The owner of TUNG Dining restaurant, who is also the head chef, has been accused of using his personal account to receive payments to evade more than 2.4 billion VND in taxes - Photo: NH Website

As reported by Tuoi Tre Online , the Hanoi People's Procuracy has completed the indictment to prosecute the accused Hoang Tung (33 years old, in Tu Liem ward, director of TUNG Dining Restaurant Company Limited) and Nguyen Do Nguyet Anh (33 years old, in Phuc Loi ward, Hanoi) for tax evasion.

Previously, in March 2024, the Hanoi Tax Department inspected and discovered that TUNG Dining Company had signs of tax evasion, selling goods without issuing invoices, leaving revenue outside the accounting books, and not declaring taxes as prescribed.

Accused of tax evasion of more than 2.4 billion VND when revenue was 53 billion but declared 29 billion

According to data from the Hanoi Business Registration Office, TUNG Dining restaurant was established in September 2018 under the original legal name of Truong Hoang Tran Nguyen Company Limited, with a charter capital of VND2.4 billion.

The founder, director and legal representative is Mr. Hoang Tung (born in 1992). The enterprise has four founding shareholders, including:

• Hoang Tung holds 57.3% of charter capital,

• Nguyen Do Nguyet Anh owns 31.66%,

• Tran Thanh Long and Truong Quang Dung hold 10% and 1% of capital respectively.

After a few months of operation, the company increased its charter capital to 4 billion VND, and at the same time, the capital contribution structure changed when two new shareholders appeared, Doan Bao Linh and Le Thu Quyen. Along with that, the ownership ratio of the original founding shareholders also decreased compared to the time of establishment.

By early 2022, the company officially changed its name to TUNG Dining Restaurant Company Limited as it is today.

According to the latest updated data (March 2025), Mr. Hoang Tung and Ms. Nguyen Do Nguyet Anh each hold 27.78% of the charter capital. The three remaining members, Truong Quang Dung, Doan Bao Linh and Le Thu Quyen, own 11.1%, 16.67% and 16.67%, respectively.

However, according to the investigation results, Tung and Anh directly monitored the company's revenue, expenses, accounting books and reported profits to shareholders. Other shareholders did not participate in monitoring detailed accounting books and were not directly involved in the company's tax declaration and payment activities.

The case file shows that the company's actual revenue was more than 53 billion VND. However, Tung and Anh declared revenue tax of more than 29.4 billion VND, but did not declare or pay revenue tax of more than 23.5 billion VND. On March 19, 2024, the Hanoi Tax Department inspected and discovered that the company had evaded more than 2.4 billion VND in taxes. Of which, value-added tax was more than 2.1 billion VND and personal income tax was more than 335 million VND.

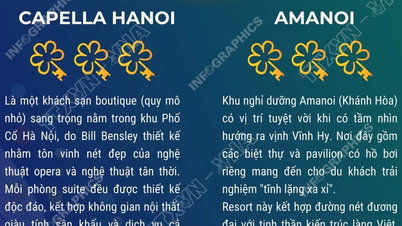

Huge "profile" of the restaurant and its owner Hoang Tung

Many people feel quite sorry for the owner of TUNG Dining because of the success of this restaurant as well as the founder himself achieved in recent times.

According to the website introduction, TUNG Dining is a restaurant that was on the list of 100 best restaurants in Asia in 2021, honored by La Liste 2023 and consecutively listed in Michelin Guide in 2023, 2024 and 2025.

Mr. Tung was introduced as the head chef who prepared the opening dish for the first Michelin Guide & Gala Dinner awards ceremony held in Hanoi in June 2023.

Notably, all four restaurants he manages are honored in this prestigious culinary anthology, including two high-end restaurants, TUNG Dining and Å by TUNG, as well as two other popular restaurants, Khoi restaurant and Tanh Tach Seafood Society.

Previously, in 2022, owner Hoang Tung was also honored by Forbes Vietnam in the "Under 30" list for his outstanding contributions to contemporary Vietnamese cuisine, bringing the creative spirit and Vietnamese fine dining style to the international level.

Meanwhile, Nguyen Do Nguyet Anh - who was identified as an accomplice - also graduated with a major in international business in Finland and completed a master's degree in business administration at the University of Birmingham (UK).

After the incident was discovered, during the investigation, Tung and Anh paid the full amount of compensation. However, from this incident, many important lessons can be drawn for the business community, especially young entrepreneurs.

A legal expert emphasized that all revenue must be declared honestly and fully and electronically invoiced according to regulations. Absolutely do not use personal accounts to receive business revenue to avoid violating tax laws.

In addition, enterprises need to build a transparent accounting and internal control system, conduct periodic audits, and maintain regular tax consultation to promptly adjust and proactively correct errors if any, ensuring legal compliance and sustainable development.

Source: https://tuoitre.vn/chu-nha-hang-tung-dining-bi-truy-to-tung-lot-vao-forbes-under-30-viet-nam-2025102118443296.htm

![[Photo] Prime Minister Pham Minh Chinh received Mr. Yamamoto Ichita, Governor of Gunma Province (Japan)](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761032833411_dsc-8867-jpg.webp)

![[Photo] Da Nang residents "hunt for photos" of big waves at the mouth of the Han River](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/21/1761043632309_ndo_br_11-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the Hungarian National Assembly Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760970413415_dsc-8111-jpg.webp)

Comment (0)