Stocks cannot hold the 1,500 mark - Photo: AI drawing

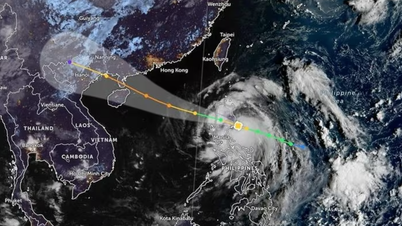

In the morning trading session on July 18, VN-Index opened with a breakthrough, quickly reaching the historical peak of 1,500 points thanks to support from the real estate and consumer goods groups.

However, active selling pressure increased at the end of the morning session, although it had not exceeded the average of the last 5 sessions, along with weakening demand, causing the index to reverse and decrease slightly.

Market liquidity slightly decreased compared to yesterday morning session, showing a return of cautious sentiment.

Notably, the real estate group - the industry that attracted strong cash flow and pushed the VN-Index up at the beginning of the session - recorded the sharpest decline when many large stocks reversed. VIC alone took 2.39 points off the index this morning.

In the afternoon session, the selling pressure has not cooled down. The number of red codes continues to increase more strongly on the board. In which, the group of stocks related to Vingroup is simultaneously under pressure to adjust with VIC (-2.46%), VRE (-1.85%), VPL (-0.22%).

The real estate group recorded a clear differentiation. Many codes simultaneously hit the ceiling such as QCG (Quoc Cuong Gia Lai ), HAG (Hoang Anh Gia Lai), HQC, DXS.

Besides, stocks NVL (+3.35%), CEO (+7.62%), LDG (+4.59%), NTL (+1.73%) also increased strongly, regaining green.

On the contrary, PDR (-1.67%), DXG (-1.77%), HDC (-1.32%) were still under selling pressure and continued to decrease in price.

The group of securities - financial stocks recorded green spreading again at the end of the morning session, with many codes increasing by 3-4%. However, the increase cooled down somewhat at the end of the afternoon session. In addition to VIX hitting the ceiling, codes SHS, VCI, HCM, EVF, VDS... all maintained an increase of 1-2%.

For the banking group, the consensus on price increases was more evident when the market entered the final minutes of the session.

Many codes increased strongly such as TCB (+3.13%), STB (+5.24%), VPB (+2.15%), whileACB , TPB, MBB, VIB... only fluctuated around 1%.

By industry group, the entire market had 9 out of 19 secondary industry groups decreasing in points. Of which, the real estate group decreased by 1.5%, while banking and finance and securities increased by 0.56% and 0.75% respectively.

Meanwhile, the food group with codes MSN, VNM, PAN, SBT recorded a breakthrough in trading volume thanks to strong net buying from foreign investors.

In general, with stock groups, all three floors had 428 stocks increasing in price, counterbalancing 380 stocks decreasing in price.

Although it has not yet regained the old peak it surpassed this morning, the VN-Index still increased by 7.27 points compared to the reference, to 1,497.28 points. Contributing to this increase are the banking, retail, and securities stocks.

Foreign investors slightly returned to net selling

Notably, foreign investors returned to net selling slightly (-75 billion VND) in the session when the index "briefly" regained the 1,500 mark. In which, this group focused on selling GEX (-82 billion VND), VHM (-78 billion VND), GMD (-77 billion VND), DXG (-75.88 billion VND), CTG (-70 billion VND)...

On the contrary, this block bought the most SSI (-98 billion VND), VIX (-84 billion VND), MWG (-78 billion VND), VSC (-57.7 billion VND), HAH (-50.88 billion VND)...

Total market liquidity today continued to increase sharply with nearly 40,000 billion VND. Of which, about 35,600 billion VND was traded on the HoSE floor.

Source: https://tuoitre.vn/chung-khoan-cham-dinh-lich-su-1-500-diem-roi-rot-trong-tiec-nuoi-20250718151036702.htm

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)