Novaland shares hit the floor after news of margin cut, VN-Index dropped to 1,253 points

Trading on the stock market on September 11 continued to be gloomy as cash flow stood on the sidelines. The differentiation of stock sectors was quite large. VN-Index decreased by 1.96 points (-0.16%) to 1,253.27 points.

|

| Novaland shares hit the floor after news of margin cut. |

After yesterday's rather negative trading session, selling pressure eased somewhat in the early part of the session on September 11. The indices briefly fluctuated around the reference level at the beginning of the session. However, weak demand made many investors discouraged, and supply quickly increased, pushing the indices deeper below the reference level.

Stock indices traded in the red for most of today's session, with only a few rare minutes pulling them above the reference level. However, relatively good low-price demand at the end of the session helped the indices only decrease slightly.

The focus of the session focused on Novaland (NVL) shares when they hit the floor price to only VND11,850/share. The matched volume suddenly reached more than 68 million shares. NVL's sharp drop in today's session came from the information that this stock was removed from the list of stocks allowed for margin trading by the Ho Chi Minh City Stock Exchange (HoSE). Specifically, HoSE added NVL shares to the list of stocks not allowed for margin trading because the company delayed in disclosing information on the audited 2024 semi-annual financial report by more than 5 working days from the deadline for information disclosure.

The news of margin cuts contributed to NVL's plunge. Selling pressure spread to many other stock groups, especially the real estate group. DIG also fell 2.67%, HDG fell 1.25%, TDH fell 2%. In addition, DRH was also pulled down to the floor price.

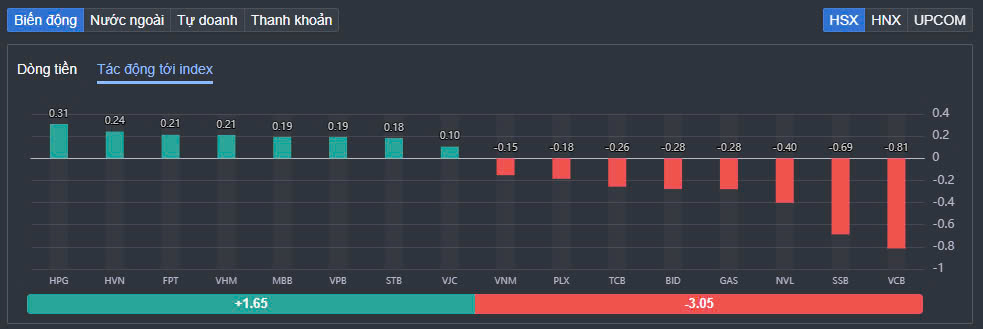

Among large-cap stocks, VCB fell 0.67% and was the stock with the most negative impact on the VN-Index, taking 0.81 points off the index. SSB fell sharply by 5.9% and also took 0.69 points off. Stocks such as GAS, BID, TCB or PLX were also in the red and put a lot of pressure on the general market.

On the other hand, some large stocks such as HPG,FPT , VHM, MBB... increased in price and this helped support the general market, significantly curbing the decline of VN-Index. HPG increased by 0.8% and contributed 0.31 points to VN-Index. FPT increased by 0.46% and contributed 0.24 points. Another stock that also attracted attention and made a significant contribution to VN-Index was HVN when it increased sharply by 2.21%.

|

| Vietcombank, SeABank and Novaland shares are the locomotives pulling down the VN-Index. |

The differentiation was quite strong in the group of securities stocks when some codes such as VND, VCI, AGR... were all in red. Meanwhile, many small and medium-cap stocks increased well such as MBS, FTS, VDS... MBS today played a leading role in the cash flow into many other securities codes when it increased by 3.8%. Besides, FTS increased by 2.14%, VDS increased by 1.2%...

In the real estate group, the differentiation was also quite strong, despite negative fluctuations from NVL or DIG, stocks such as PDR, DXG... still maintained a good green color. PDR increased by 1.2% and DXG increased by 0.68%.

At the end of the trading session, VN-Index decreased by 1.96 points (-0.16%) to 1,253.27 points. The entire floor had 170 stocks increasing, 218 stocks decreasing and 82 stocks remaining unchanged. HNX-Index decreased by 0.24 points (-0.1%) to 231.45 points. The entire floor had 53 stocks increasing, 84 stocks decreasing and 61 stocks remaining unchanged. UPCoM-Index decreased by 0.04 points (-0.04%) to 92.32 points.

|

| Foreign investors disburse heavily into FPT shares. |

Total trading volume on HoSE alone reached nearly 584 million shares, down 15% compared to the previous session, of which negotiated transactions accounted for VND1,584 billion. Trading value on HNX and UPCoM reached VND816 billion and VND468 billion, respectively.

Foreign investors returned to net buying today with about 7 billion VND. Of which, this capital flow bought the most FPT code with 140 billion VND. VNM and VHM were net bought 66 billion VND and 36 billion VND respectively. On the other hand, MSN was net sold the most with 71 billion VND. MWG and HPG were net sold 60 billion VND and 55 billion VND respectively.

Source: https://baodautu.vn/co-phieu-novaland-giam-san-sau-tin-bi-cat-margin-vn-index-giam-ve-1253-diem-d224675.html

![[Photo] Hanoi morning of October 1: Prolonged flooding, people wade to work](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/1/189be28938e3493fa26b2938efa2059e)

![[Photo] Panorama of the cable-stayed bridge, the final bottleneck of the Ben Luc-Long Thanh expressway](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/30/391fdf21025541d6b2f092e49a17243f)

Comment (0)