Why does the VN-Index keep green when the "big brother" Vietcombank's stock adjusts?

Two real estate stocks, DIG and KBC, attracted strong cash flow with liquidity suddenly reaching over a thousand billion VND. KBC increased sharply and was one of the factors contributing positively to the general index's increase.

|

| KBC shares hit the ceiling in the session on March 3 and were in the top 10 stocks contributing the most points to the VN-Index. |

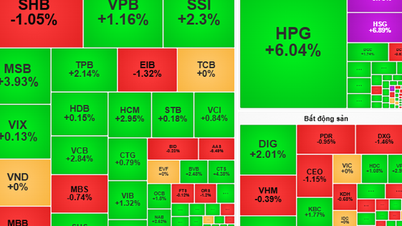

Green dominates VN-Index, pushing it up despite VCB's decline

After surpassing the highest price peak of 2023, equivalent to 1,255.11 points, VN-Index continued to increase points despite being quite struggling in the first session of the new week. VN-Index closed at 1,261.4 points, up 3.1 points (+0.25%) compared to the end of last week.

Vietcombank shares - the listed organization with the largest market capitalization - decreased by 1.34%. VCB shares closed at VND96,000/share. In the last three sessions, after surpassing the VND100,000/share mark, VCB has not recorded any trading session with an increase in price.

However, with the overwhelming green color, both VN-Index and HNX-Index increased simultaneously. In total, the whole floor had 462 stocks increasing, 28 stocks hitting the ceiling; while only 294 stocks decreased and 12 stocks hit the floor.

The top 10 stocks that contributed most positively to the VN-Index were GVR, CTG, HVN, BCM, KBC, MWG, NLG, VNM and MBB. Vietnam Airlines ' HVN stock unexpectedly increased by a huge margin of 6.67%, closing at VND50,710/share. KBC also increased by the ceiling price of 6.89%. Meanwhile, on the HNX, PVS, HUT, PTI, TNG and CDN were the stocks leading the increase.

Banking stocks traded differently with many stocks correcting after a long rally. The negative credit growth in the first two months of the year partly created selling pressure for this group of stocks at the beginning of the session. However, there were still bright spots such as CTG (+1.12%), LPB (+0.88%)...

Meanwhile, real estate stocks recorded many positive developments. Industrial real estate also had very outstanding developments, focusing on codes that have not increased much with quite sudden liquidity such as TIP (+6.96%), KBC (+6.89%), BCM (+2.83%), IDV (+2.65%)... in addition to codes with slight adjustments, liquidity below average SIP (-1.06%), IDC (-0.85%), D2D (-0.70%)... In the residential real estate sector, some stocks also increased strongly with sudden transactions such as NLG (+6.89%), KDH (+2.86%)...

Securities stocks increased well at the beginning of the session, but many stocks have seen corrections. In a recent document sent to securities companies, the Ho Chi Minh City Stock Exchange (HoSE) said that from March 4, 2024 to March 8, 2024, it will convert to the new KRX information technology system. Accordingly, HoSE requires securities companies to prepare their systems for conversion according to schedule, conduct system checks and check the conversion. During the period from March 11, 2024 to March 15, 2024, securities companies will test the entry of trading orders, ensuring operations as on a normal trading day.

More than a billion shares on HoSE changed hands, trillions of liquidity appeared in DIG and KBC

Not only did both indices continue to maintain green on the listed floor, the bright spot of today's session was also the market liquidity. Cash flow was active on the stock market.

The matched value on the two listed exchanges reached approximately VND30,800 billion, exceeding the average. Of which, on the HoSE, a total of 1.18 billion shares were transferred with a trading volume of VND28,606 billion. The trading value on the HOSE increased by 18% compared to the previous session, reaching the highest level in more than a week. Trading on the HNX also increased sharply to VND2,206 billion.

Leading in liquidity are DIG and KBC stocks with trading values of VND 1,400 billion and VND 1,166 billion, respectively.

Foreign investors bought net for the second consecutive session, but the purchase value narrowed significantly compared to yesterday, with only a net disbursement of VND110 billion. Foreign investors focused on buying the most KBC (+VND282 billion) and DIG (+VND104 billion) - the two most actively traded stocks of the session. The stocks that were bought the most by foreign investors all closed in green, even increasing in price impressively. On the contrary, fund certificates FUEVFVND (-VND116 billion) and HPG (-VND109 billion) were under the greatest net selling pressure.

Source

![[Photo] President of the Cuban National Assembly visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/39f1142310fc4dae9e3de4fcc9ac2ed0)

![[Photo] Keep your warehouse safe in all situations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/3eb4eceafe68497989865e7faa4e4d0e)

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

Comment (0)