensions later.

Having worked in the banking sector for many years, Mr. Tri believes that in credit activities, lending is just a small matter, the important thing is the ability to repay the debt. If the worker is still working and has an income, commercial banks can participate. However, it will be very difficult for unemployed workers to pay off their debts. At this time, the participation of policy banks, state credit funds, and microfinance organizations with small loans will be more suitable.

Director of Ho Chi Minh City Social Insurance Lo Quan Hiep said that it is necessary to refer to the very successful way of doing things in Korea. In addition to limiting one-time withdrawals, this country's banks design appropriate loan levels, quick disbursement, and support from employees. In particular, Korea stipulates that if a business owes insurance, it will not be able to access loans from banks. Therefore, contributing to the fund is implemented seriously, almost as a top priority, making credit rating very favorable.

Le Tuyet

Source link

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to deploy overcoming consequences of storm No. 10](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/544f420dcc844463898fcbef46247d16)

![[Photo] Students of Binh Minh Primary School enjoy the full moon festival, receiving the joys of childhood](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/3/8cf8abef22fe4471be400a818912cb85)

Comment (0)