At the end of the session on September 18, the VN-Index stopped at 1,665 points, down slightly by 5.7 points, equivalent to 0.35%.

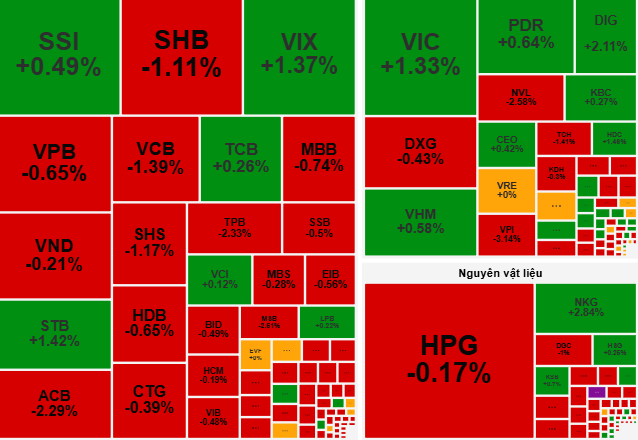

In the morning session of September 18, the VN-Index maintained a tug-of-war trend, fluctuating within a range of 15-20 points around the reference level. Market liquidity decreased significantly, reflecting the cautious sentiment of investors when many large-cap stocks were under pressure to correct. However, the green color of Vingroup stocks, including VIC and VHM, contributed to helping the market maintain balance.

In the afternoon session, negative developments from the blue-chip group continued to drag down the index. Some pillar stocks such as VIC and VHM narrowed their gains, even turning red at times. Notably, the VN-Index recorded the sharpest drop of 25 points near the end of the session, before gradually recovering thanks to the restructuring of stock portfolios of investment funds.

At the end of the session, VN-Index stopped at 1,665 points, down slightly by 5.7 points, equivalent to 0.35% compared to the previous session.

In contrast to the sluggishness of large-cap stocks, small and medium-sized stocks in sectors such as public investment, real estate and steel recorded strong cash flows, becoming the bright spots of the market. These codes showed signs of positive accumulation, attracting attention from investors.

Commenting on the trading session on September 19, VCBS Securities Company forecasts that the VN-Index will continue to move sideways with a fluctuation range of 20-30 points, alternating with increases and decreases. According to VCBS, the market may form an attractive price level, creating opportunities for demand to return. "The group of small and medium-sized stocks is maintaining a stable price base, while showing positive signs of increasing points. Investors can consider disbursing part of their investment into stocks that show signs of attracting strong cash flow in the upcoming sessions" - VCBS Securities Company recommends.

Meanwhile, Dragon Viet Securities Company (VDSC) commented that for the market to regain sustainable growth momentum, cash flow needs to absorb the stock supply well. Therefore, investors should carefully observe the supply and demand developments and maintain the portfolio proportion at a reasonable level, waiting for clearer accumulation signals from the market.

Source: https://nld.com.vn/chung-khoan-ngay-19-9-co-phieu-vua-va-nho-tiep-tuc-thu-hut-dong-tien-196250918181156383.htm

![[Photo] Prime Minister Pham Minh Chinh launched a peak emulation campaign to achieve achievements in celebration of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/5/8869ec5cdbc740f58fbf2ae73f065076)

![[Photo] Bustling Mid-Autumn Festival at the Museum of Ethnology](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/4/da8d5927734d4ca58e3eced14bc435a3)

![[VIDEO] Summary of Petrovietnam's 50th Anniversary Ceremony](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/10/4/abe133bdb8114793a16d4fe3e5bd0f12)

![[VIDEO] GENERAL SECRETARY TO LAM AWARDS PETROVIETNAM 8 GOLDEN WORDS: "PIONEER - EXCELLENT - SUSTAINABLE - GLOBAL"](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/23/c2fdb48863e846cfa9fb8e6ea9cf44e7)

Comment (0)